【Steel Exports】Forecast of China's Indirect Steel Exports: Up 7% to 143 million tonnes in 2025...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel Exports】Forecast of China's Indirect Steel Exports: Up 7% to 143 million tonnes in 2025; up 4.9% to 150 million tonnes in 2026

China's indirect steel exports mainly involve the export of downstream products such as machinery, metal products, ships, steel structures, home appliances, containers, automobiles, motorcycles, bicycles, and railway vehicles. According to estimates, China's indirect steel exports reached approximately 134 million tonnes in 2024, an increase of 18 million tonnes year-on-year. Based on calculations, indirect steel exports are expected to reach about 143 million tonnes in 2025, an increase of 9.5 million tonnes year-on-year, representing growth of around 7%. Looking ahead to 2026, with an improving international trade environment and exports remaining an important pillar of China's economic development, indirect steel exports are expected to continue growing. Total indirect steel exports are projected to reach around 150 million tonnes, with growth of approximately 4%–5%.

I. Indirect Steel Exports and Steel Consumption Estimates in 2025

Indirect steel exports are expected to reach approximately 143 million tonnes in 2025, up 7% year-on-year.

In 2025, China's foreign trade exports are expected to maintain relatively rapid growth, continuing to serve as a major driver of economic growth. Data show that from January to November, China's total export value increased by 5.4% year-on-year (in USD terms). Among them, exports of mechanical and electrical products led the growth with an increase of 8.0%, accounting for as much as 60.9% of total exports, with most categories showing significant growth. During the same period, export values of ships, automobiles, and general machinery equipment increased by 26.8%, 16.7%, and 6.4%, respectively.

The strong growth in mechanical and electrical product exports has driven an increase in indirect steel exports. These products consume large quantities of steel during manufacturing, and the expansion of their export scale directly boosts indirect steel exports. According to statistics, the combined growth of machinery equipment, automobile, and home appliance exports accounted for more than 60% of the incremental increase in indirect steel exports.

By sector, exports of machinery, ships, automobiles, and motorcycles are expected to maintain growth momentum in 2025.

Automobile, ship, and motorcycle exports recorded substantial increases. From January to October, automobile exports (including chassis) reached 6.51 million units, up 23.3% year-on-year; ship exports totaled 5,660 vessels, up 20.5%; and motorcycle exports reached 38.39 million units, up 24.9%.

Exports of machinery products showed some divergence, but overall volumes continued to grow. Among them, exports of basic machinery components performed well: exports of fasteners, bearings, and hand or machine tools increased by 8.6%, 7.6%, and 11.9% year-on-year, respectively. Exports of finished machinery products were mixed. Tractor exports increased by 20%, while exports of excavators, loaders, tower cranes, and crawler cranes rose by 15%, 12%, 42%, and 24%, respectively. In contrast, exports of food processing machinery declined by 20% year-on-year, and machine tool exports fell by 7%.

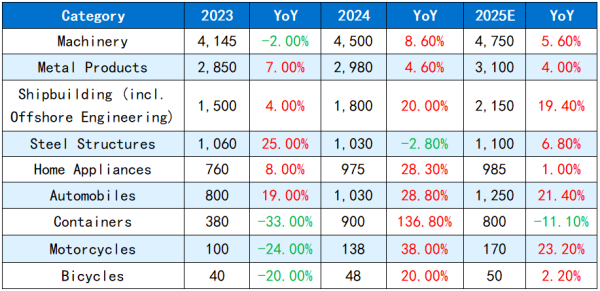

Based on unit steel consumption per product, we estimate that in 2025, steel consumption associated with machinery exports will increase by 5.6% year-on-year; steel consumption for ship exports will increase by 22%; automobile exports by 21%; home appliance exports by a modest 1%; while steel consumption for container exports will decline by 11%. Overall, indirect steel exports in 2025 are expected to reach approximately 143 million tonnes, up about 7% year-on-year.

Table 1: Estimated Steel Consumption of Major Export Products in China, 2023–2025

(Unit: 10,000 tonnes, %)

Source: Mysteel Forecast

II. Factors Affecting Indirect Steel Exports in 2026

(1) Moderate Recovery of the Global Economy in 2026

After the inflation-suppressing effects of the high-interest-rate environment in 2024–2025, central banks in major economies are expected to enter the mid-to-late stage of an interest rate cut cycle in 2026, with liquidity conditions improving significantly compared with 2025. According to forecasts by the IMF and the World Bank, global GDP growth is expected to recover to the range of 3.0%–3.2%.

Continued dual easing of fiscal and monetary policies in major developed economies drives economic recovery.

The U.S. Federal Reserve is expected to cut interest rates twice in 2026, with global monetary liquidity continuing to expand. On the fiscal side, the United States has introduced the "Big Beautiful Bill," aimed at expanding tax cuts and raising the debt ceiling. Several European countries have launched packages of fiscal expansion plans, including increased spending on defense and infrastructure, along with relaxed deficit constraints.

High tariffs and high interest rates continue to constrain global economic growth.

Although tariff tensions have eased somewhat, driven by considerations such as midterm elections and fiscal revenue needs, U.S. tariff policies are expected to remain volatile next year. In addition, rising global trade protectionism, uncertainty in trade policies and geopolitics, high global debt levels, and persistently high interest rates in developed economies continue to weigh on the momentum of global economic recovery.

(2) Adjustment of Foreign Trade Structure, with Emerging Economies Supporting China's Export Demand Growth

While China's overall exports remain resilient, growth momentum is accelerating toward emerging markets such as ASEAN, Africa, and Belt and Road Initiative countries. Market diversification has become the core engine of export growth. This provides an important buffer and support for addressing potential uncertainties in the global trade environment in 2026.

(3) The "Steel Export License System" May Create Conditions for Growth in Indirect Exports

On December 12, 2025, China's Ministry of Commerce and the General Administration of Customs jointly issued an announcement stating that export license management would be implemented for certain steel products starting January 1, 2026. This marks the first reinstatement of the system since its cancellation 16 years ago in 2009. In terms of impact, small and medium-sized enterprises face pressure from rising compliance costs and may experience short-term pain. In the long run, the policy will guide China's steel exports toward higher value-added products such as high-end plates and specialty steels. Exports of ordinary steel products may decline, while the competitiveness of high-end steel exports will strengthen. In addition, direct steel exports may decrease in the future, but finished steel products from China, benefiting from their high quality and cost advantages, may see increased global demand. Overall, the policy is favorable for exports of steel-containing finished products.

III. Forecast of Indirect Steel Exports in 2026

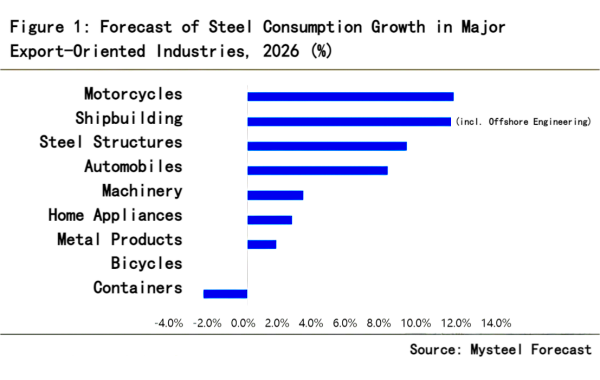

Overall, China's foreign trade exports are expected to maintain medium-to-high growth in 2026, with export value growth projected at around 4.5%. The share of labor-intensive products (such as garments and furniture) is expected to continue declining, but these industries will maintain and enhance value-added through transformation toward branding, high-end positioning, and intelligence. Mechanical and electrical products are expected to continue growing, and the global market share of high-end manufacturing will further increase. The outlook for major steel-consuming industries is shown in the table below.

Indirect steel exports are expected to continue their growth trend in 2026, with steel consumption potentially reaching around 150 million tonnes, representing growth of approximately 4%–5%. The main drivers will remain machinery, automobiles, and shipbuilding. Home appliances and metal products may see modest growth; exports of new energy products will be more heavily influenced by overseas policies; and container exports remain weak.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies