【Petroleum Coke】 Refineries actively shipping, low-sulfur coke prices fluctuate

【Petroleum Coke】 Refineries actively shipping, low-sulfur coke prices fluctuate

1. Recent focus

In March 2023, the weighted average full cost of China's aluminum electrolysis industry was 17,080 yuan/ton, down 157 yuan/ton from the previous month (the weighted average full cost of China's aluminum electrolysis industry in February was revised to 17,237 yuan/ton).

2. Recent market trends

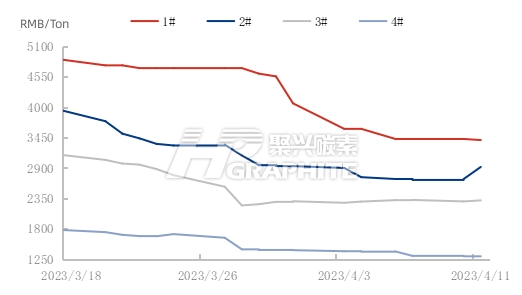

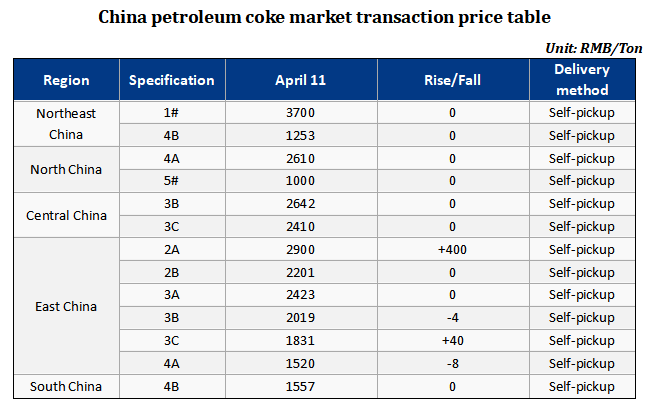

China petroleum coke price trend chart

In recent, domestic petroleum coke market actively ships and sells, with low-sulfur coke market prices fluctuating as refinery coke prices adjust. In the regional refining market, transactions are generally stable with some price fluctuations.

In terms of major refineries, Sinopec refineries' petroleum coke is sold at contract prices, with transactions temporarily stable during the transition. CNOOC's low-sulfur coke prices have improved after a decline, and the current round of bidding downstream procurement is strong, driving the refinery's latest prices to generally rise in response to market demand. PetroChina's northeast and north China low-sulfur coke conducts the latest bidding, downstream enterprises enter the market with a cautious attitude, and the winning bid price falls compared to the previous round; the northwest market continues to be weak, with insufficient support for petroleum coke prices; southwest and south China market's petroleum coke is expected to release the latest pricing in recent, continuing to follow up on prices. In terms of local refineries, refineries actively ship and clear inventory, and the shipment of index-grade petroleum coke is still acceptable with individual coke prices rebounding, while high-sulfur petroleum coke shipments are generally stable with some coke prices continuing to decline. Shandong Hengfeng Petrochemical delays the coking unit feed and is expected to start coke production tomorrow. East China's Zhejiang Petrochemical petroleum coke's latest pricing drops by 200 yuan/ton, with a total winning bid of 40,000 tons in this round. North China's Xinhai Petrochemical adjusts its petroleum coke sulfur content to within 1.5% and vanadium content to 100 ppm, implementing the latest pricing sales.

3. Production trend

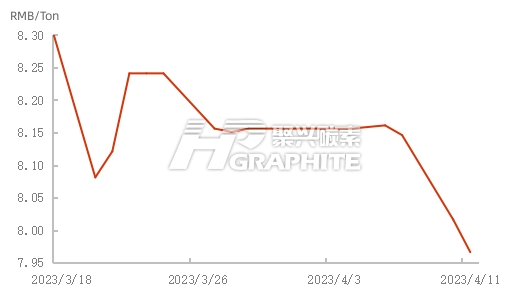

Petroleum coke daily production trend chart

Current domestic petroleum coke production is 79,660 tons, down 500 tons or 0.62% compared to the previous working day. Boxiong Yongxin's delayed coking unit is shut down.

4. Related product situation

In terms of demand, enterprises maintain a wait-and-see attitude, traders' enthusiasm for entering the market is lacking, and there is insufficient support for refinery shipments. Terminal spot aluminum electrolysis prices continue to fluctuate downwards, aluminum carbon market transactions remain weak, commercial calcination enterprises' operating load drops to around 56%, supporting carbon enterprises' operation is stable, but due to the continuous decline in raw material prices, enterprises make small purchases to replenish inventory, and market support is insufficient. Steel carbon market transactions continue to be weak, graphite electrode enterprises' production slightly increases, but the positive pull on petroleum coke shipments is limited, and the petroleum coke market still lacks favorable factors.

5. Market forecast

In the short term, the domestic petroleum coke market will mainly undergo consolidation, with mainstream coke prices remaining weakly stable and local refining markets actively shipping. The enthusiasm for entering the market on the demand side is generally limited, providing limited support for refinery petroleum coke shipments. In addition, the continuous increase in port spot inventories prolongs the oversupply situation, leaving limited room for petroleum coke prices to rise. Petroleum Coke Market Trend Forecast – Contact us for more information.

No related results found

0 Replies