【Overseas】Australian Graphite Market: Poised for Explosive Growth Driven by Electric Vehicles...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Overseas】Australian Graphite Market: Poised for Explosive Growth Driven by Electric Vehicles and Energy Storage

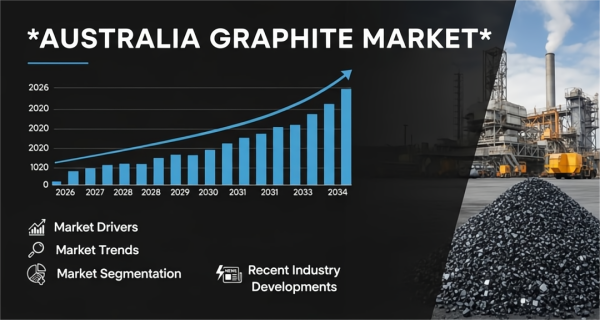

Driven by the accelerated transition to clean energy and the continued rise in demand for battery materials, Australia's graphite market is expected to grow sharply from USD 438.76 million in 2024 to USD 2.25777 billion by 2033, with a compound annual growth rate (CAGR) of 17.8% from 2025 to 2033.

Australia's graphite market is emerging as one of the most dynamic segments within the country's critical minerals sector, benefiting from the rapid global growth in demand for battery materials and sustainable energy solutions. According to data from IMARC Group, the industry was valued at USD 438.76 million in 2024 and is forecast to reach USD 2.25777 billion by 2033, registering a strong CAGR of 17.8% during 2025–2033.

Graphite is a naturally occurring crystalline form of carbon with excellent electrical conductivity and is indispensable in modern technologies—especially in lithium-ion batteries, electric vehicles (EVs), renewable energy storage systems, and high-performance industrial applications. Australia possesses abundant high-grade graphite deposits, covering both natural graphite and synthetic graphite, which positions the country as a key player in the global supply chain for these advanced materials.

As countries accelerate transportation electrification and expand renewable energy infrastructure, demand for battery-grade graphite is surging. This trend, combined with government support for mining and processing projects and increasing foreign direct investment, has made Australia a preferred destination for graphite development and investment.

Strategic offtake agreements between Australian producers and multinational battery and automotive manufacturers, advances in graphite processing technologies, and expanding exports to major markets in Asia, Europe, and North America are further driving market growth. Together, these dynamics indicate a robust development trajectory for the industry over the coming decade.

Core Drivers of Rapid Market Growth

1. Rapid Expansion of Electric Vehicle Production

The surge in global demand for electric vehicles is one of the most critical growth drivers. Graphite is the core component of lithium-ion battery anodes, accounting for a large share of battery weight. As major economies such as Europe, China, and the United States accelerate EV adoption, demand for high-performance graphite continues to rise. Australian graphite producers are signing long-term supply contracts with global battery manufacturers, further strengthening the country's strategic position in the battery materials supply chain.

2. Strong Demand for Renewable Energy Storage

Beyond EVs, the proliferation of solar farms and wind power projects is driving demand for grid-scale battery energy storage systems, which also rely on graphite-based anode materials. As countries seek to balance intermittent power generation with stable electricity supply, demand for efficient and durable battery technologies continues to grow, providing additional momentum to the graphite market.

3. Government Support and Critical Minerals Strategy

Both the Australian federal government and state governments have designated graphite as a critical mineral, strongly supporting related exploration and processing projects. For example, through grants and funding, they are expanding graphite processing capacity and enhancing downstream manufacturing capabilities. This policy focus reflects Australia's broader goal of developing sovereign supply chains and attracting high-value mineral processing investments.

4. Continued Growth in Synthetic Graphite Production

Synthetic graphite, known for its high purity and consistency, is increasingly demanded in high-end battery applications. Australian companies are investing in facilities capable of producing electrode-grade synthetic graphite, positioning the country as a competitive global supplier. Long-term offtake agreements with automotive companies further stabilize demand expectations for synthetic graphite output.

5. Broad Industrial and Technological Applications

In addition to batteries, graphite's unique thermal and electrical properties make it essential in refractories, lubricants, casting, electronics, and other industrial sectors. Growth in these industries—particularly electronics and metallurgy—creates incremental demand for various grades of graphite, diversifying the market's end-use base.

Market Opportunities

1. Downstream Processing and Value-Added Manufacturing

Expanding graphite purification, micronization, and spherical graphite production can capture additional value within the domestic supply chain and reduce reliance on raw material exports.

2. Strategic International Partnerships

Cooperating with global battery and automotive manufacturers through offtake agreements and joint ventures can enhance investment flows and secure long-term supply commitments.

3. Investment in Synthetic Graphite Facilities

Building synthetic graphite production plants, especially those focused on battery-grade anode materials, will enable Australian companies to meet the growing demand for higher-performance specifications in EV and energy storage markets.

4. Expansion of Export Markets

Leveraging Australia's proximity to Asia and its existing trade relationships can improve market access and reduce logistics costs to major export destinations.

5. Alignment with Critical Minerals Policy Initiatives

Aligning graphite projects with national and regional critical minerals strategies can unlock policy incentives, streamline permitting, and shorten project timelines.

6. Industrial Diversification

Targeting emerging applications in aerospace, specialty polymers, and next-generation electronics can diversify demand and reduce reliance on the battery sector.

7. ESG and Sustainable Mining Practices

Strengthening ESG credentials, including sustainable mining practices and low-emission processing technologies, can attract environmentally conscious investors and enhance long-term competitiveness.

Developments in Australia's Graphite Industry

July 2025: Queensland Major Graphite Development Accelerates

A USD 1.2 billion graphite mining and processing project in Queensland led by Graphinex was approved for fast-track development by the state government, aiming to reduce global reliance on Chinese graphite supplies. The project includes a new mine in Croydon and a processing plant in Townsville, and is expected to create more than 230 jobs during construction and operation. This move underscores graphite's strategic importance in the battery supply chain and clean energy transition.

October 2025: Esmeralda Graphite Project Receives U.S. Support

The Esmeralda Graphite Project in North Queensland received a USD 1.3 billion letter of intent from the U.S. Export-Import Bank, highlighting strong international cooperation in the critical minerals sector. Australia's streamlined approval processes and international backing have boosted investor confidence and are expected to accelerate battery-grade graphite development and export capacity.

2025: Policy Adjustments Boost Investment Sentiment

In 2025, the United States increased tariffs on Chinese graphite imports, shifting global attention toward alternative suppliers such as Australia. The higher tariff framework raised the cost of Chinese graphite by more than 160%, prompting investors to focus on Australian mining stocks and encouraging the expansion of domestic processing and mining infrastructure.

Why Pay Attention to the Australian Graphite Market?

Australia's graphite market sits at the intersection of climate technology, energy storage, and electric vehicles, making it a critical growth frontier. Supported by a strong CAGR, government backing, and strategic international partnerships, its rapid expansion offers highly attractive opportunities for investors and industry leaders. For companies, securing reliable, high-quality graphite supply is essential for next-generation battery manufacturing and industrial applications; for policymakers, fostering the graphite industry enhances national supply-chain resilience while aligning with clean-energy goals. As the world transitions toward electrification and sustainability, Australia's graphite market is becoming a major force driving global economic and environmental progress.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies