Graphitization prices fell off a cliff, graphite anode prices down

Graphitization prices fell off a cliff, graphite anode prices down

Market analysis

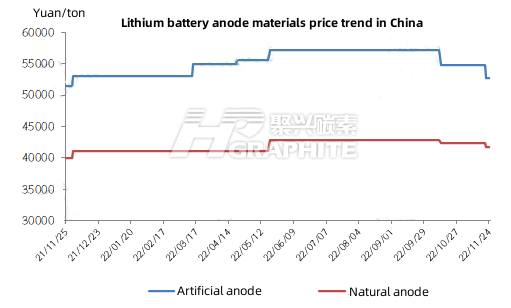

Recently, anode materials market price has declined slightly, with a range of 2000-3000 yuan/ton. At present, anode material downstream demand is still strong, the head enterprise order quantity is sufficient, most of which are full production and full sales. However, the price of small enterprises has decreased compared with the early period. The main reason is that the cost of anode materials has dropped repeatedly, leading to a downward trend in the cost side of anode materials and a sharp rise in downstream prices; Graphitized needle coke product parameters and specifications are for reference. On the other hand, the products of small and medium-sized enterprises are mostly common products with different quality, and enterprise's shipment volume is unstable, resulting in the shipment price decline. Near the end of the year, the number of new anode projects has increased in 2022. The products of the new enterprise have not been recognized to a certain extent, and the shipment situation needs to be improved; Due to anode capacity concentrated expansion, downstream battery enterprises are more willing to ship, and the anode price drops. Overall, the anode material market remains relatively stable. In order to better control their own costs, most leading anode material enterprises began to build their own integration projects to reduce costs. As comprehensive projects give priority to the construction of graphitization process, some graphitization enterprises in the new production compete to place orders at a low price, and the graphitization processing price drops sharply. As of November 24, the high-end anode mainstream price is 68,000-75,000 yuan/ton, the mid-end anode price is 48,000-58,000 yuan/ton, and the low-end anode price is 32,000-35,000 yuan/ton.

Raw materials

The overall shipment of petroleum coke market is average. At present, the epidemic has affected the logistics and transportation in many regions of China, and the market freight is increasing. In addition, the domestic petroleum coke market has abundant supply, and the downstream wait-and-see mood is getting stronger. The purchase is mainly on demand, which is unfavorable to petroleum coke prices. At present, the price of some low sulfur petroleum coke of PetroChina and CNOOC has dropped 270-750 yuan/ton, and the price of petroleum coke of local refineries has dropped 40-500 yuan/ton.Since June, needle coke market operating rate has been declining, from a high of 69% to about 35%. At present, mainstream petroleum needle coke enterprises operate normally, but few enterprises operate at full capacity due to flat demand.

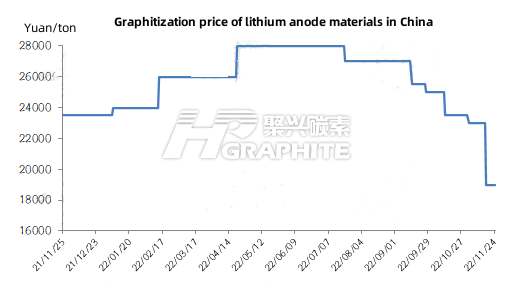

Some enterprises have reduced or stopped production, and the overall operation is at a medium level. In terms of coal based needle coke, the cost and profit are seriously inverted, the production enthusiasm of manufacturers continues to be low, and many of them have stopped production. At present, the utilization rate of coal-based needle coke is less than 15%. As more anodes and graphitization capacity continue to be released, the overall graphitization market is experiencing an oversupply situation. Orders for graphitization have been reduced, the company said. In order to maintain orders, some enterprises reduced the price of sales, graphitization capacity shortage has eased compared with the first half of the year. Anode raw materials, graphitization processing and finished product prices decreased compared with the first half of the year. This year, some graphitization capacity will be put into production by the end of the year. In the long run, the graphitization capacity will be surplus. As of November 24, 2022, graphitization processing cost main price is 18,000 yuan/ton, and some new graphitization enterprises price is lower than the market transaction price, about 14,000 to 16,000 yuan/ton.

Demand side

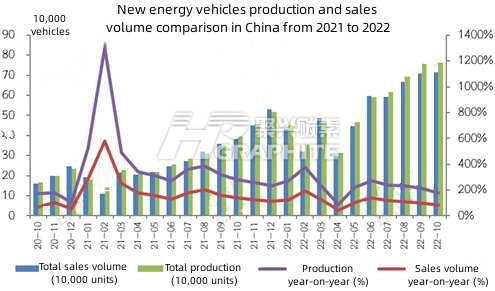

The rapid growth of the new energy vehicle industry has directly driven the growth of power battery demand, which is the main growth point of the lithium battery market. According to the data of China Automobile Association, the production and sales of new energy vehicles in China reached a new high in October, reaching 762,000 and 714,000 respectively, with year-on-year growth of 87.6% and 81.7% respectively, and the market share reached 28.5%. In October, China's power battery output totaled 62.8GWh, up 150.1% year-on-year and 6.2% month on month. From January to October, the cumulative output of power battery in China was 425.9GWh, with a year-on-year growth of 166.5%, showing a rapid growth trend.

Future market forecast

In the short term, with the gradual release of new graphitization capacity, the structural supply and demand tension in graphitization has been fully alleviated. The market is oversupplied, and the market prices of graphitized materials and anode materials begin to fall. The price of anode materials is expected to remain stable after falling in the short term. In the long run, new anode material enterprises will mainly focus on the low-end market, so the traditional and quantitative product segments may form a competitive pattern of oversupply. The scale of new supply is relatively limited due to the high barriers to entry of medium and high-end anode materials. There may still be insufficient supply in the future. Therefore, cost control and breakthrough in high-end process technology will still be one of the core competitiveness of anode enterprises. Follow us to learn more about the industrial trends of graphite anode.

No related results found

0 Replies