【Graphite Electrode】Mild Price Increase in July Driven by Rising Raw Material Costs

【Graphite Electrode】Mild Price Increase in July Driven by Rising Raw Material Costs

1. Price Performance: Cost-Driven Moderate Increase

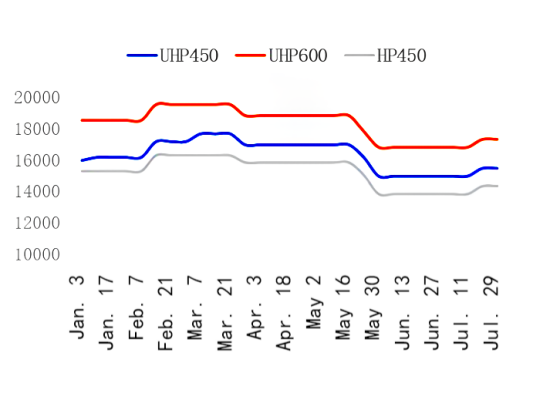

In July, the graphite electrode market showed a moderate upward trend amid the tug-of-war between strong cost support and weak demand recovery. The price of low-sulfur petroleum coke, a major raw material, was raised multiple times, becoming the primary driver behind the graphite electrode price increases.

As of the end of July, mainstream market quotations were as follows:

1) UHP 400mm: ¥15,500–16,000/ton

2) UHP 450mm (30% needle coke content): ¥15,000–15,500/ton

3) UHP 600mm: ¥17,000–17,500/ton

4) UHP 700mm: ¥20,000–21,000/ton

Graphite Electrode Price Trend Chart – China, 2025

2. Cost Side: Raw Material Market as the Core Driver of Price Increases

On the raw material side, mid- and low-sulfur coke prices rose under the influence of major refiners in July. The rise in green coke prices directly drove up the price of low-sulfur calcined petroleum coke, which in turn pushed up graphite electrode production costs. This price increase placed considerable cash flow pressure on some small and medium-sized graphite electrode producers.

3. Supply Side: Price Stabilization Led by Major Enterprises, Followed by SMEs

Major graphite electrode manufacturers maintained stable operating rates in July, keeping supply-side conditions steady. Small and medium-sized enterprises (SMEs) generally operated at minimum production levels and adopted intermittent production strategies to reduce costs, adjusting output flexibly based on order volumes.

Under the pressure of negative profit margins, major producers took the lead in initiating price adjustments. In mid-July, leading companies raised the prices of ultra-high power (UHP) graphite electrodes by 3%–5%, while also tightening credit terms and limiting spot market supply to support pricing. Following this, SMEs in regions such as Henan and Hebei raised prices by around 3% in late July, though there remained a negotiation buffer of ¥100–200/ton in actual transactions.

4. Demand Side: Low Electric Furnace Operating Rates, Weak Capacity to Absorb High Prices

The recovery of downstream demand fell short of expectations, becoming the main resistance to price increases. In July, the national electric arc furnace (EAF) steel capacity utilization rate continued to decline month-over-month, with slight signs of recovery only at the end of the month. Meanwhile, the profits of blast furnace mills shrank due to rising coking coal prices, prompting them to continue a "purchase as needed" strategy for graphite electrodes.

It is especially noteworthy that downstream players demonstrated weak acceptance of high-priced inventory. This ongoing dynamic of "upstream pushing for price increases vs. downstream resisting prices" resulted in graphite electrode prices rising passively due to cost pressures, rather than actively due to strong demand.

5. Outlook for August: Cost Support Remains Strong, Demand Recovery Is the Key Variable

Looking ahead to August, cost-side support remains valid. Fushun Petrochemical is scheduled for maintenance in August, and raw material prices are likely to remain firm or rise. However, the pace of demand recovery remains uncertain.

If electric furnace operating rates at steel mills increase significantly before the traditional high season of September and October ("Golden September, Silver October"), graphite electrode prices may rise by ¥500–1,000/ton. Otherwise, the market may fall into a volatile state, caught between rising costs and suppressed demand.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies