Needle Coke Import and Application

Needle Coke Import and Application

Import

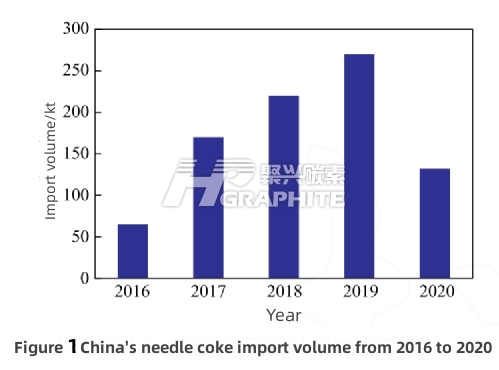

Figure 1 shows China's needle coke import volume during the past 5 years. It can be seen that before the COVID-19 outbreak, China's needle coke import volume increased significantly, reaching a record high of 270kt in 2019. UHP graphite electrode (imported needle coke as raw material) has been widely used in the steelmaking industry. In 2020, due to the high price of imported needle coke, declining competitiveness, large port inventory, and the continuous outbreak of epidemic in Europe and the United States, China's import volume was only 132,000 tons, down 51% year on year. According to statistics, in 2020, the petroleum series needle coke was 275,000 tons, down 82.93% from last year; The coal series needle coke was 1.041 million tons, an increase of 18.26% year on year. The main reason was that the sea transport in Japan and South Korea was less affected by the epidemic, secondly, some specifications price in Japan and South Korea was lower than that of similar needle coke in China, and the downstream order volume was large.

Application

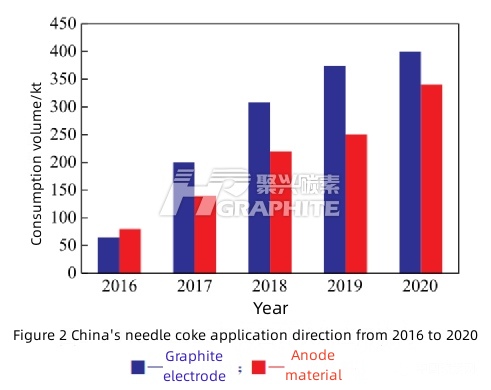

Needle coke is one of the high-end carbon materials, mainly used as raw materials for producing ultra-high power graphite electrode and artificial graphite anode materials. The most important terminal applications are electric arc furnace steelmaking and new energy vehicle power battery.

Figure 2 shows the application direction of needle coke in China in the past 5 years. Graphite electrode is the largest application field. The growth rate of demand has entered a relatively stable stage, while anode materials continue to grow rapidly. In 2020, China's total consumption of needle coke (including inventory consumption) was 740,000 tons, including 340,000 tons of anode materials and 400,000 tons of graphite electrodes, accounting for 45% of the consumption of anode materials. For market analysis of needle coke and graphite electrode products, feel free to contact us.

No related results found

0 Replies