【Calcined Petroleum Coke】Analysis of Market Supply and Demand Trends with Profit Decline in November

【Calcined Petroleum Coke】Analysis of Market Supply and Demand

Trends with Profit Decline in November

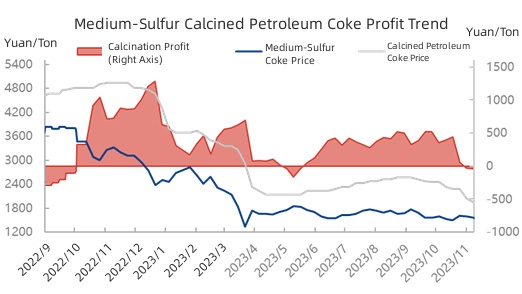

From January to November 2023, taking the domestic general-purpose 3.0 calcined petroleum coke as an example, the average price is 2642 yuan/ton, with a year-on-year decrease of about 45%. Meanwhile, the average price of domestic medium-high sulfur petroleum coke from January to November is 1824 yuan/ton, showing a year-on-year decrease of 49%.

In terms of the overall operation in 2023, the profit level of calcined petroleum coke has improved compared to 2022. However, starting from mid-October, there has been a significant decline in domestic calcined petroleum coke profits.

Source: Oilchem

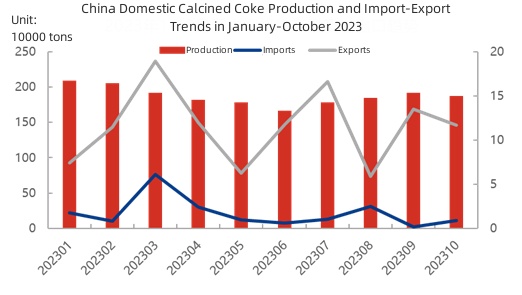

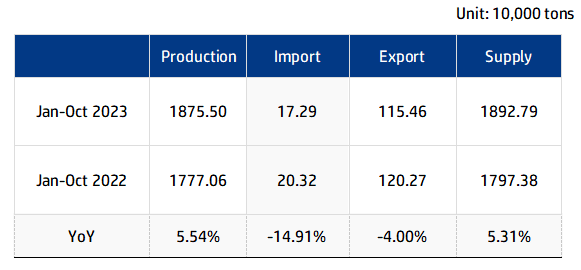

From January to October 2023, the domestic production of calcined petroleum coke totaled 18.755 million tons, with a year-on-year increase of 5.54%. The import volume from January to October totaled 172,900 tons, with a year-on-year decrease of 14.91%. The overall domestic supply increased by 5.31%. In addition, looking at the export situation of calcined petroleum coke in 2023, the export volume from January to October was 1.1546 million tons, showing a year-on-year decrease of 4.00%.

Source: Oilchem, China Customs

From January to October 2023, the apparent consumption of calcined petroleum coke in China increased by 1 million tons, a growth rate of nearly 6% compared to the same period last year. The projected consumption of petroleum coke in China for the entire year 2023 is expected to reach 44 million tons, with a year-on-year increase of 8%.

Source: Oilchem, China Customs

Entering late November, some calcining enterprises experienced low processing operations due to poor order situations and profit conditions. Overall, there may be a slight decline in calcined petroleum coke production in November-December. It is expected that with the slow decline in petroleum coke prices at the end of November, calcined petroleum coke profits may stabilize at a low level. More details of the fourth quarter calcined coke market analysis, feel free to Contact us.

No related results found

0 Replies