【Anode Materials】Low-Sulfur Coke Stops Falling and Rebounds – What's Next for the Anode Market?

The rapid growth of electric vehicles and energy storage systems is boosting demand for high-performance lithium batteries, driving the need for high-quality petroleum coke and synthetic graphite. High-quality calcined petroleum coke is essential for producing reliable lithium battery anode materials.

【Anode Materials】Low-Sulfur Coke Stops Falling and Rebounds – What's Next for the Anode Market?

In the first half of 2025, the price of low-sulfur coke initially surged widely and then gradually declined, hitting a rebound by the end of June. In June, the high-cost pressure of artificial graphite anode eased, turning losses into profits. However, with the rebound in low-sulfur coke prices, how will the anode materials market perform going forward?

I. Low-Sulfur Coke Prices Stop Falling and Rebound at the End of June

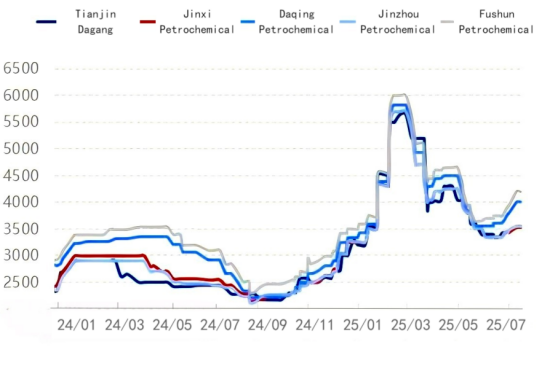

Figure 1: Low-Sulfur Petroleum Coke Price Trend Chart (RMB/ton)

Source:Oilchem

In the first half of 2025, the price of low-sulfur coke first rose significantly and then gradually declined, rebounding at the end of June. The average price of No.1 high-quality petroleum coke was RMB 4,408/ton, up RMB 1,189/ton year-on-year, an increase of 36.94%;

The average price of No.1 standard-quality petroleum coke was RMB 4,175/ton, up RMB 1,535/ton year-on-year, an increase of 58.14%;

The average price of 2A petroleum coke was RMB 3,497/ton, up RMB 1,082/ton year-on-year, an increase of 44.80%.

II. Needle Coke and Graphitization Processing Support Cost Side

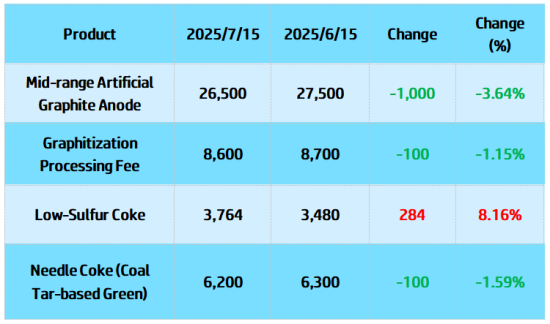

Table 1: Comparison of Artificial Graphite Anode and Raw Material Prices

In June, graphitization processing fees dropped by RMB 100/ton, mainly due to electricity discounts during the abundant water period in Southwest China; most fees remained stable in the northern regions.

Acheson crucible graphitization costs ranged from RMB 8,400–9,400/ton, while box furnace graphitization costs ranged from RMB 7,900–8,400/ton.

The price of artificial graphite anodes fell by RMB 1,000/ton, mainly due to continuous declines in upstream raw material prices. Downstream battery manufacturers demanded price reductions for anode materials. Manufacturers were mainly digesting inventory and held cautious production attitudes due to weak downstream demand expectations.

In terms of demand, the anode market was mostly in a wait-and-see mode this month. The energy storage market showed slight recovery, while the power battery market remained weak and stable. Car manufacturers still had inventories to digest.

III. Anode Material Prices Expected to Fall First, Then Rise in the Second Half of the Year

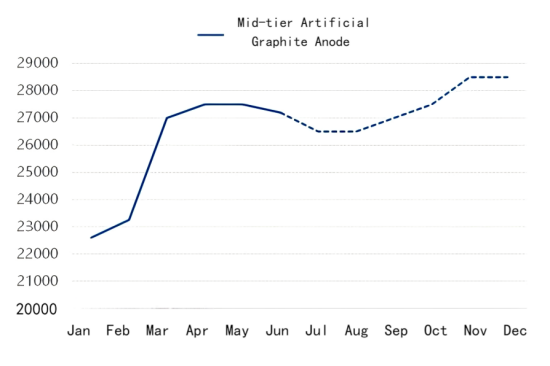

Figure 2: Price Forecast for Mid-Tier Artificial Graphite Anode in 2025 (RMB/ton)

Source:Oilchem

Currently, demand in the small-scale energy storage market is warming slightly, which to some extent offsets the demand gap caused by the slowdown in power-side production. The demand side is relatively stable; the supply side remains sufficient; and on the cost side, anode raw material prices have stopped falling and started to rebound, providing strong support for artificial graphite prices.

With many manufacturers still using previously purchased low-cost raw materials, current anode market prices lack solid support. Combined with signs of weakening downstream demand, prices are expected to decline in Q3.

In Q4, traditional peak season for lithium battery demand — driven by electric vehicles and consumer products — is expected to boost anode material orders. As a result, prices in the anode materials market are projected to rebound in Q4.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies