【Petroleum Coke】February 2026 Market Analysis and Outlook

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】February 2026 Market Analysis and Outlook

1.1 Petroleum Coke Market Analysis

Domestic Market Analysis:

During this month, the domestic petroleum coke market generally showed a pattern of stability with a narrow downward trend. Throughout the month, the imbalance between increasing supply and demand dominated by rigid demand exerted pressure on prices. At the beginning of the month, market sentiment was cautious and wait-and-see prevailed, with prices under pressure.

On the supply side, bearish pressure in the domestic petroleum coke market was significant, with output increasing. As refineries that previously underwent maintenance, such as Yunnan Petrochemical and Dongming CNPC, gradually resumed operations, domestic petroleum coke supply rebounded. Meanwhile, a large volume of imported petroleum coke arrived at ports in a concentrated manner, leading to a sharp accumulation of port inventories and further intensifying supply pressure. Although traders actively shipped goods, inbound volumes continued to exceed outbound volumes, causing inventories to rise rather than fall. This became a key bearish factor suppressing market prices.

On the demand side, support remained weak, with purchases mainly driven by rigid demand. Approaching the traditional pre-holiday stocking period before the Spring Festival, downstream enterprises did not show a concentrated purchasing spree. Most focused on consuming existing inventories and purchasing on demand, resulting in generally average procurement enthusiasm. Downstream industries showed mixed performance. The operating rate of the anode material industry increased significantly, providing some support to petroleum coke demand. The operating rate of the end-user electrolytic aluminum industry remained at a high level, offering a floor for upstream demand. However, the operating rate of the prebaked anode industry declined slightly month-on-month, while demand from carburizer and graphite electrode industries remained limited due to constraints from the downstream steel market.

Overall, the growth in domestic petroleum coke demand failed to match the increase in supply. Traders actively offered cargo, but downstream buyers remained cautious, and market wait-and-see sentiment was strong. Prices experienced brief rebounds, only to retreat again due to insufficient demand.

Market Outlook:

From the supply perspective, the operating rate of domestic delayed coking units is expected to remain at a relatively high level, with national output projected to decrease slightly within a narrow range. Imported petroleum coke ordered earlier is expected to arrive at ports in a concentrated manner, replenishing port inventories.

On the demand side, February demand is expected to contract overall due to the Spring Festival, although the rigid demand base remains intact. During the holiday period, logistics disruptions and factory shutdowns at downstream plants will reduce actual purchasing activities. Pressure transmitted from the terminal electrolytic aluminum industry is expected to lead to downward pricing expectations for prebaked anodes, thereby weakening procurement enthusiasm for petroleum coke. The anode material sector shows limited purchasing interest for raw petroleum coke, mainly operating on small, on-demand orders, making it difficult to provide strong bullish support to the market.

In summary, under the influence of the Spring Festival holiday, the overall trading atmosphere of the national petroleum coke market is expected to follow a rhythm of pre-holiday wait-and-see and post-holiday recovery. Prices are expected to remain under pressure, characterized by overall stability with minor adjustments and narrow-range fluctuations. Going forward, close attention should be paid to refinery maintenance and restart progress, as well as port inventory levels.

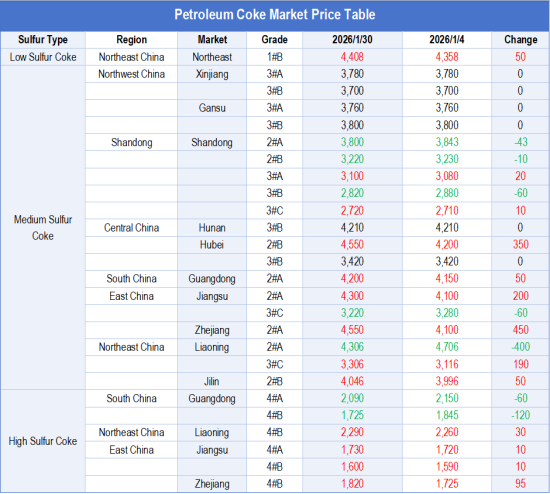

1.2 Monthly Petroleum Coke Price Comparison

Unit: RMB/ton

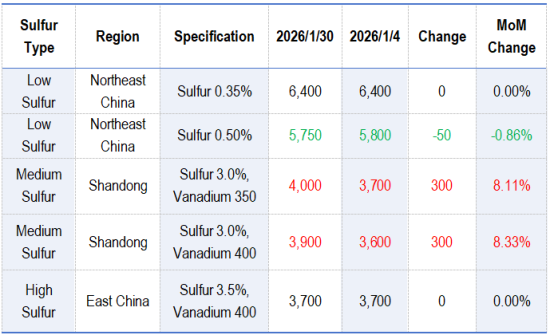

1.3 Monthly Calcined Petroleum Coke Price Comparison

Unit: RMB/ton

2. Chinese Domestic Unit Operating Status

3. Analysis of Domestic Delayed Coking Unit Operation and Output This Month

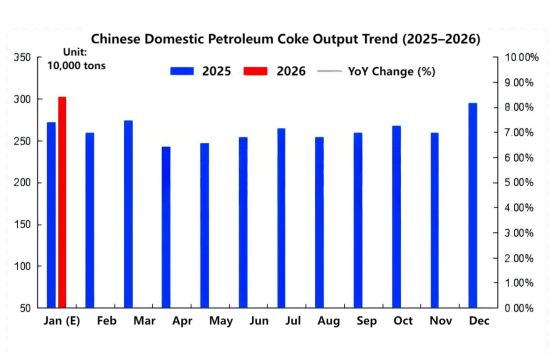

3.1 Analysis of China's Petroleum Coke Output in January 2026

China's petroleum coke output in January 2026 was approximately 3.03 million tons, an increase of 306,200 tons year-on-year, representing a growth rate of 11.25%; output increased by approximately 71,000 tons month-on-month, a month-on-month growth rate of 2.40%.

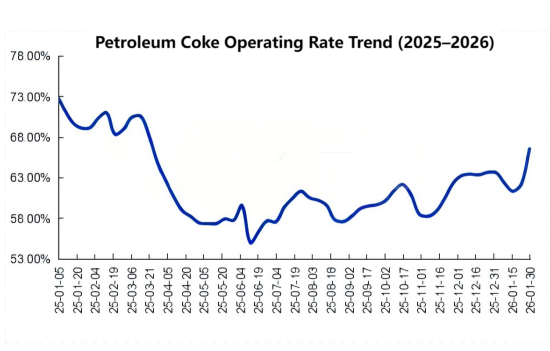

3.2 Analysis of China's Petroleum Coke Operating Rate in January 2026

During the month, the delayed coking market showed an upward trend, with the average operating rate at approximately 63.47%. In January, a total of five new delayed coking units entered maintenance, including Anqing Petrochemical, Zhejiang Petrochemical, and Yunnan Petrochemical, while domestic refinery supply increased slightly. Meanwhile, three delayed coking units resumed operations during the month, with some refineries adjusting output levels.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies