【Negative Electrode Materials】 Expecting 2024 Price Drop; Graphitization Processors Share <30%

【Negative Electrode Materials】 Expecting 2024 Price Drop;

Graphitization Processors Share <30

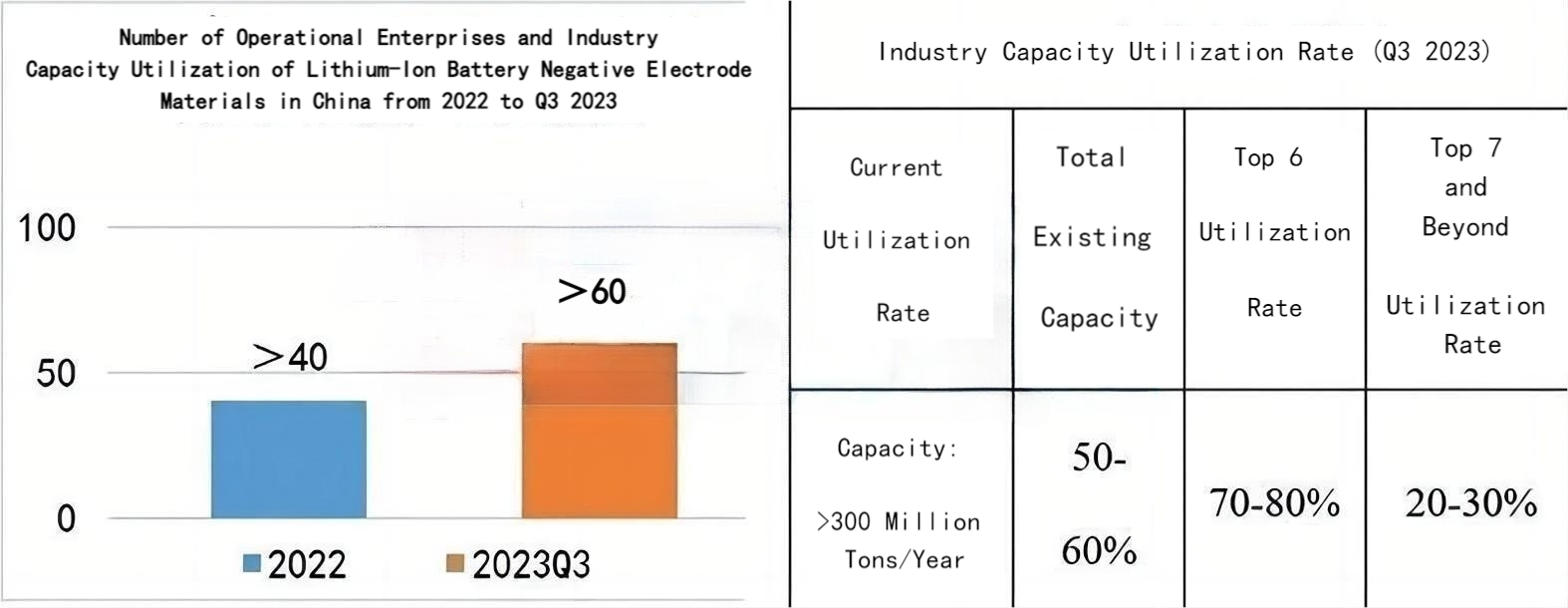

Currently, there are over 90 enterprises engaged in negative electrode production, with industry capacity nearing 4 million tons. The average capacity utilization rate for the entire industry is less than 50%. Most enterprises face challenges such as starting and stopping production simultaneously, making it difficult to absorb the capacity, and learn more about the graphitized petroleum coke product. In 2024, small and medium-sized enterprises in the negative electrode sector are expected to face the following challenges: further decline in the prices of negative electrode materials, mainstream artificial graphite products with a capacity of 340mAh/g to fall below RMB 16,000 per ton; difficulties in starting shutdown projects, high operating costs; limited customer orders being fragmented in the market; prolonged payment cycles from upstream negative electrode suppliers, increasing payment risks. Despite structural overcapacity and industry consolidation, the negative electrode materials market still has growth potential. It is estimated that by 2030, China's negative electrode materials shipments will reach 5.8 million tons, with artificial graphite remaining the market mainstream, accounting for over 4.7 million tons.

The current concentration ratio (CR6) of the negative electrode materials industry is 78%, with fewer than 15 enterprises with monthly shipments exceeding one thousand tons, occupying over 80% of the market share. The remaining 80-plus enterprises will "compete" for about 20% of the market.

According to incomplete statistics, there are currently over 90 enterprises engaged in negative electrode production, with industry capacity nearing 4 million tons. The average capacity utilization rate for the entire industry is less than 50%. Most enterprises face challenges such as starting and stopping production simultaneously, making it difficult to absorb the capacity. From the perspective of capacity utilization, the industry's capacity is in a "head-tail" differentiated state. The total capacity utilization rate of the top 6 enterprises exceeds 70%, while the average total capacity utilization rate of the 7th and subsequent enterprises is less than 30%. In 2024, small and medium-sized enterprises in the negative electrode sector are expected to face:

(1) Further decline in the prices of negative electrode materials. The mainstream artificial graphite product with a capacity of 340mAh/g will fall below RMB 16,000 per ton;

(2) Difficulties in starting shutdown projects; high operating costs. Due to low capacity utilization rates, the depreciation cost of equipment for over 95% of small and medium-sized enterprises is more than three times that of leading enterprises;

(3) Limited customer orders being fragmented in the market;

(4) Prolonged payment cycles from upstream negative electrode suppliers, increasing payment risks. In the face of industry oversupply and pressure from industry giants, small and medium-sized enterprises need to seek "common ground while reserving differences," through measures such as product differentiation, market segmentation, and targeted development of raw materials, to form a differentiated competition. Despite structural overcapacity and entering a period of industry reshuffling, the negative electrode materials market still has room for growth. It is estimated that by 2030, China's negative electrode materials shipments will reach 5.8 million tons, with artificial graphite remaining the market mainstream, accounting for over 4.7 million tons.

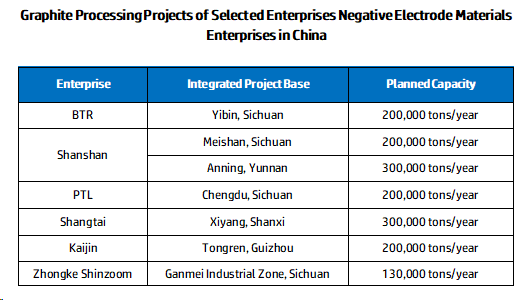

It is expected that China's graphite production capacity will exceed 3.5 million tons per year in 2024, more than three times the level at the beginning of 2022. Under long-term "internal circulation," extreme cost reduction has become the core competitiveness of graphite and downstream negative electrode enterprises in the next 2-3 years. Influenced by this, the industry may experience the following phenomena:

(1) The self-sufficiency rate of graphite may exceed 70%. Non-integrated graphite projects incur costs such as packaging and transportation, and for cost reduction, the proportion of integrated or graphite processing projects in proximity (within 500 kilometers) may exceed 90%.

Source: Publicly available information, compiled by GGII , Dec. 2023

(2) There are still many crucible furnaces producing artificial graphite products with less than 350mAh/g. This flexibility allows enterprises to accept orders. In 2024, graphite will develop towards professional differentiation, with crucible furnaces mainly supporting artificial graphite products with 350mAh/g and above, and box furnaces mainly supporting artificial graphite products with 340 and 345mAh/g.

(3) In the next 2 years, the peak value of graphite processing prices may be between RMB 10,000 and 12,000 per ton. Three years later, the proportion of continuous furnaces is expected to exceed 30%, which may further reduce the average price of graphite processing by more than 15%.

Three years later, the market share of third-party graphite processing enterprises will be less than 30%, and most enterprises will face elimination or merger. The surviving enterprises will have the following characteristics:

(1) Have the capability of graphite processing for medium/high sulfur coke;

(2) In proximity to large customers, supporting large negative electrode production bases with orders;

(3) Projects with more affordable electricity prices than their counterparts (such as preferential electricity prices, self-generated electricity, etc.). Wecome to contact us for the latest market news of negative electrode materials.

No related results found

0 Replies