【Calcined Petroleum Coke】Downstream Demand Steady, CPC Shipments Slow

【Calcined Petroleum Coke】Downstream Demand Steady, Calcined Petroleum Coke Shipments Slow

Market Overview

On August 7, the average market price of calcined petroleum coke was RMB 2,962/ton, unchanged from the previous working day. At present, the low-sulfur calcined petroleum coke market is operating steadily. Demand from downstream electrode and cathode markets is average, and procurement of low-sulfur calcined petroleum coke has slowed. Most calcined petroleum coke producers have raised their quotations and then held them steady, with limited price increases for new orders in the market. The medium- and high-sulfur calcined petroleum coke market continues to see stable transactions. Downstream enterprises still have rigid demand for medium- and high-sulfur calcined petroleum coke. Coupled with a slight recent increase in raw material prices, overall medium- and high-sulfur calcined petroleum coke prices remain firm, with some enterprises achieving good order sales and slightly higher quotations.

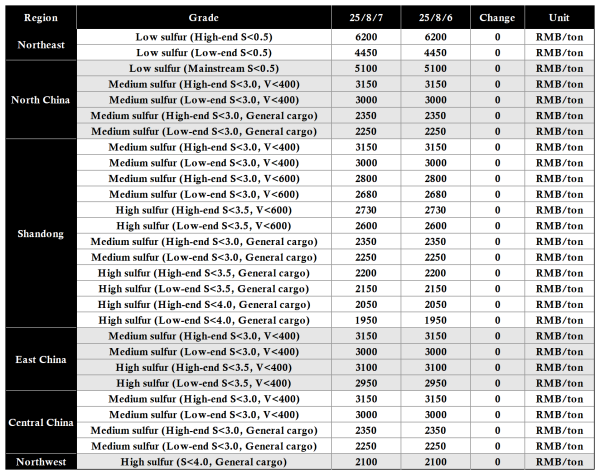

Main Regional Market Transaction Prices

Market Prices

Low-sulfur calcined petroleum coke (using Jinxi and Jinzhou petroleum coke as raw material) mainstream market transaction prices: RMB 4,850–5,200/ton; Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material) mainstream ex-factory transaction prices: RMB 6,100–6,200/ton; Low-sulfur calcined petroleum coke (using Liaohe and Binzhou CNOOC petroleum coke as raw material) mainstream market transaction prices: RMB 4,450–5,300/ton.

Medium- and high-sulfur calcined petroleum coke (S 3.0%, no microelement requirements) previous mainstream ex-factory contract cash prices: RMB 2,250–2,350/ton; current negotiated mainstream ex-factory cash prices: RMB 2,250–2,350/ton; Medium- and high-sulfur calcined petroleum coke (S 3.5%, no microelement requirements) previous mainstream ex-factory contract cash prices: RMB 2,150–2,200/ton; current negotiated mainstream ex-factory cash prices: RMB 2,150–2,200/ton; Medium- and high-sulfur calcined petroleum coke (S 3.0%, V 400) previous contract cash prices: RMB 3,050–3,150/ton; current negotiated ex-factory cash prices: RMB 3,050–3,150/ton.

Supply

Currently, Chinese commercial calcined petroleum coke daily supply is 26,135 tons, with an operating rate of 55.29%. This represents a 0.11% decrease in supply compared with the previous working day.

Upstream Market

Petroleum Coke: At present, refineries under Sinopec mainly maintain stable prices. Downstream anode material demand is acceptable, with anode coke shipments performing well in regions along the Yangtze River and in Shandong. In South China, Guangzhou Petrochemical and Beihai refineries maintain stable shipments, with stable downstream demand, and Maoming Petrochemical is producing needle coke. In Northwest China, Tahe Petrochemical focuses on shipments outside Xinjiang. Currently, refineries under PetroChina are fulfilling orders; in Northeast China, Fushun Petrochemical plans to shut down for maintenance starting on the 15th, leading to insufficient spot market resources. Other refineries have no shipment pressure. In Northwest China, refineries are producing normally and shipping steadily. Refineries under CNOOC are mainly delivering against orders.

Downstream Market

Graphite Electrodes: With upstream raw material prices continuing to rise, small- and medium-sized graphite electrode producers are cautiously observing the market, and some have suspended new order sales while awaiting market changes. However, downstream demand has not changed significantly and purchases graphite electrodes as needed, limiting the potential for further graphite electrode price increases. Current actual transactions in the graphite electrode market remain steady.

Electrolytic Aluminum: External aluminum prices have risen, and although social inventories of aluminum ingots have increased, they remain relatively low. Some buyers are optimistic about the market outlook, leading to higher spot aluminum prices.

Anode Materials: The anode materials market is currently stable. Based on market feedback, demand release from downstream power cell plants is limited. Orders and inquiries in the anode materials market are below expectations. Competition among anode enterprises for orders remains intense, and the market is highly competitive.

Market Outlook

The low-sulfur calcined petroleum coke market is weak on the demand side, and prices are expected to remain stable in the short term after the recent increases. The medium- and high-sulfur calcined petroleum coke market remains stable, with all grades holding firm on prices while shipping goods.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies