【Needle Coke】Supply-Demand Imbalance, Weak Demand, and Persistent Decline: May Market Analysis

Needle coke is a primary raw material for both lithium-ion battery anode materials and graphite electrodes.

【Needle Coke】Supply-Demand Imbalance, Weak Demand, and Persistent Decline: May Market Analysis and Outlook

Market Overview

Demand weakened in May, and with no favorable price drivers, a slight decline occurred.

As of May 20:

Domestic needle coke market price range: green coke RMB 5,476–6,300/ton, calcined coke RMB 7,500–8,600/ton;

Imported oil-based needle coke mainstream transaction prices: green coke USD 600–1,300/ton, calcined coke USD 850–1,350/ton;

Imported coal-based needle coke mainstream calcined coke prices: USD 700–820/ton.

Oil-based needle coke market prices have declined slightly, particularly for green coke, which dropped by around RMB 150/ton. This is due to falling low-sulfur petroleum coke prices and slowed downstream anode materials procurement. Spot availability of needle coke is ample, and some oil-based suppliers reported excessive inventory buildup, forcing price reductions to clear stock.

In the calcined coke market, mainstream graphite electrode companies purchased small volumes. Small and mid-sized graphite electrode producers, affected by losses, adjusted raw material blends and procured less needle coke. Overall, the graphite electrode market cannot bear high-priced calcined coke. Still, with only a few calcined coke suppliers in production, supply provides limited price support.

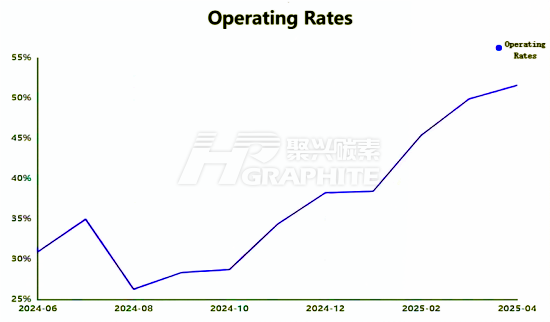

Operating Rates

In the coal-based needle coke market, as of May, only three companies are producing. One resumed operations in early to mid-May, while another remains shut with no restart date.

As of today, total suspended/converted capacity in China reaches 1.66 million tons, with an average operating rate of about 45.41%. Major oil-based needle coke producers continue normal production, though one Shandong plant has partially halted and plans maintenance next month.

Demand Side

With petroleum coke prices declining, needle coke no longer holds a cost advantage. After restocking, anode material manufacturers remain cautious amid a “buy on the rise, wait on the fall” sentiment. Companies reported new orders being heavily bargained down, although most May orders were signed early in the month, so actual price adjustments may take time.

Around the May Day holiday, the graphite electrode market was quiet. Inquiry and procurement activity was low, with producers focused on executing previous orders. Current market shipments are sluggish, inventory is depleting slowly, and operating enthusiasm remains low, limiting needle coke procurement to essential needs.

Raw Materials

Since May, slurry oil prices have fluctuated upward. This is partly due to post-holiday restocking demand and partly supported by macro factors such as U.S.-China tariff adjustments, which boosted global crude oil prices. These trends increased slurry oil costs, maintaining pressure on oil-based needle coke production costs.

Coal tar pitch prices have remained stable to slightly higher post-holiday. U.S.-China tariff adjustments lifted market sentiment, strengthening support from downstream coal tar segments and pushing coal tar pitch prices up. Consequently, coal-based needle coke costs continued to rise.

Market Outlook

On the supply side, by the end of May, operating levels of existing needle coke producers remain mostly unchanged, with only one Shandong company planning to suspend operations next month. New project start-ups remain uncertain. Thus, overall supply remains stable and relatively sufficient, with operating rates expected to hover around 50%.

On the demand side, downstream graphite electrode and anode materials producers show subdued procurement interest and are resistant to high-priced needle coke. In the short term, current orders will continue to be fulfilled.

In summary, needle coke prices are expected to remain stable with slight fluctuations in the short term, with bearish fundamentals dominating supply and demand. However, high oil-based production costs offer some price support, and with most orders signed early in the month, the market is expected to transition steadily. Green coke is projected at RMB 5,400–6,200/ton, and calcined coke at RMB 7,500–8,600/ton.

Feel free to contact us anytime for more information about the needle coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies