【Anode Materials】Crisis! North America Accelerates Graphite Deployment, Challenging China's...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Crisis! North America Accelerates Graphite Deployment, Challenging China's Leadership in the Global Supply Chain

North America, in an effort to break free from dependence on Chinese graphite, is vigorously developing domestic graphite mining and processing to meet the growing demand for electric vehicle batteries.

From Alaska to Australia, graphite exploration in recent years has added more than 3.7 billion tonnes to the global graphite resource base.

The European Carbon and Graphite Association (ECGA) estimates that the total amount of graphite contained in proven global resources exceeds 350 million tonnes — calculated at a 70% mining yield, this equates to 245 million tonnes of products covering all flake sizes.

More and more graphite mines are being developed in North America, Africa, Asia, Australia, and parts of Europe. However, to date, China remains the world's largest supplier of natural graphite, accounting for about 70% of production.

According to ECGA data, Brazil, Canada, India, North Korea, Mozambique, and Tanzania collectively occupy the remaining 30% of this booming graphite market.

Founded in 1995, the ECGA is a Brussels-based representative body of EU carbon and graphite producers, including EU manufacturers supplying graphite electrodes to the European steel and foundry industries, electrodes and cathodes for the aluminium and ferroalloy industries, as well as specialty graphite and carbon products.

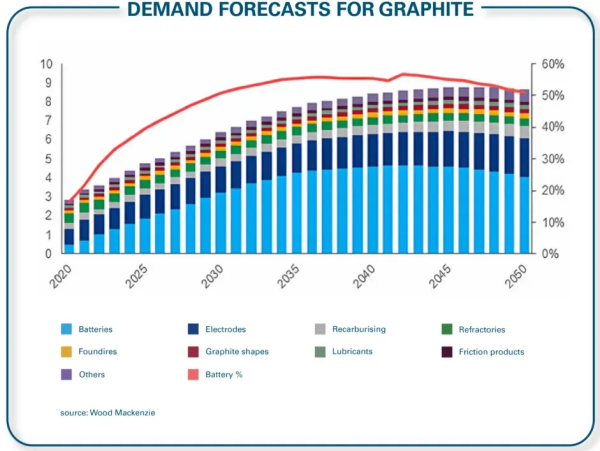

Benchmark Mineral Intelligence predicts that by 2030, demand for natural graphite will surge by 140%, meaning the world will need 30 new natural graphite mines and 12 new synthetic graphite plants to come online to fill the gap.

But where will these new mines come from?

Reducing China's Grip on Graphite

China holds a dominant position in the global graphite supply chain, from synthetic and natural graphite production to refining processes. However, with demand continuing to soar, fierce market share competition is expected between synthetic and natural graphite.

With mines outside China coming online, natural graphite output is projected to grow at an annual rate of 6% to reach 1.5 million tonnes by 2027. In particular, in North America, more companies are making progress to capture this market share.

Canadian exploration company E-Power Resources believes that its Tetepisca flake graphite project in Quebec is bound to become one of the 30 projects that Benchmark estimates will need to start production in the next five years.

After all, E-Power's stated mission is "to deliver graphite now, not 20 years from now." As CEO James Cross told Australian Mining, the company's resource target area lies at surface, and E-Power is "only interested in graphite that is easy to delineate, easy to mine, and suitable for manufacturing needs."

"Our property is accessible by pickup truck. The site is crisscrossed by forestry roads, making access easy. This is not a project in a high-latitude Arctic region requiring helicopter access, nor is it one where we're looking for graphite 1,000 metres below surface," Cross explained to the news outlet.

"We want to deliver solutions now. The only obstacle is permitting, and if the West wants to be competitive — and more importantly, wants to be autonomous — it must go all-in."

"Those large industrial enterprises that need and will ultimately have to have this graphite can go all-in better and faster than we can."

Therefore, as Australian Mining revealed last week, E-Power plans to exit the project before production begins. Potential end-users and customers for Tetepisca graphite would include the defence industry, basic manufacturing, or battery anode manufacturers.

Another North American company poised to fill the gap is Graphite One, which is focused on advancing its Graphite Creek project to production to strengthen the U.S. graphite supply chain.

Last week, the company completed the Coordinated Project Plan process after listing its Graphite Creek project in Alaska on the FAST-41 dashboard. FAST-41 is designed to improve the timeliness, predictability, and transparency of federal environmental review and permitting processes for covered infrastructure projects.

CEO Anthony Huston said that with U.S. President Donald Trump's recent executive orders on critical minerals and Alaska, "Graphite One is at the forefront of the domestic critical minerals resurgence, which will power transformative applications across sectors from energy and transportation to AI infrastructure and defence."

Graphite One's U.S. supply chain strategy includes building an integrated business operation, using primarily natural graphite from Alaska to mass-produce lithium-ion battery anode materials and other graphite products for the domestic U.S. market.

The project includes constructing an advanced graphite manufacturing facility in Ohio, supplied with natural flake graphite from the proposed Graphite Creek mine in Alaska.

Alaska Governor Mike Dunleavy has even spoken highly of Graphite One. The governor said the company's participation on the FAST-41 dashboard "paves the way" for projects that contribute to the U.S. economy and national security.

"(Graphite Creek) is the largest natural graphite deposit in North America and is the foundation for any effort to rebuild our domestic supply chain. We now have a concrete timeline — federal agencies have 13.5 months to complete their review process," Governor Dunleavy said.

Reportedly, Graphite Creek is the first Alaska project to enter the dashboard.

Meanwhile, earlier this year, iMetal Resources completed drilling at its Carheil project in Quebec's Northern Abitibi Greenstone Belt, targeting three previously identified graphite zones. The focus is to determine the extent of graphite along strike and dip.

Although Carheil is an exploration-stage project with multi-metal potential, its prior graphite exploration results may help accelerate iMetal's exploration and project advancement. The project lies about 170 km north of Rouyn-Noranda in the Northern Abitibi Greenstone Belt.

Efforts to Eliminate Foreign Competition

Competition remains fierce, and China is working to maintain control of this lucrative industry. The reason is obvious: the International Energy Agency (IEA) forecasts that the global graphite market will grow from $8.32 billion in 2025 to $13.35 billion ($20.54 billion) by 2032.

China's synthetic graphite production is now shifting to provinces with a higher share of hydropower, thereby reducing greenhouse gas emissions and improving environmental, social, and governance (ESG) performance. Since 2023, new capacity in China has increased synthetic graphite supply by about 40%.

This capacity expansion is expected to lower costs and boost demand for synthetic graphite supply.

Australia's Department of Industry, Science and Resources (DISR) notes that although synthetic graphite has historically been more expensive to produce, the expansion of capacity and the shift to cheaper raw materials are bringing costs closer to those of natural graphite.

The DISR report states: "Growing focus on sustainability and lower costs should see synthetic graphite maintain its current market share (about 70% of total graphite production) over the outlook period."

Western countries view this oversupply as a tool for China to manipulate the global market. Flooding the market with cheap, heavily subsidised products is seen as a coordinated effort to eliminate foreign competition.

This trade practice makes it difficult for graphite producers to secure the necessary investment to expand capacity to meet growing domestic demand.

North American Graphite Alliance

As E-Power's Cross told Australian Mining, it is astonishing that Western countries such as Australia, Canada, and the United States have fallen so far behind, allowing China to maintain such a firm grip on the market.

"Imagine relying on your competitor — or adversary — to buy from them the essential critical raw material you need to compete against them. As a business model, it doesn't work. As a defence strategy, it's sheer stupidity," Cross said.

The North American Graphite Alliance (NAGA) was established to address this situation. It was formed to advocate for U.S. federal government intervention to protect the region's emerging graphite industry.

It supports the U.S. Department of Commerce's preliminary ruling in July that China is dumping active anode material (AAM) into the U.S. market. This move by the Department marks a shift in the North American battery materials landscape and promotes domestic sourcing of graphite-based AAM.

In its July 17, 2025 ruling, the Department of Commerce imposed a 93.5% preliminary anti-dumping duty on graphite-based active anode materials imported from China (including AAM in finished lithium-ion batteries).

Coupled with the 11.5% countervailing duty imposed by the Department in May, the 30% blanket tariffs levied by U.S. President Donald Trump on goods from China, and the 25% Section 301 tariffs implemented by the U.S. Trade Representative (USTR) in 2024, the effective tariff rate on AAM now stands at 160%.

The Department of Commerce stated that U.S. imports of AAM from China were valued at $350 million in 2023, compared to $380 million in 2022. It determined that some Chinese companies are subject to the 93.5% preliminary duty, while others not specifically listed — and unable to prove independence from the Chinese government — will face an even higher rate of 102.72%.

Northern Graphite, commenting on recent developments, said these measures take effect almost immediately. Due to their retroactive nature, importers must pay substantial cash deposits for recent and future shipments.

CEO Hugues Jacquemin said the moves strongly support domestic sourcing, providing a historic opportunity for companies like his. Northern Graphite is touted as the only flake graphite producer in North America.

Jacquemin plans to build one of the region's largest AAM plants in Baie-Comeau, Quebec. He said that as the market continues to evolve, Northern Graphite is fully positioned to support a secure and sustainable graphite supply chain for North America.

Few Survivors, Growing Challenges

As E-Power's Cross explained to the news outlet, in North America only a handful of significant graphite companies have survived — his company being one of them. The required supply far exceeds current availability, meaning there is virtually no competition between companies in the region.

The CEO added: "At the same time, we are careful to avoid emulating the business models of some other companies in the North American graphite space, which expand downstream in the supply chain, making their business plans unnecessarily complex."

Cross said these complexities primarily revolve around entering manufacturing — particularly the production of battery anode materials. Ironically, in most cases, these manufacturing plans are advancing far faster than their mining projects, which may lead them to turn to China's graphite market for supply in order to compete.

"At least one company has prematurely monetised its asset, which will be a problem, while another has prematurely entered into an offtake agreement with a Chinese company, receiving virtually nothing in return," Cross continued.

"We keep the company debt-free and as lean, simple, and unburdened as possible. We are here simply to provide a critical link in the supply chain for Western industry, not to build an integrated, complex business to compete with China's cost structure."

"With so few significant upstream graphite projects in North America, our exploration work is about climbing that very short list. In North America's graphite sector, competing with China is no longer mainly about project economics — it's about having an insurance policy against losing the entire manufacturing base."

"The graphite in the ground is that insurance policy, and there is no substitute. The economics that should be applied are the economics of having no graphite at all."

An Irreplaceable Key Ingredient

The European Carbon and Graphite Association (ECGA) states that graphite is one of the most fascinating elements found on Earth. It occurs naturally as a mineral and can also be produced synthetically.

The earliest uses of graphite date back to prehistoric times, when it was used to draw on cave walls. The Egyptians used it to decorate pottery. In the Middle Ages, graphite was used as a refractory material to line moulds for producing smoother, longer-firing cannonballs.

In modern times, graphite has traditionally been used in lubricants and steelmaking, but its importance is increasing due to its application in battery anodes. It can be obtained by mining (natural or flake graphite) or by boiling green petroleum coke and subsequently calcining it (synthetic graphite).

Typically, natural graphite consumes less energy and generates fewer emissions than synthetic graphite, because producing synthetic graphite requires high temperatures.

E-Power CEO James Cross said graphite possesses extraordinary properties. The three most important are extreme heat resistance, excellent electrical conductivity, and lubricating ability.

"In a lithium-ion battery, graphite makes up almost the entire anode. It is the largest material component in the battery. Without graphite, there is no battery. There is no substitute," the CEO added.

"This is not just about electric vehicles — it's about batteries for any purpose, including power generation, drones, household appliances, or anything that requires electricity."

"The growth in battery numbers for various uses may be the biggest driver of global demand, but in the West, defence will also be a huge driver, particularly as the West rearms after depleting vast resources in Ukraine."

Graphite is a key ingredient in many materials, with even more applications. As Cross explained, "Without it, there is no ammunition, artillery, fighter jets, ships, submarines, drones, tanks," and so on.

Without graphite, the defence industry would grind to a halt. It accounts for only a tiny proportion of the cost of the finished products that use it, but it is absolutely essential.

The CEO added: "It's like salt in a restaurant. You must have it, but it represents only a small proportion of your total production cost."

"You don't care too much about what you pay for it, but you care a great deal about being able to find it — and not relying on your competitor's restaurant to get it. Remember that restaurant buying salt?"

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies