Needle Coke Report Ⅵ:February 2023 Profit Analysis

Needle Coke Report Ⅵ:

February 2023 Profit Analysis

Profit: needle coke profit decreased

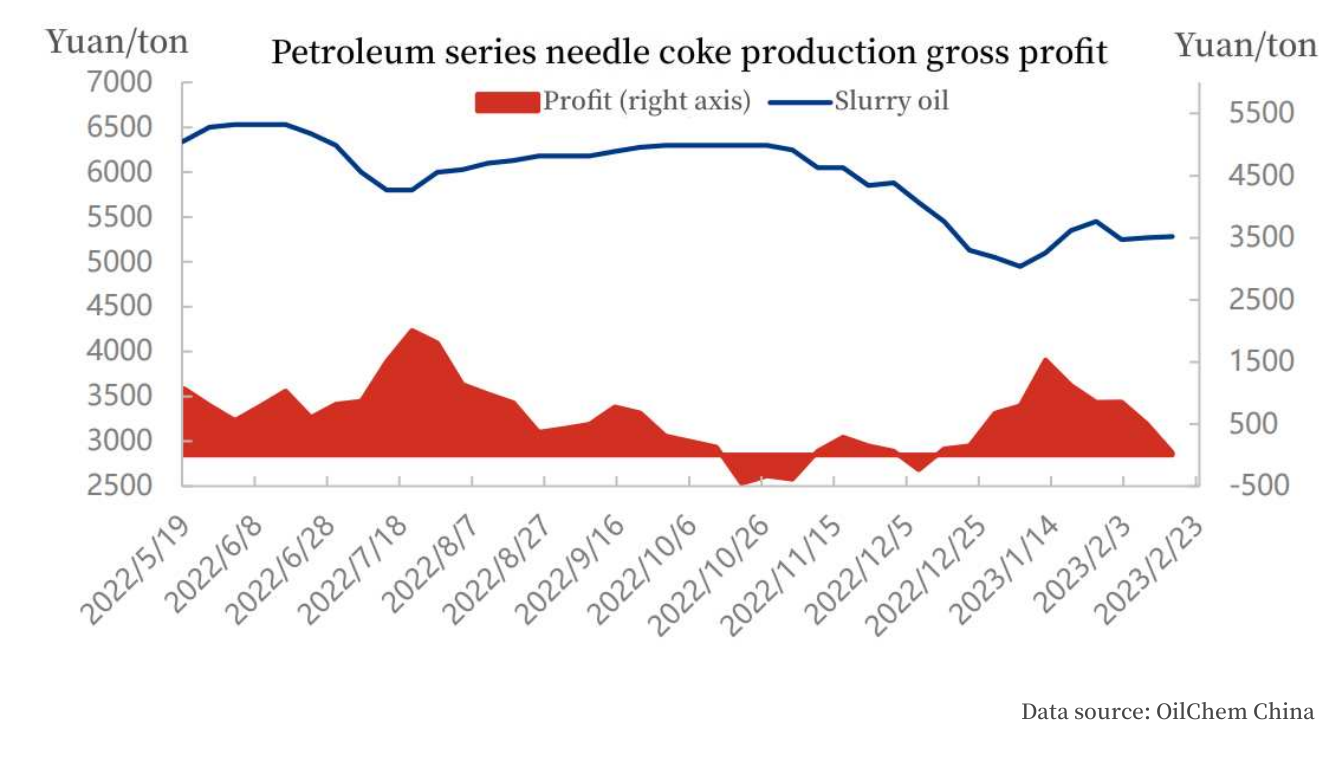

1. Profit: petroleum series theoretical profit declined

1. Profit: oil system theoretical profit declined

In February, the theoretical profit of petroleum series needle coke decreased significantly compared with the previous month, with a monthly average of 379 yuan/ton. The decline in production profit was mainly caused by a decrease in the market price of needle coke and an increase in the price of upstream raw oil slurry; The oil slurry average monthly price was 5185 yuan/ton, up 3.29%. The needle coke price fell by 200 yuan/ton, and other by-products prices rose. The coking gas oil price rose by 296 yuan/ton, the diesel oil price rose by 361 yuan/ton, the gasoline rose price by 180 yuan/ton, and the coking gas price rose by 221 yuan/ton.

2. Upstream products: raw material prices vary

2.1 Oil slurry: oil slurry price rises

In February, the major market Shandong medium-high sulfur slurry average price was 4978 yuan/ton, up 301 yuan/ton or 6.44% from the previous month. At the beginning of this month, affected by the overhaul of catalytic units in some refineries, oil slurry availability was tight in the first half of the month, and crude oil prices were trending upwards. There was an obvious reluctance by the refineries to sell at low prices. In the first and middle of February, oil slurry prices remained high, with little fluctuation. However, as a result of high costs, downstream needle coke and traditional oil slurry deep processing suffered losses, and purchase intentions were low. During the second half of the month, crude oil fluctuated and fell, the downstream negative sentiment gradually rose, oil slurry shipment and price fluctuation decreased.

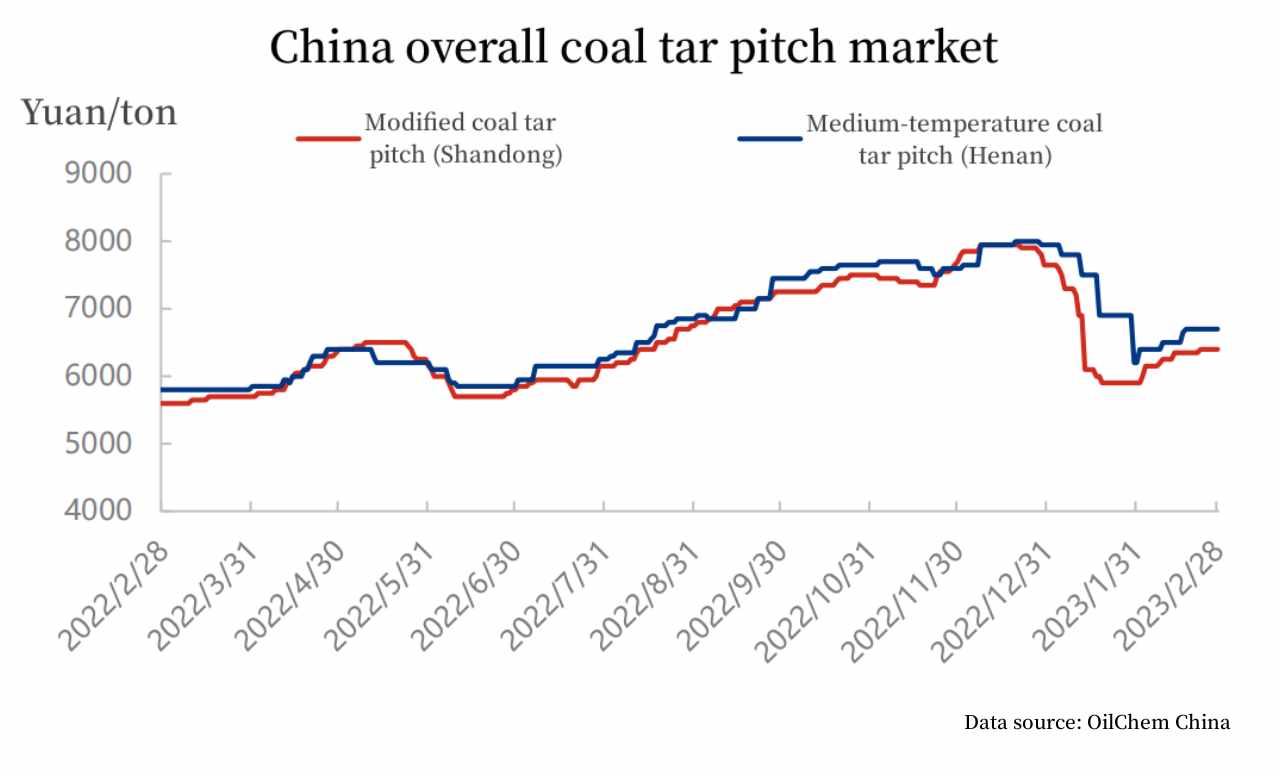

2.2 Coal tar pitch: supply and demand of coal tar pitch are weak

In February, China's coal tar pitch market average spot price was 6292.11 yuan/ton, down 5.9% month-on-month and up 6.6% year-on-year. From the perspective of the market this month, the high-temperature coal tar price has been rising in general, and the cost has been a positive support for the new coal tar offer. Since early this month, the downstream enterprises entered the market to replenish the inventory periodically, and the demand side was favorable and the support was acceptable; Since the end of this month, with the increase of deep processing load and the decline of downstream demand, the supply and demand side has been weak. Only the raw material side has given favorable support to the coal tar pitch market, and the supply-demand side has dragged the rise of coal tar pitch. More needle coke market reports will be provided. Please continue to follow us.

No related results found

0 Replies