End of May, how about petroleum coke price forecast?

End of May, how about petroleum coke price forecast?

Petroleum coke market analysis

In late May, it is expected that the petroleum coke market of local refineries is still not optimistic. In terms of supply side, Sinopec Yangzi Petrochemical, CNOOC Asphalt (Binzhou) and other main refineries, China International United Petroleum & Chemicals, Shandong Huaxing Petrochemical Group, Zibo Qirun Petrochemical and other local refineries are scheduled to resume production, with a production capacity of nearly 9.5 million tons/year. Graphite electrode is used in electric arc furnace, refining, ferroalloy and submerged arc furnace, which is available from stock. By then, petroleum coke supply will be greatly increased. In terms of import side, recently the concentrated arrival volume of petroleum coke is increasing, especially high-sulfur coke supply is sufficient, which caused certain pressure on the local refineries shipment. In terms of demand side, electrolytic aluminum price maintains at about 20000 yuan/ton and the price fluctuated slightly, and aluminum profit per ton is significantly compressed. In the process of replenishment of petroleum coke, the downstream carbon enterprises have added a lot of uncertainties and worries, most of which are waiting for market direction guidance. At the same time, the downstream carbon enterprises completed the replenishment of petroleum coke storage, and there is no obvious centralized replenishment demand in the short term.

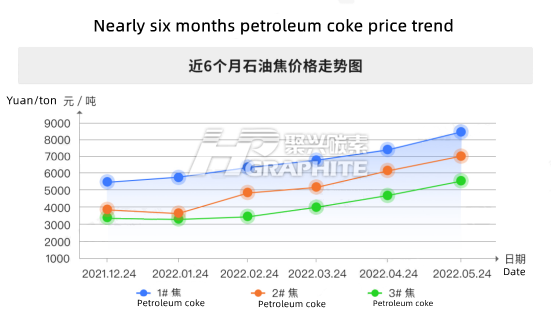

Price trend

In general, although the supply and demand of petroleum coke market is still tight at present, in view of many uncertain factors released by downstream electrolytic aluminum and carbon market sentiment and the expectation that domestic local refining supply will recover, the downstream customers receiving goods attitude has changed. In end of May, the local refining market trading is expected to maintain weak, with a downside potential.

However, in view of downstream anode materials capacity expansion and the industry development planning, in the later period, low sulfur petroleum coke will still mainly flow to anode materials, graphite electrodes and cathode materials. Low sulfur petroleum coke market price will maintain at a high level in the medium and long term, and the price difference between low sulfur petroleum coke and medium sulfur aluminum petroleum coke will remain high in a long run. Similarly, the price difference of medium sulfur petroleum coke will also appear due to different downstream flows. Communicate with us for more petroleum coke market news.

No related results found

0 Replies