【CPC Market】High Inventory + Weak Demand: Will CPC Prices Struggle to Improve?

【CPC Market】High Inventory + Weak Demand: Will Calcined Petroleum Coke Prices Struggle to Improve?

Market Overview

On April 8, the average price of calcined petroleum coke was 3,360 yuan/ton, unchanged from the previous working day. Currently, the low-sulfur calcined petroleum coke market is weak and stable in price, with high inventories at production enterprises and weak demand. Downstream enterprises have few inquiries. Prices in the medium-to-high sulfur calcined petroleum coke market remain stable. Although raw petroleum coke prices have slightly rebounded, downstream buyers of medium-to-high sulfur calcined petroleum coke are pressing for lower prices. As a result, calcined petroleum coke producers are mainly shipping at stable prices, and price increases are lacking momentum.

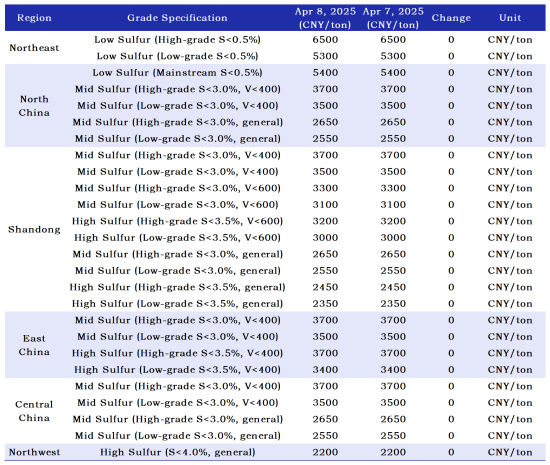

Main Regional Market Transaction Prices

Market Prices

1. Low-sulfur calcined petroleum coke (using Jinxi, Jinzhou petroleum coke as raw materials): Mainstream transaction prices are 5,200–5,500 yuan/ton.

2. Low-sulfur calcined petroleum coke (using Fushun petroleum coke as raw material): Ex-factory mainstream transaction prices are 6,200–6,500 yuan/ton.

3. Low-sulfur calcined petroleum coke (using Liaohe, Binzhou CNOOC petroleum coke as raw materials): Mainstream transaction prices are 5,300–5,800 yuan/ton.

4. Medium-to-high sulfur calcined petroleum coke (3.0% sulfur, no requirement for trace elements): Previous ex-factory mainstream contract prices were 2,550–2,650 yuan/ton (cash); currently negotiated prices are still 2,550–2,650 yuan/ton (cash).

5. Medium-to-high sulfur calcined petroleum coke (3.5% sulfur, no requirement for trace elements): Previous ex-factory mainstream contract prices were 2,350–2,450 yuan/ton (cash); current negotiated prices are the same.

6. Medium-to-high sulfur calcined petroleum coke (3.0% sulfur, vanadium 400): Previous contract prices were 3,500–3,700 yuan/ton (cash); currently negotiated ex-factory prices remain at 3,500–3,700 yuan/ton (cash).

Supply Side

Currently, China's commercial calcined petroleum coke daily supply is 27,693 tons, with an operating rate of 59.69%. Compared with the previous working day, calcined petroleum coke market supply has increased by 0.32%.

Upstream Market

Petroleum Coke: At present, Sinopec-affiliated refineries are delivering as needed, with some prices slightly increasing since April 7. In the Yangtze River region, anode coke prices generally increased by 50 yuan/ton, and carbon coke increased by 30–80 yuan/ton. In East China, some increased by 50 yuan/ton. In North China, Yanshan Petrochemical has depleted its inventory of 4B and No.5 coke and stopped quoting; currently producing No.3 coke. Other refineries raised prices by 20–50 yuan/ton. In Shandong, Qilu Petrochemical maintained stable prices, while other refineries raised prices by 30–80 yuan/ton. In South China, Guangzhou Petrochemical raised prices by 20–50 yuan/ton for some grades.

PetroChina-affiliated refineries mainly ship at stable prices. Northeast refineries are expected to see increased maintenance, and supply-side factors provide short-term price support. In the Northwest, supply and demand remain stable, and prices are temporarily unchanged. CNOOC-affiliated refineries are conducting normal auctions, and final prices have not yet been announced—please continue to follow Baichuan Yingfu.

Downstream Market

Graphite Electrode: Trade frictions and tariff disputes are intensifying internationally, and the graphite electrode export situation is tense. Domestic enterprises have rising panic sentiment. Meanwhile, low-price resources are active in the domestic market, hitting bottom-line prices. Mainstream transaction focus is unstable with a trend of hidden discounts. Downstream buyers are mostly observing the market and being cautious in procurement. The graphite electrode market is running weak and stable overall.

Aluminum (Electrolytic Aluminum): External markets continue to exert pressure, and in the context of international tariff confrontations, the market holds a bearish view on aluminum prices in the short term. Spot transactions are weak, and spot aluminum prices are declining.

Anode Materials: The anode materials market remains stable for now, but oversupply continues. Low- and mid-end anode materials suffer from severe product homogenization. As a result, battery cell factories focus heavily on price comparisons and bargaining during procurement, maintaining a price-suppressing mindset. Anode material prices continue at low levels.

Market Outlook

Demand for low-sulfur calcined petroleum coke remains weak, and prices are expected to remain stable. Medium-to-high sulfur calcined petroleum coke prices are overall stable, with slight fluctuations in some grades depending on market conditions.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies