【Needle Coke】Continuous Increase in Production Capacity, Exacerbating Supply-Demand Imbalance

【Needle Coke】Continuous Increase in Chinese Needle Coke Production Capacity,

Exacerbating Supply-Demand Imbalance

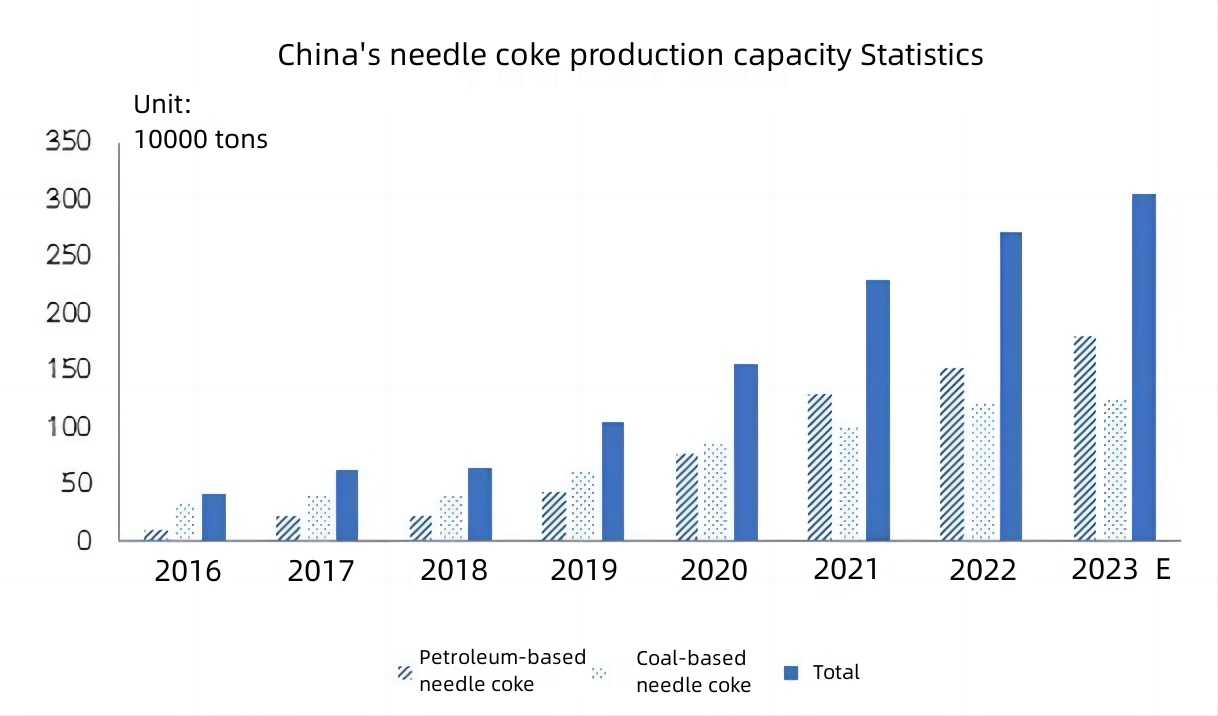

According to statistics, as of December 15, China's needle coke production capacity for 2023 is approximately 3.05 million tons, with petroleum-based needle coke at 1.8 million tons and coal-based needle coke at 1.25 million tons. This marks an increase of 330,000 tons compared to 2022. The expansion of needle coke production capacity has gradually shifted from new factory construction to the expansion of existing well-established enterprises. Despite continuous capacity expansion, demand has been weak, leading to an increased pace of industry restructuring. The average operating rate in the market for 2023 is less than 35%, and under the supply-demand imbalance, market prices are struggling to rise, learn more about the carburants market.

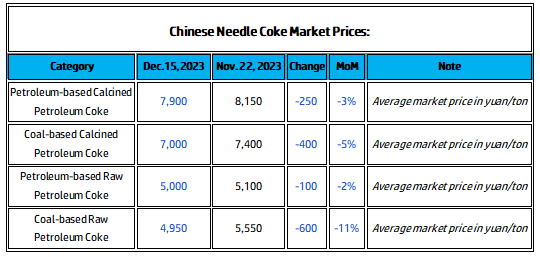

Since late November, market prices have been consistently declining, with a decrease ranging from 100 to 600 yuan/ton. As of December 15, the price range for needle coke in the Chinese market is calcined coke at 6,500-8,800 yuan/ton and raw coke at 4,700-5,300 yuan/ton. The mainstream transaction prices for imported petroleum-based needle coke are 450-1,250 USD/ton for raw coke and 950-1,700 USD/ton for calcined coke. The mainstream transaction prices for imported coal-based needle coke are 600-850 USD/ton.

1. Adequate Market Supply Leading to Continuous Price Decline:

In the petroleum-based needle coke sector, mainstream enterprises are producing normally, while a few have stopped or shifted production to petroleum coke. Due to poor demand, most enterprises in the market show a clear intention to control production and try to maintain a balance with sales. However, as previous inventories have not been fully consumed, the market supply remains more than demand. In the coal-based needle coke sector, many enterprises have shifted or halted production, but there is still existing inventory available in the market, leading to an overall oversupply.

2. Caution in Graphite Electrode Orders Affects Needle Coke Procurement:

The current graphite electrode market sees some enterprises aiming to recover funds at the end of the year, frequently engaging in low-priced transactions. This has resulted in a divergence in market transaction attitudes, causing caution in needle coke procurement. There are fewer new orders in the calcined coke market, with most transactions being with old customers. Additionally, as the end of the year approaches, electrode enterprises have no stocking expectations, resulting in a bearish impact on needle coke prices.

3. Decrease in Demand for Negative Electrode Materials Affects Needle Coke Procurement Sentiment:

The current downstream demand for negative electrode materials has weakened, leading to the clearance of accumulated inventory across the entire industry chain. As a result, the priority is to digest previous raw material inventory, and the mindset for hoarding and stocking is low. Procurement is primarily aimed at maintaining basic production, with fewer-than-expected orders in the raw coke market. The enthusiasm of needle coke enterprises for production has decreased, and the market's wait-and-see sentiment has become stronger.

Future Market Forecast

Supply Aspect: In December, a new unit in a Shandong factory has started production, and at the same time, the operation of a unit in a Shandong factory is expected to increase significantly, with a total operating rate expected to rise by 1.34% compared to November. There will be a small increase in supply, providing support for the weakening market.

Demand Aspect: Some enterprises in the negative electrode materials market are currently experiencing a continued decline in supply, and needle coke procurement is expected to maintain just-in-time purchasing. With the graphite electrode market running in a long-term negative profit scenario, there is continued pressure on lowering needle coke prices. The overall market demand for needle coke is in a bearish trend, and cautious purchasing is expected by the end of the year.

Overall Analysis: With significant bearish factors in the market, it is expected that by the end of December, needle coke market prices will be weak and stable, with a downward adjustment of around 200 yuan/ton. The price range for needle coke is projected to be 4,600-5,200 yuan/ton for raw coke and 6,500-8,600 yuan/ton for calcined coke. For more information on the coke market, feel free to communicate with us.

No related results found

0 Replies