Negative material collective limit! Graphitization price rose sharply Ⅱ

Negative material collective limit! Lithium battery market broke out again and graphitization price rose sharply Ⅱ

2 High quality track, seed player

With the boom of new energy vehicles, the upstream lithium battery industry has become a password for wealth.

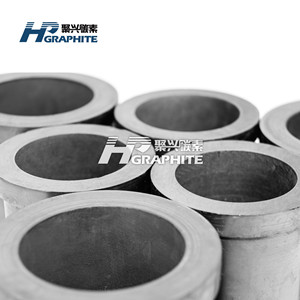

Under this high boom, the market scale of negative electrode materials in China has rapidly increased from 2.41 billion yuan in 2014 to 16.4 billion yuan in 2020, and the CAGR is as high as 37.6%, get the high quality graphite crucible information.

At present, the five leading enterprises in China's lithium battery negative material industry are Beitree, Putailai, Shanshan Stock, Kaijin New Energy, Shinzoom Technology.

In terms of the output of negative electrode materials in 2020, the market shares of Beitrui, Putailai, Shanshan and Kaijin New Energy are all in the range of 10%-20%, and the market share of Shinzoom Technology is 5%. In terms of negative electrode material shipments, the market share of Beitree reached 23%, while the market share of Pultala, Shanshan and Kaijin New Energy were 17%, 16% and 14.6%, respectively.

In this way, although there are negative material related enterprises such as Zhongke electric, Nations Technologies, Sunward Intelligent and Jiangsu Baichuan shares in China, accounting for 23% of the "others" in the shipment. However, the overall industry concentration is high, with CR5 shipments accounting for more than 75%.

In terms of production capacity, at present, Beitrui has about 110,000 tons of negative material production capacity, Shanshan has 120,000 tons of negative material production capacity, and Putailai (Jiangxi Zichen) has 80,000 tons of production capacity. At the same time, these enterprises are expanding their production on a large scale, with a cumulative expansion plan of more than 1 million tons, which can fully meet the rapidly growing demand of the downstream.

Major companies in the industry have entered the supply of mainstream lithium battery enterprises. Among them, Shanshan Co., Ltd., Putailai, Kaijin energy, Zhongke electric and other companies have entered the supply chain of CATL. Beiteri also supplies lithium battery head enterprises such as Samsung, LG Chemical, BYD and so on.

The sharp increase in demand for new energy vehicles also has obvious performance in representation. Taking Beitrui as an example, according to the 2021 semi-annual report released by Bao'an, China, Beitrui achieved a revenue of 4.21 billion yuan in the first half of this year, a year-on-year growth of 168%; Net profit reached 730 million yuan, up 232% year on year. Shanshan shares also turned losses into profits by selling, and realized a net profit of 724 million yuan in the first half of the year.

At the same time, China's trillion energy storage market will further expand the market of negative electrode materials. With the time of carbon peak approaching, the country is gradually building an energy Internet, which can connect a large number of renewable energy and distributed energy in the large power grid, of which electrochemical energy storage technology is the link.

According to statistics, the shipment volume of energy storage lithium ion batteries in China reached 16.2GWh in 2020, with a year-on-year growth of 70.5%, and the CAGR reached 66% from 2017 to 2020. The growth is mainly driven by the growth of energy storage demand in overseas energy storage market and domestic base station side. In addition, the overseas wind power and photovoltaic grid integration of new energy storage installation demand is also growing at the same time, electrochemical energy storage field is in a state of rapid development.

3 Summary

Looking back, the reason for today's surge is because of the factory building news released by CATL last night, because today in addition to lithium batteries, sodium ion plate also synchronous surge.

Recently, all localities are implementing the "double control" policy of energy consumption. Yesterday, the reduction of production of yellow phosphorus and silicon in Yunnan triggered a wave of big market. As an important production base of graphitization, Inner Mongolia also implemented a new "double control" policy of energy consumption this year, resulting in the continuous rise of the price of graphite foundry since the beginning of the year, with a cumulative increase of more than 70%.

Therefore, under the influence of this aspect, the leading enterprises of negative electrode materials are also laying out graphitization capacity in other regions to control costs.

According to the newly released installed capacity of power batteries in August, China's power battery production totaled 19.5GWh, a year-on-year growth of 161.7%, a sequential growth of 12.3%, this part of the demand is still increasing.

In this way, on the premise of large demand and high industry concentration, the logic of negative electrode materials is very simple: who stands on the Top of output and shipment, who is king , contact us to get more graphitization news.

No related results found

0 Replies