【Anode Materials】2025 Market Review: Global Anode Shipments Reached 3.0615 Million Tons...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】2025 Market Review: Global Anode Shipments Reached 3.0615 Million Tons, Up 47% YoY

In 2025, global lithium battery output reached 2,297 GWh, representing a year-on-year increase of 48.5%. The growth rate of global lithium battery anode material production was slightly lower than that of batteries, and the market pattern of anode overcapacity showed signs of improvement. With the continued increase in penetration of the new energy vehicle market—especially the rapid expansion of new energy heavy trucks and commercial vehicles—combined with the high-speed growth in energy storage demand, the anode material market exhibited a cyclical rebound from the bottom. The supply–demand structure improved, further optimizing the overall market landscape. Specifically:

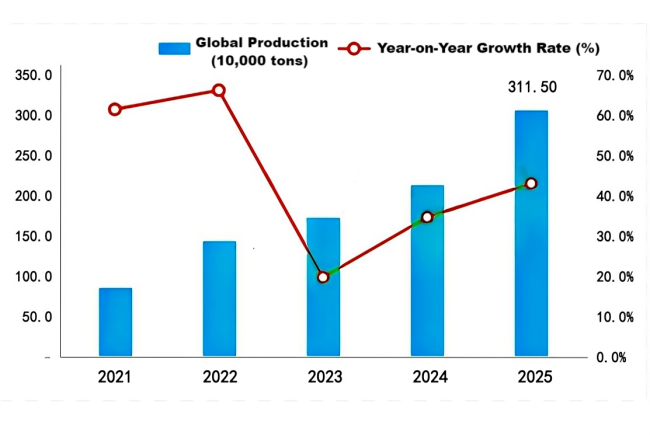

Global anode production reached 3.115 million tons in 2025, up 43.7% year-on-year.

In 2025, global anode material output totaled 3.115 million tons, representing a year-on-year increase of 43.7%. Among this, China's share of anode material production further increased to 99.0%, up from 98.5% last year. In terms of sales volume, global shipments reached 3.0615 million tons, with China accounting for as much as 98.4%.

Figure: Global Anode Material Production Statistics, 2021–2025 (10,000 tons, %)

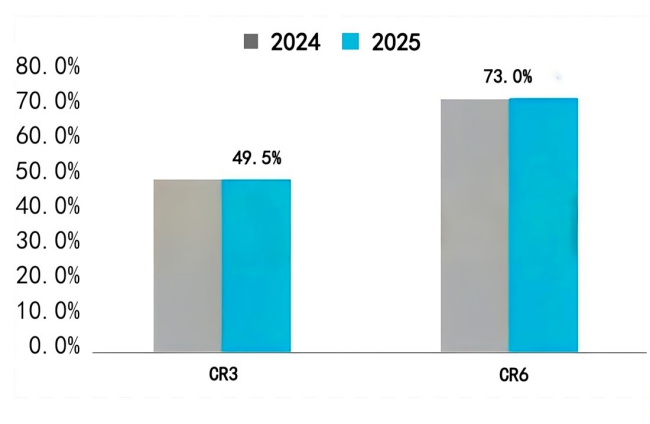

Global anode material CR3 share stood at 49.5%, basically unchanged from last year.

In 2025, the CR6 share reached 73.0%, slightly higher than 72.7% in the previous year, indicating a marginal increase in market concentration. The CR3 share was 49.5%, slightly down from 49.7% last year. Second-tier manufacturers made modest progress in penetrating top-tier customers; however, overall, the competitive landscape of the lithium battery anode industry remained largely unchanged.

Figure: Changes in Industry Concentration of the Lithium Battery Anode Sector in 2025

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies