The price difference of needle coke raw materials for lithium anode materials expands

The price difference of needle coke raw materials for lithium anode materials expands, and enterprises that solve the problem of raw materials are expected to benefit

Needle coke is used in lithium anode and graphite electrode. Benefiting from the boom of lithium battery industry in 2017-2021, the demand for needle coke increased from 227,600 tons to 1,309,400 tons, CAGR=55%, among which, China's output reached 1.0839 million tons, with a low dependence on overseas imports. The production of needle coke can be divided into oil series and coal series. At present, the production capacity of the two process in China is similar. Due to the high sulfur content of crude oil in China, there is less low-sulfur oil suitable for the production of needle coke. In the future, the production of oil series needle coke is limited, and enterprises that can solve the problem of raw materials are expected to benefit.

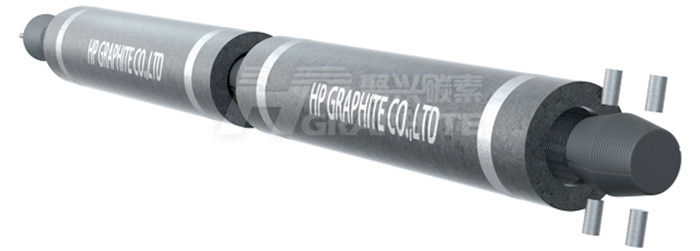

1) Needle coke is applied to lithium anode and graphite electrode.

According to Institute of Coal Chemistry Chinese Academy of Sciences (ICCCAS), needle coke is a high-quality variety of carbon materials vigorously developed in the 1970s. It belongs to artificial graphite and has a series of advantages such as low thermal expansion coefficient, low porosity, low sulfur, low ash, low metal content, high conductivity and easy graphitization. Its graphitized products have good chemical stability, corrosion resistance, high thermal conductivity, and good mechanical strength at low and high temperatures. Needle coke is divided into raw coke and calcined coke. The raw coke is mainly used to produce anode materials, and the downstream is new energy vehicles, accounting for 64%; calcined coke is mainly used to produce graphite electrode, and the downstream is steel smelting industry, accounting for 36%.

2) The production of needle coke is divided into oil series and coal series, and their production capacity scale is equivalent in China.

According to Institute of Coal Chemistry Chinese Academy of Sciences (ICCCAS), needle coke can be divided into oil series and coal series according to different raw material routes. There is a definite difference in production methods. The production method of oil series needle coke was developed by the United States in the late 1950s. The oil series needle coke was prepared from heavy distillates of petroleum processing plants, such as thermal cracking residue and catalytic cracking clarified oil, through delayed coking and calcination processes. The production method of coal series needle coke was developed by Nippon Steel and Mitsubishi Chemical Company in 1979. The method takes coal tar pitch, a by-product of coal coking, as raw material, and produces coal series needle coke through three processes: raw material pretreatment, delayed coking and calcination. Since 2022, the production capacity of oil series and coal series needle coke in China is equivalent, including 1.2 million tons of coal series needle coke and 1.52 million tons of oil series needle coke.

3) The demand for needle coke in China exceeds 1 million tons, which can basically ensure self-sufficiency.

Due to strong downstream demand, China's production and apparent consumption of needle coke have increased significantly since 2017. According to statistics, in 2017, China produced 151,200 tons of needle coke, its apparent consumption was 227,600 tons, and its imports were 76,400 tons. In 2021, China's production of needle coke was 1,083,900 tons, with a CAGR of 64% from 2017 to 2022; Apparent consumption of 1,39,400 tons, 2017-2021 CAGR=55%; The import volume was only 225,500 tons.

Due to the high sulfur content of China's crude oil, the oil series needle coke production is limited. The main component of petroleum is aliphatic hydrocarbon, the content of aromatic hydrocarbon is very low. Due to the long-term storage in underground and the use of various catalysts in the processing process, the heavy petroleum oil contains certain impurity elements, which are not conducive to the production of needle coke. Therefore, it is necessary to select and deal with the raw materials of needle coke. First choose the heavy oil with high aromatic hydrocarbon content and low sulfur content, and then remove the impurities. Most of the crude oil processed in our country belongs to high sulfur crude oil, and the low sulfur oil suitable for the production of needle coke is less and the catalyst powder brought in heavy oil is difficult to be removed in the refining process.

4) The price difference of heavy aromatic hydrocarbons in needle coke raw materials continues to expand.

On August 1, 2022, the heavy arene-residue price difference was 450 yuan/ton, and on November 10, 2022, the heavy arene-residue oil price difference had risen to 1,170 yuan/ton. The widening of the spread is mainly due to the divergence between heavy aromatics and residual oil prices. From August 1 to November 10, the price of heavy aromatic hydrocarbons rose by 950 yuan/ton, while the residue oil price only rose by 230 yuan/ton.

Needle coke used in lithium anode materials, the future market space is broad. The production of oil series needle coke in China is limited by the sulfur content of petroleum products. Enterprises that can solve the problem of raw materials are expected to benefit. Graphite industry future market report, welcome to communicate with us at any time.

No related results found

0 Replies