【Carbon Industry Outlook】Three Major Technology Trends in 2025: Who Will Lead ...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Carbon Industry Outlook】Three Major Technology Trends in 2025: Who Will Lead the Next Round of Competition?

Zhengzhou, Henan Province — an academic conference focusing on the future of carbon materials is being prepared, where industry experts will discuss the transformation and breakthroughs of this traditional material sector at the closing stage of China's 14th Five-Year Plan.

In 2025, the final year of the 14th Five-Year Plan, China's carbon industry stands at a critical crossroads of transformation. With the in-depth advancement of the "dual-carbon" strategy and the accelerated penetration of new quality productive forces, this once traditional industry is undergoing a profound technological revolution.

According to the latest reports, the global carbon market size is expected to exceed USD 20 billion in 2025, while the Chinese market is projected to reach approximately RMB 52.4 billion. Within the industry, a transformation in technological pathways and future directions has quietly begun.

01 Industry Transformation: From Scale Expansion to Quality and Efficiency

In 2025, China's carbon industry is experiencing a deep transformation from extensive manufacturing to green and intelligent production, and from basic materials to high-end manufacturing. While the industry scale continues to expand, the underlying growth logic has fundamentally changed.

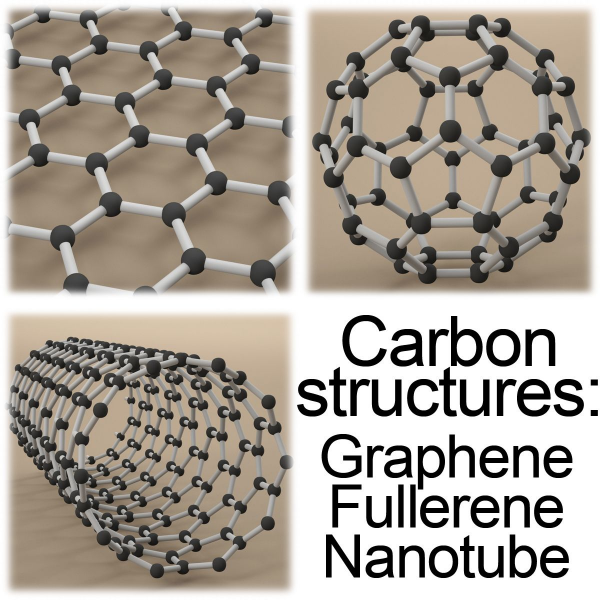

In recent years, the industry has shown clear structural growth characteristics. On one hand, traditional carbon products are accelerating upgrades toward higher efficiency and lower energy consumption. On the other hand, high-end categories such as high-purity graphite, carbon products for thermal fields, carbon fibers, and their composites have demonstrated outstanding performance.

Leading enterprise Fangda Carbon has built a complete industrial chain by integrating 13 subsidiaries, forming core capacities of 260,000 tons of carbon products and 354,000 tons of raw materials annually. Such industrial chain integration has become an important strategy for the industry to cope with volatility.

02 Three Major Technology Trends: Redefining the Competitive Landscape

Trend 1: Accelerated R&D and Application of High-End New Materials

R&D of new carbon materials is increasingly focused on high value-added fields, with nuclear energy and new energy sectors becoming new growth drivers.

Driven by innovation strategies, leading enterprises have maintained R&D investment ratios above 4.5% for three consecutive years (reaching RMB 120 million in 2024), accumulating 77 patents and 13 national or industry standards.

High-end carbon materials have become particularly prominent in aerospace applications, serving as key materials supporting national strategic sectors. These materials enjoy strong demand in international markets, with robust export growth.

As a representative high-end product, carbon–carbon composites continue to expand in market size, with applications extending to single-crystal silicon growth furnaces, carbon–carbon grid systems, glass processing industries, and aerospace industries.

Trend 2: Comprehensive Acceleration of Intelligent Manufacturing

Intelligent transformation has become a key pathway for carbon enterprises to reduce costs and improve efficiency. Fangda Carbon invested RMB 98 million to build the industry's first "5G + fully connected intelligent carbon manufacturing factory," enabling full-process data acquisition and AI-based quality prediction.

This transformation has delivered tangible benefits: overall equipment effectiveness (OEE) increased to 89%, product defect rates dropped below 0.3%, energy consumption per furnace was reduced by 14% through digital twin optimization of calcination processes, and order delivery cycles were shortened by 35%.

In the activated carbon sector, intelligent technologies are also gaining traction. Traditional DCS control systems are being replaced by intelligent management systems, with multi-PLC subsystem control, smart metering systems, and energy management systems.

Trend 3: Green and Low-Carbon Processes as Standard Practice

Under the dual-carbon goals, green and low-carbon development has become a rigid constraint and mandatory indicator for the carbon industry. Cumulative investments in green factory upgrades have exceeded RMB 200 million, reducing energy consumption per unit of output by 22%.

In the activated carbon industry, optimization of carbonization processes and the introduction of solar preheating systems, flap-type drying systems, and belt scales have enabled energy savings and material balance calculations.

Solar preheating systems can heat water from 5–15°C to 50–90°C, saving enterprises 10%–20% of energy investment. Such green technologies are shifting from "optional" to "essential."

03 Industry Leaders: Advancing Through Innovation and Industrial Chain Synergy

In the new round of competition, enterprises with strong R&D capabilities and industrial chain coordination are gradually standing out.

Through breakthroughs in low-sulfur calcined petroleum coke production technology, Fangda Carbon has increased raw material self-sufficiency to 73%, further strengthening industrial chain resilience. In the first half of 2025, the yield rates of its high-end products such as graphite electrodes and nuclear-grade carbon/graphite materials increased by 18%, effectively offsetting volatility.

Some enterprises have also adopted a "domestic production base + overseas service center" model, establishing technical service centers in Southeast Asia and the Middle East, supported by intelligent production lines. Overseas revenue contribution has increased from 18% in 2023 to 27% currently.

04 Future Growth Tracks: Nuclear Energy, New Energy, and Aerospace

Future growth momentum of the carbon industry will mainly come from high-end fields such as nuclear energy, new energy, and aerospace.

Carbon enterprises are focusing on breakthroughs in nuclear-grade graphite materials, carbon materials for high-temperature gas-cooled reactors, and carbon-based composite materials for new energy batteries. These technological breakthroughs will bring higher added value and stronger technical barriers.

Meanwhile, applications of carbon–carbon composites in aerospace continue to expand. Globally, companies such as SGL Carbon, Toyo Tanso, and Mersen, along with domestic enterprises including Jinbo Shares, Boyun New Materials, and Chaoma Technology, are actively positioning in this field.

05 Challenges and Risks: Obstacles on the Transformation Path

The development of the carbon industry still faces multiple challenges. Capacity distribution shows clear divergence, with coexistence of overcapacity in some traditional products and insufficient supply of high-end products.

Under the dual-carbon goals, carbon cost pressures are gradually transmitting across the industrial chain. High dependence on imported raw materials for high-end production has not been fundamentally resolved, posing potential risks to industrial chain security.

Industry concentration continues to increase, with leading enterprises further consolidating advantages in technology, capacity, and market channels, placing greater competitive pressure on small and medium-sized manufacturers. Promoting industry integration and accelerating technological upgrades have become urgent tasks.

Industry experts predict that with the release of dividends from intelligent transformation, overall profit margins of the carbon industry will rebound to the 18%–22% range by 2026, forming a dual-advantage pattern of "technology-driven + cost leadership."

The future has arrived. Enterprises that can grasp high-end material R&D, deepen green manufacturing systems, and expand global layouts will not only win the next round of competition, but also drive China's transition from a major carbon producer to a strong carbon industry powerhouse.

Feel free to contact us anytime for more information about the Carbon products market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies