【Calcined Petroleum Coke】Cost-side Support Continues to Drive Price Increases

【Calcined Petroleum Coke】Cost-side Support Continues to Drive Price Increases

Market Overview

On October 9, the average market price of calcined petroleum coke (CPC) in China reached 3,270 RMB/ton, up 20 RMB/ton or 0.61% from the previous working day.

Low-sulfur CPC transactions remained stable, with feedstock green coke prices slightly increasing. A few low-sulfur CPC producers followed the upward trend, while most maintained stable prices for shipments.

Medium- and high-sulfur CPC sales were generally active. During the National Day holiday, green coke prices continued to rise, increasing cost pressure on producers. With sustained demand-side support, CPC producers in this segment raised quotations accordingly.

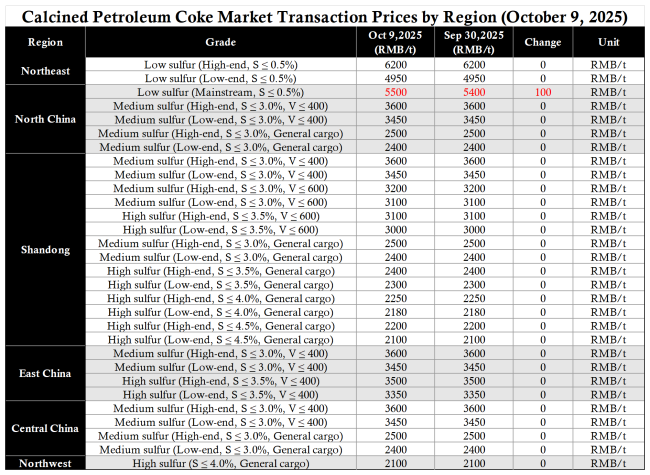

Main Regional Transaction Prices

Low-sulfur CPC (using Jinxi/Jinzhou petroleum coke): mainstream transaction prices 5,400–5,600 RMB/ton.

Low-sulfur CPC (using Fushun petroleum coke): ex-factory mainstream prices 6,100–6,200 RMB/ton.

Low-sulfur CPC (using Liaohe/Binzhou CNOOC petroleum coke): mainstream market prices 4,950–5,600 RMB/ton.

Medium- to high-sulfur CPC (S≈3.0%, no trace element requirements): previous contract prices 2,400–2,500 RMB/ton, current negotiation prices remain 2,400–2,500 RMB/ton.

Medium- to high-sulfur CPC (S≈3.5%, no trace element requirements): previous contract prices around 2,400 RMB/ton, current negotiations 2,350–2,450 RMB/ton.

Medium-sulfur CPC (S≈3.0%, V≤400): previous contract prices 3,450–3,600 RMB/ton, current negotiations remain 3,450–3,600 RMB/ton.

Supply Situation

China's daily commercial CPC supply was 27,318 tons, with an operating rate of 57.19%, remaining stable compared with the previous working day.

Upstream Market

Petroleum Coke: PetroChina refineries maintained smooth shipments. Northeast refineries raised prices by 30 RMB/ton starting October 1; Fushun Petrochemical resumed calcination operations. In North China, Dagang Petrochemical's auction price increased by 40 RMB/ton.

In the Northwest, Karamay Petrochemical raised prices by 100 RMB/ton, while others held steady.

CNOOC refineries shipped according to orders, and Zhoushan Petrochemical planned to increase auction volumes tomorrow.

Downstream Markets

Graphite Electrodes: During the National Day holiday, most graphite electrode producers suspended external trading, focusing on fulfilling existing orders. Transportation was limited during the holiday, but resumed gradually afterward. Mainstream market prices remained stable, awaiting post-holiday feedback.

Electrolytic Aluminum: The National Development and Reform Commission and the Ministry of Finance jointly allocated the fourth batch of 69 billion RMB in ultra-long-term special treasury bonds to support the trade-in of consumer goods, completing this year's 300 billion RMB total central fund allocation. This policy boosted consumer sentiment and lifted spot aluminum prices.

Anode Materials: The anode materials market remained stable, with downstream demand gradually improving. Operating rates among anode producers increased slightly. However, supply remains ample, and with new capacity continuing to come online, mid- and low-end products are flooding the market, intensifying price competition. Prices are expected to remain at a low level.

Market Outlook

Low-sulfur CPC trading remains quiet, with limited supply-demand fluctuations, and prices are expected to stay stable.

For medium- and high-sulfur CPC, shipments are favorable, and with continued cost-side support from raw materials, prices are expected to keep rising moderately.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies