【Carbon Materials】A Key Driving Force in the Current Industrial Revolution — Who Is the Leader...

【Carbon Materials】A Key Driving Force in the Current Industrial Revolution — Who Is the Leader in the Carbon Industry?

Carbon materials, known as "black gold," are solid materials with carbon as the main component. They are widely used in aerospace, new energy, semiconductors, the automotive industry, and robotics manufacturing. Their unique physical and chemical properties—such as high electrical conductivity, high temperature resistance, corrosion resistance, and lightweight characteristics—enable these versatile materials to drive the industrial revolution with distinctive advantages.

I. Definition of Carbon Materials

Carbon materials, in a narrow sense, are inorganic materials mainly composed of graphite or amorphous carbon. They have characteristics such as heat resistance, corrosion resistance, and strong electrical conductivity, making them suitable for extreme environments. Carbon materials are divided into two major categories: raw materials (coal, petroleum coke, graphite, etc.) and finished products. According to functionality, they can be classified into three major categories: conductive, structural, and special functional materials:

1. Conductive materials: including graphite electrodes, carbon electrodes, electrode paste, prebaked anodes, carbon cathodes, and brushes, widely used in electric arc furnaces, aluminum electrolytic cells, and dry batteries.

2. Structural materials: such as blast furnace carbon bricks, neutron moderators for nuclear reactors, rocket nozzle liners, corrosion-resistant equipment for the chemical industry, and wear-resistant materials for the machinery industry, suitable for high-temperature and highly corrosive environments.

3. Special functional materials: including biochar, stealth aircraft materials, pyrolytic carbon, carbon fiber composites, graphite intercalation compounds, and nanocarbon, applied in biomedicine, aerospace, and new energy fields.

II. Current Market Landscape and Development Trends of the Carbon Industry

(1) Market Size and Growth Trends

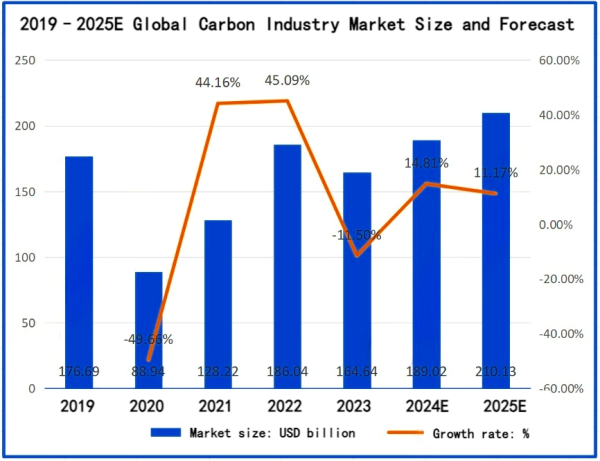

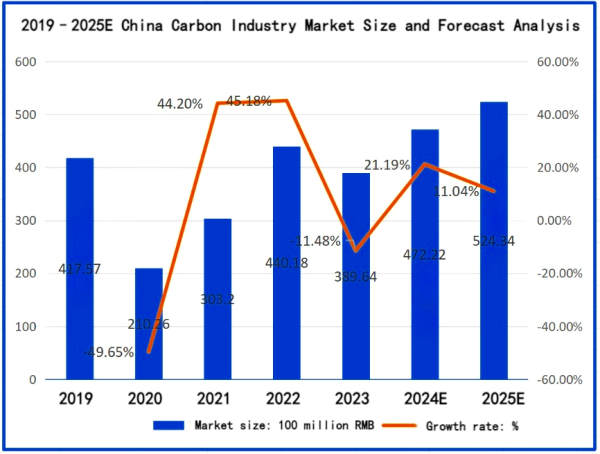

The global carbon market has maintained steady growth in recent years. In 2019, the global carbon market size was USD 17.669 billion, rising to USD 18.902 billion in 2024, and is expected to reach USD 21.013 billion in 2025.

China, as the world's largest producer and consumer of carbon products, saw its total carbon product output reach 7.427 million tons in 2023, exceed 8 million tons in 2024, and is expected to surpass 8.9 million tons in 2025.

From the perspective of market value, China's carbon market size reached 38.964 billion RMB in 2023 and is expected to reach 52.434 billion RMB in 2025, with a compound annual growth rate of approximately 16%.

(2) Demand Growth Driven by Emerging Fields

The application scope of carbon materials continues to expand, especially in new energy, semiconductors, and aerospace, where demand has grown significantly.

In the semiconductor field, with the large-scale adoption of 8-inch silicon carbide (SiC) production lines, the graphite consumables market is expected to enter the tens-of-billions-of-dollars level after 2025.

In the new energy sector, carbon materials are widely used in lithium-ion battery anodes and hydrogen storage tanks. Although the current anode materials market is affected by fluctuations in the new energy vehicle sector, demand is expected to recover with the advancement of fast-charging technologies.

In addition, strong demand from the photovoltaic industry chain, nuclear energy, and aerospace continues to inject new momentum into the development of high-performance carbon materials.

(3) Technological Progress and Industrial Upgrading

Technological progress is the core driving force of the carbon industry. Domestic enterprises are increasingly shifting their R&D focus toward high-end, high value-added products such as specialty graphite and carbon fibers to break through technological bottlenecks.

(4) Policy Support and Green Transformation

As a key national raw materials industry, the carbon sector receives strong policy support. Environmental protection regulations are driving enterprises to increase investment in green production, eliminate outdated capacity, and accelerate upgrading toward high-end and environmentally friendly production.

(5) Industry Challenges and Opportunities

The carbon industry faces multiple challenges.

First, traditional products such as conventional graphite electrodes and carbon electrodes suffer from overcapacity, with supply exceeding demand and prices remaining low.

Second, high-performance carbon fiber and nuclear graphite still lag behind international advanced levels. In particular, for high-end needle coke, imports accounted for 25.3% in 2022, indicating a high degree of external dependence.

In addition, raw material price fluctuations and complex global economic conditions put pressure on the profitability of the industry.

III. Industry Leader: Fangda Carbon

As a leading enterprise in China's carbon industry, Fangda Carbon plays a benchmark role in the industry through technological innovation, intelligent transformation, global market expansion, and industry–academia–research cooperation.

(1) Technological Innovation and Intelligent Transformation

Fangda Carbon leads the industry in technological innovation. The industry's first "5G + Carbon Intelligent Manufacturing Fully Connected Factory" built by the company has increased Overall Equipment Effectiveness (OEE) to 89% and shortened order delivery cycles by 35%.

Its graphite joint pre-assembly robots reduced electrode assembly time from 5 minutes to 1.5 minutes, increasing efficiency fourfold and reducing defect rates by 90%, significantly lowering costs for downstream enterprises.

The intelligent batching dynamic optimization system developed in cooperation with XtalPi solves the challenges of intermittent production, significantly reducing consumption and improving product uniformity.

In terms of R&D investment, Fangda Carbon invested more than 57 million RMB in 2024—far exceeding the industry average. The company continues to promote innovation-driven strategies and has achieved a series of breakthroughs in carbon new materials.

(2) Global Expansion and Market Development

Fangda Carbon adopts a "domestic base + overseas service center" model, establishing four technical centers in Southeast Asia and the Middle East. The proportion of overseas revenue increased from 18% in 2023 to 27% in 2024.

In the first half of 2025, the company issued more than 60 preferential certificates of origin, enabling products such as carbon electrodes exported to Vietnam to enjoy tariff reductions of up to 5%, with some products achieving zero tariffs. This significantly enhances international competitiveness.

These measures have saved overseas customers millions of RMB and promoted coordinated development of the upstream and downstream industrial chains.

(3) Industrial Chain Integration and Cost Reduction

Through a full-chain supply system and digital transformation, Fangda Carbon has achieved cost reduction and efficiency improvement.

The digital carbon management platform jointly developed with Huawei covers real-time data collection for 132 key processes and optimizes resource allocation.

In 2024, the company's carbon product output reached nearly 200,000 tons. Its market share for large-diameter graphite electrodes (600mm and above) remained stable at over 35%, consolidating its leading industry position.

Its blast furnace carbon bricks were recognized as a National Key New Product, contributing to green smelting technologies.

Its subsidiary Fangda Xikemo (Jiangsu) Needle Coke Technology Co., Ltd. adopts Japan's advanced coal-based needle coke technology, with a designed capacity of 60,000 tons. Product performance has reached the same level as imported Japanese needle coke, filling the domestic gap for high-end needle coke and providing crucial support for graphite electrode and lithium battery anode production.

Needle Coke Image (Source: Sinopec Petrochemical Science Research Institute WeChat Account)

(4) Talent Development and Industry–Academia–Research Collaboration

In 2024, Fangda Carbon launched a recruitment plan for more than 600 positions, focusing on high-end scientific research talent.

Its technology center includes a post-doctoral research workstation, the Gansu Carbon New Materials Engineering Research Center, and a CNAS-accredited laboratory.

The company has established industry–academia–research cooperation with leading institutions such as Tsinghua University, Hunan University, the Chinese Academy of Sciences Lanzhou Institute of Chemical Physics, Wuhan University of Science and Technology, Lanzhou University, and Lanzhou University of Technology.

Breakthroughs have been achieved in nuclear graphite and graphene research. For example, the graphene–chitosan composite hemostatic dressing jointly developed with Lanzhou University has reached international advanced levels, opening new opportunities in biomedical applications.

(5) Strategic Cooperation and Emerging Field Development

Fangda Carbon signed a strategic cooperation agreement with CATL, focusing on R&D of lithium battery anode materials, solid-state battery electrolytes, and supercapacitor electrodes, supporting the layout of the new energy industry.

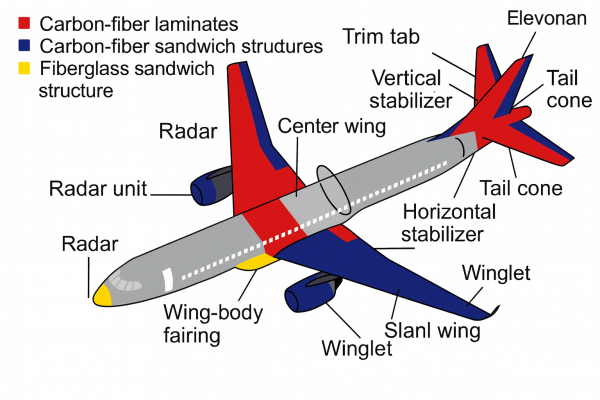

Its technological accumulation in nuclear reactor graphite components and aerospace composite materials has set industry benchmarks.

In the aerospace sector, Fangda Carbon's structural materials drive lightweight innovation, improving equipment performance and supporting lightweight upgrades for aircraft components and satellite structures.

Fangda Carbon provides valuable experience for China's carbon industry to move from being a "large-scale player" to a "strong global competitor." Its breakthroughs in graphite electrodes, nuclear graphite, carbon fiber composites, graphene, and other fields not only strengthen its industry leadership but also accelerate the carbon industry chain's transformation toward high-end, green, and globalized development.

In the future, as new productive forces continue to advance, Fangda Carbon is expected to further lead the carbon industry and play an increasingly important role in the global market.

Feel free to contact us anytime for more information about the Carbon products market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies