【Petroleum Coke】Prices Soar: What's Driving the Surge and What's Next?

【Petroleum Coke】Prices Soar: What's Driving the Surge and What's Next?

Analysis of the Price Surge in February 2025

Supply Tightness:

1. Refinery Maintenance and Production Cuts: In February 2025, some major refineries plan to halt coking units for maintenance. Additionally, local refineries are expected to reduce or stop production due to increased taxes and poor coking profits, leading to a decrease in petroleum coke supply.

2. Tight Import Supply: The discharge speed of petroleum coke at ports is fast, and downstream enterprises are restocking after the holiday, leading to a further decline in port inventory and tight supply of imported coke.

3. Limited Raw Material Supply: The key raw material for petroleum coke production, sponge coke, faces tight imports, and traders are reluctant to sell their stock, further restricting the supply of raw materials.

Demand Increase:

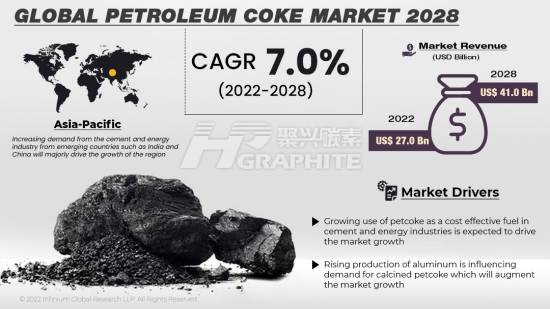

1. Resurgence of Downstream Industries: As the economy recovers, especially with strong demand from industries like aluminum and anode materials, the petroleum coke market is experiencing a revival. The continuous increase in aluminum output and the start of procurement by anode companies have increased demand for petroleum coke. The price of petroleum coke continues to rise, and the cost pressure on calcined petroleum coke enterprises has increased. Some enterprises have suspended quoting and shipping.

2. Low Inventory Levels: After the inventory reduction in 2024, petroleum coke stocks are relatively low, prompting downstream companies to actively purchase as demand increases, which pushes prices higher.

Rising Costs:

1. Crude Oil Price Surge: Crude oil is the primary raw material for petroleum coke production, and fluctuations in oil prices directly impact production costs. In early 2025, the extension of the OPEC+ production cut agreement and U.S. sanctions on Russia raised concerns over supply disruptions, causing crude oil prices to spike, which in turn raised petroleum coke production costs.

Market Outlook:

Price Trends:

1. Given the current supply tightness, increased demand, and rising costs, petroleum coke prices are expected to continue their upward trajectory. Particularly for low-sulfur coke, which is widely used in industries like aluminum and anode materials, price increases may be even more significant.

2. However, continuous price hikes could suppress demand from certain downstream industries, potentially placing downward pressure on prices.

Market Supply and Demand:

1. On the supply side, although some refineries have maintenance or production cuts planned, the price increase may encourage some refineries to increase production for higher profits. The supply of imported coke may also adjust based on international market changes.

2. On the demand side, with continued economic recovery and growth in downstream industries, demand for petroleum coke will remain strong, though macroeconomic changes and policy adjustments may impact demand.

Risk Factors:

1. Crude Oil Price Uncertainty: Crude oil prices are a major factor influencing petroleum coke prices. Future fluctuations in oil prices could directly impact petroleum coke prices.

2. Policy and Regulatory Adjustments: Strengthened environmental regulations could affect small refineries, impacting petroleum coke supply. Additionally, restrictions on high-pollution industries could indirectly affect petroleum coke demand.

3. International Market Changes: The supply and demand dynamics in international markets, along with trade policies, could also affect petroleum coke prices.

In conclusion, the price surge of petroleum coke in February 2025 is primarily driven by supply tightness, increased demand, and rising costs. The price is expected to continue rising, but potential risk factors such as crude oil price fluctuations, policy adjustments, and international market changes should be closely monitored as they could impact future price trends.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies