【Indian Petroleum Coke】Market Stalemate: Sellers Hold Firm, Buyer Interest Cools

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Indian Petroleum Coke】Market Stalemate: Sellers Hold Firm, Buyer Interest Cools

A wide bid–offer spread has pushed Indian petroleum coke trading into paralysis

Buyers shift toward cheaper thermal coal as inventories remain high

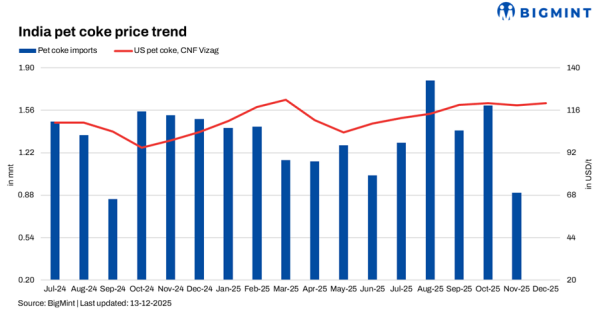

Indian Petroleum Coke Price Trends

In December 2025, the Indian petroleum coke market fell into a state of complete stagnation. A persistent USD 4–8/ton bid–offer gap led to a total halt in substantive trading activity. For U.S.-origin petroleum coke with 6.5% sulfur, sellers maintained CIF Kandla Port offers at USD 118–121/ton, while buyers were only willing to bid USD 111–114/ton, resulting in a complete breakdown of transactions.

This domestic stalemate has coincided with a broader global downturn in the petroleum coke market — prices along the U.S. Gulf Coast (USGC) have declined, Turkish import volumes have collapsed, and new geopolitical risks have begun to threaten petroleum coke exports from Venezuela.

Indian Market: Price Dynamics and Trading Deadlock

Seller offer range: U.S.-origin petroleum coke (6.5% sulfur), CIF Kandla Port USD 118–121/ton

Buyer bid range: CIF Kandla Port USD 111–114/ton

Market status: No transactions recorded since early December

Market sentiment: One major market participant stated, "There are no deals at current high prices," reflecting the broadly resistant stance among Indian buyers.

Multiple Headwinds Suppressing Indian Demand

Accelerating Substitution by Thermal Coal

During December, Indian buyers significantly increased purchases of U.S. Northern Appalachian (NAPP) thermal coal, driven by several factors:

Mozambican and South African thermal coal prices are USD 5–10/ton lower than petroleum coke

The additional Goods and Services Tax (GST) surcharge on thermal coal has been removed

FOB Baltimore price for 6,900 kcal/kg GAR thermal coal translates into a CIF India price close to USD 110/ton

Severe Inventory Overhang

Cement producers built up sufficient inventories following purchases in October, leaving little urgency for new spot procurement in December.

Weak Economics

An industrial consumer noted that at current price levels, U.S. and Saudi petroleum coke is no longer economically viable. Ample domestic coal supply further exerts downward pressure on demand for imported petroleum coke.

Ultimately, the market has settled into a classic standoff: sellers hold firm on prices, while buyers wait for declines.

U.S. Market: Export Weakness Emerges

USGC 6.5% sulfur petroleum coke FOB prices fell to USD 67–71.25/ton

Seaborne export volumes declined 13% month-on-month

Chinese buying interest, which briefly surged in November, faded rapidly

Turkish Market: Imports Collapse

October import volumes plunged 37% year-on-year

Buyers shifted to Russian-origin thermal coal (6,000 kcal/kg GAR), priced USD 15–18/ton lower than petroleum coke

Cross-Market Convergence

Across India, Turkey, and most of the Atlantic Basin, petroleum coke markets are exhibiting common characteristics:

Cheaper substitute energy sources

Ample buyer inventories

Widespread buyer resistance across all petroleum coke grades

New Geopolitical Factors

The United States has seized an oil tanker near Venezuelan waters, and further enforcement actions are anticipated. This development has elevated the risk of shipping Venezuelan petroleum coke. Rising marine insurance risks, reduced willingness of shipowners to call at Venezuelan ports, and potential delays in refinery operations could all constrain Venezuelan petroleum coke supply to India, Turkey, and Mediterranean markets.

These factors may introduce a new geopolitical risk premium, potentially tightening mid-sulfur petroleum coke supply and partially offsetting the current global oversupply.

Four Key Factors to Watch Closely

Thermal coal prices

Particularly U.S. NAPP, South African, and Mozambican thermal coal

Freight rate stability

Current USGC–India freight is around USD 45.50/ton; a sharp increase could erode thermal coal's cost advantage

Recovery in the Chinese market

Any rebound in China could lift global U.S. petroleum coke price benchmarks

Escalation of Venezuelan geopolitical tensions

Expanded U.S. enforcement could tighten Venezuelan supply, reshape Atlantic Basin supply–demand balances, and support the price floor for U.S. high-sulfur petroleum coke

India's Waiting Game in a Global Downcycle

India's petroleum coke market is firmly in a wait-and-see mode. Its trajectory reflects both global market weakness and India's unique energy substitution pathways. The current bid–offer stalemate is a microcosm of the broader global petroleum coke market reset, while new geopolitical risks linked to Venezuela further complicate the outlook.

As 2026 approaches, the core questions remain whether suppliers will cut prices, and whether India's shift toward cheaper thermal coal will solidify into a long-term structural change. For now, market control rests squarely with Indian buyers — they have alternative energy options, ample inventories, and minimal procurement urgency.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies