【Petroleum Coke】Has the Price Rise Channel Opened? Analyzing Future Trends from...

Calcined petroleum coke, with its high carbon content, low sulfur, and low impurities, plays a vital role in modern manufacturing, especially in the aluminum and steel industries.

【Petroleum Coke】Has the Price Rise Channel Opened? Analyzing Future Trends from Calcined Coke to Anode Materials

Market Overview

Recently, the petroleum coke market price has shown a relatively stable trend.

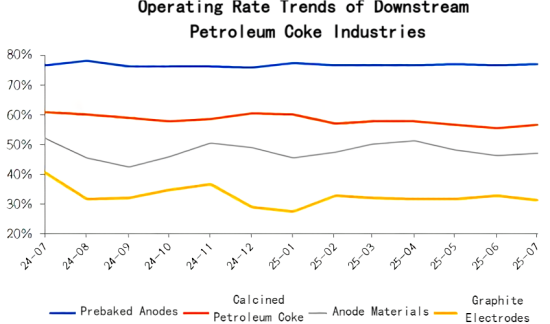

Downstream carbon industries have generally stable production, which is the main support for petroleum coke demand. The demand for calcined petroleum coke remains steady, and the output and operating rates of prebaked anodes have generally increased slightly and steadily.

Demand from downstream power battery cell manufacturers for anode materials remains stable, and the energy storage market demand is improving.

The production of graphite electrodes has shown a slight decline over a longer time frame.

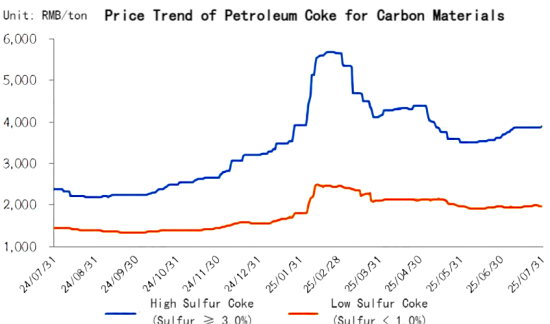

As of July 31, 2025,

The average price of low-sulfur petroleum coke (sulfur content within 1.0%) was 3,717 yuan/ton, up 12.80% compared to the beginning of the year;

The average price of medium-high sulfur petroleum coke (sulfur content around 3.0% or above) was 1,972 yuan/ton, up 26.9% compared to the beginning of the year.

Supply Situation

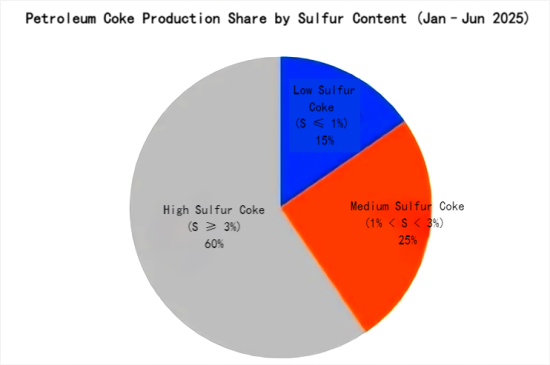

According to statistics, China's petroleum coke production in June 2025 was approximately 2.4302 million tons, an increase of 4.39% compared to the previous month.

Among them, the production of low-sulfur coke (sulfur content within 1.0%) was about 387,900 tons, up 7.93% compared to May; the main reason being that the coking units of two main low-sulfur coke refineries underwent maintenance in May, significantly affecting production.

The production of medium-high sulfur petroleum coke (sulfur content around 3.0% or above) was about 1.431 million tons, an increase of 1.93% compared to May, mainly due to the resumption of coke output at some medium-high sulfur coke refineries in June and fluctuations in production indices at some local refineries.

Demand Situation

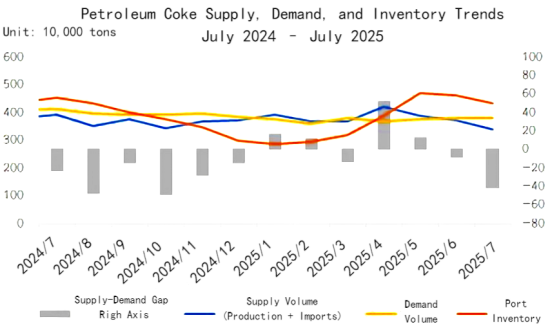

Downstream demand overall is stable, providing fundamental support to the petroleum coke market.

Calcined petroleum Coke:

The calcined petroleum coke industry operating rate in July was about 56.46%, a slight increase of 0.82% compared to June. With raw petroleum coke prices continuing to rise, calcined petroleum coke companies have a strong willingness to raise prices; low-sulfur calcined petroleum coke companies have active shipments, while medium-high sulfur calcined petroleum coke companies continue to face losses. Overall, the demand for petroleum coke remains relatively stable.

Prebaked Anodes:

The prebaked anode industry operating rate in July is estimated at about 77%, showing little change compared to June. Prebaked anode companies maintain good operation, with new investments continuing to progress and the overall market supply being sufficient. For prebaked anodes, petroleum coke costs account for a large proportion of total costs, approximately 60%–65%. The stable operation and demand in prebaked anode enterprises provide stable support for petroleum coke prices.

Anode Materials:

Overall demand for anode materials is steadily improving. Most anode companies produce according to orders and sales forecasts. The industry operating rate in July is expected to be about 47%, a slight increase from June. Coke-type raw materials account for about 30% of the total cost of anode materials, significantly affecting their price. Since June, the demand for petroleum coke by anode materials has improved markedly, with increased restocking activity; shipments of coke for anode use are without pressure, and trading is active.

Graphite Electrodes:

The graphite electrode industry operating rate in July was about 31.32%, down 1.44% compared to June. The main reason is the continued weak market demand for graphite electrodes, poor production enthusiasm among enterprises, and some companies facing inventory and shipment pressure. To alleviate the imbalance between production and sales, some enterprises reduced production during the month. For graphite electrodes, coke-type raw material costs account for about 60%–70% of total costs. Graphite electrode transactions are in a loss state, and market operation remains at a low to medium level, with average demand for raw petroleum coke.

Market Outlook

Considering supply and demand factors comprehensively, it is expected that petroleum coke market prices will maintain a relatively stable trend next month, with a possibility of mild price increases.

Low-sulfur petroleum coke inventories are generally at low levels; some refineries have tight supply; the futures cost for imported medium and low sulfur petroleum coke is relatively high; and major downstream industries maintain stable demand, so prices are likely to rise slightly.

The price increase for medium-high sulfur petroleum coke is relatively limited due to the constrained acceptance capacity of downstream purchasers.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies