【Graphite】Market Turning Point Arrives Early, Graphite Assets Surge!

【Graphite】Market Turning Point Arrives Early, Graphite Assets Surge! Petroleum Coke, Needle Coke, and Graphite Electrodes Prices All Rise

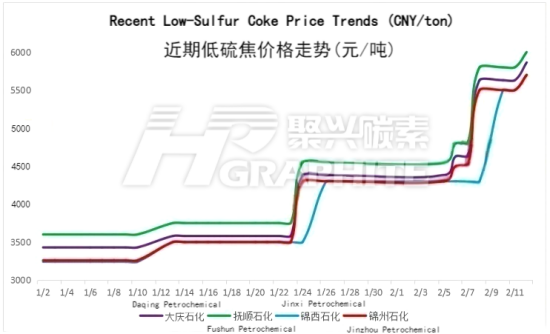

Recently, the graphite-related market has been booming, with petroleum coke prices changing daily. Meanwhile, needle coke, carbon products, and graphite electrodes are also seeing price increases! This hot market has reignited enthusiasm among industry enterprises and professionals, especially as most companies suffered losses in 2024. The tightening supply and continuous price hikes of petroleum coke indicate that the raw material market is leading the turnaround!

Petroleum Coke:Fushun Petrochemical: Raised petroleum coke sales price by 200 CNY/ton to 6,000 CNY/ton on February 12.

Daqing Petrochemical: Increased sales price by 200 CNY/ton to 5,830 CNY/ton.

Jinxi Petrochemical: Adjusted price up by 200 CNY/ton, now selling at 5,700 CNY/ton.

With petroleum coke supply tightening, anode and negative electrode enterprises are actively procuring, pushing prices higher. Major refineries continue to follow the uptrend, and local refiners also maintain the rising momentum. Meanwhile, imported sponge coke prices are increasing alongside domestic coke, reflecting a supply-demand imbalance in the low-sulfur coke sector.

Needle Coke:

On February 11, 2025, China's needle coke market surged. According to Baichuan Yingfu:

· Domestic needle coke prices: Green coke 5,500-6,800 CNY/ton, calcined coke 6,500-8,200 CNY/ton.

· Imported oil-based needle coke prices: Green coke $500-1,200/ton, calcined coke $750-1,250/ton.

· Imported coal-based needle coke prices: Calcined coke $700-820/ton.

Following the rapid price increase in regular coke, needle coke prices have soared. Since the Spring Festival, prices have risen by 800-1,000 CNY/ton. Some manufacturers have yet to update their prices and are waiting to observe market movements. Anode material buyers are expected to start inquiries later this month, while needle coke suppliers are currently testing market responses. Some companies are opting for negotiated pricing on a case-by-case basis.

For coal-based needle coke, production has resumed at Baowu Carbon Materials and Henan Baoshun, while other plants remain in observation mode.

Market Outlook:

Driven by the rising regular coke prices, the upward trend in needle coke prices is expected to continue. However, downstream buyers remain cautious, and actual transaction prices are yet to be finalized. The estimated price range is:

· Green coke: 6,000-7,300 CNY/ton

· Calcined coke: 7,000-8,700 CNY/ton

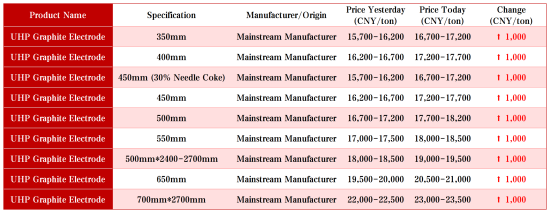

Graphite Electrodes:

In the past two days, multiple steel mills have reported a price increase of around 1,000 CNY/ton for graphite electrodes. This indicates that the price hike is not just at the supplier level but has successfully passed down to steel mills, completing the full pricing transmission from raw materials to end products.

Looking ahead to 2025, graphite electrode prices are expected to surge significantly. Tokai Carbon recently announced a 10% price increase on all graphite electrode orders.

Fushun Petrochemical: Raised petroleum coke sales price by 200 CNY/ton to 6,000 CNY/ton on February 12.

Daqing Petrochemical: Increased sales price by 200 CNY/ton to 5,830 CNY/ton.

Jinxi Petrochemical: Adjusted price up by 200 CNY/ton, now selling at 5,700 CNY/ton.

With petroleum coke supply tightening, anode and negative electrode enterprises are actively procuring, pushing prices higher. Major refineries continue to follow the uptrend, and local refiners also maintain the rising momentum. Meanwhile, imported sponge coke prices are increasing alongside domestic coke, reflecting a supply-demand imbalance in the low-sulfur coke sector.

Needle Coke:

On February 11, 2025, China's needle coke market surged. According to Baichuan Yingfu:

· Domestic needle coke prices: Green coke 5,500-6,800 CNY/ton, calcined coke 6,500-8,200 CNY/ton.

· Imported oil-based needle coke prices: Green coke $500-1,200/ton, calcined coke $750-1,250/ton.

· Imported coal-based needle coke prices: Calcined coke $700-820/ton.

Following the rapid price increase in regular coke, needle coke prices have soared. Since the Spring Festival, prices have risen by 800-1,000 CNY/ton. Some manufacturers have yet to update their prices and are waiting to observe market movements. Anode material buyers are expected to start inquiries later this month, while needle coke suppliers are currently testing market responses. Some companies are opting for negotiated pricing on a case-by-case basis.

For coal-based needle coke, production has resumed at Baowu Carbon Materials and Henan Baoshun, while other plants remain in observation mode.

Market Outlook:

Driven by the rising regular coke prices, the upward trend in needle coke prices is expected to continue. However, downstream buyers remain cautious, and actual transaction prices are yet to be finalized. The estimated price range is:

· Green coke: 6,000-7,300 CNY/ton

· Calcined coke: 7,000-8,700 CNY/ton

Graphite Electrodes:

In the past two days, multiple steel mills have reported a price increase of around 1,000 CNY/ton for graphite electrodes. This indicates that the price hike is not just at the supplier level but has successfully passed down to steel mills, completing the full pricing transmission from raw materials to end products.

Looking ahead to 2025, graphite electrode prices are expected to surge significantly. Tokai Carbon recently announced a 10% price increase on all graphite electrode orders.

Feel free to contact us anytime for more information about the graphite market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies