【Graphite Electrode】Up 4.31%! Strong Cost Support in 2025, Slight Uptrend Expected in 2026

【Graphite Electrode】Up 4.31%! Strong Cost Support in 2025, Slight Uptrend Expected in 2026

2025 Market Overview

In 2025, the graphite electrode market showed a "rise – fall – rise" price trend, basically moving in line with upstream low-sulfur petroleum coke prices. Overall, downstream demand remained weak throughout the year, and the actual market was strongly influenced by upstream raw-material price movements.

In the domestic market, graphite electrode prices fluctuated slightly in 2025 due to cost changes and showed a small upward trend at year-end.

In the first half of 2025, downstream demand for graphite electrodes was relatively weak. After the Spring Festival, steel mills resumed production slowly, resulting in poor shipments of graphite electrodes. At the same time, upstream low-sulfur petroleum coke prices rose and fell sharply, significantly affecting graphite electrode costs and causing brief periods of rapid price increases and declines.

In the second half of the year, as low-sulfur petroleum coke prices rose steadily, cost support for graphite electrodes strengthened and transaction prices continued to rise. With the arrival of the "Golden September and Silver October" peak season, downstream inquiries and purchases increased. Supported by both cost and demand, mainstream graphite electrode prices kept rising.

Toward year-end, cold weather and environmental controls affected production, but major producers maintained stable operations, so supply changes were limited. However, raw-material prices declined, which was bearish for negotiations, resulting in nominally stable but actually weakening prices.

Overall, in 2025 the graphite electrode market was strongly supported by upstream costs. Although downstream demand did not improve significantly, rigid demand remained stable, and combined with strong price-pushing by major producers, the market showed an overall upward trend.

Export Market

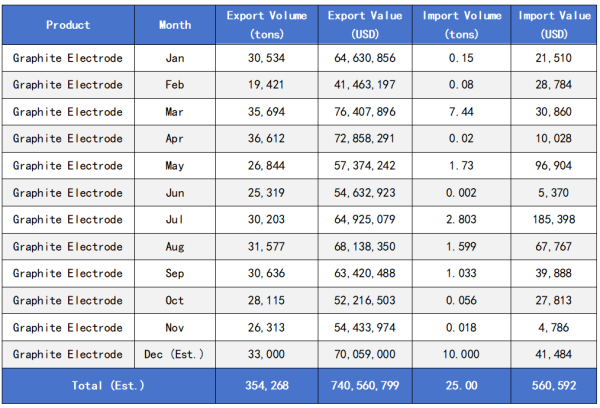

In 2025, graphite electrode exports fluctuated within a narrow range. In the first half, the China–US tariff standoff affected exports to some extent. However, since China exports relatively small volumes of graphite electrodes directly to the US, the overall impact on export volume was limited.

The Eurasian Economic Union's anti-dumping investigation narrowed China's export channel to Russia, but rigid demand in the Russian market remained. After a short adjustment, China's graphite electrode exports to Russia still ranked among the top three.

In the second half, the US restarted trade friction by imposing a 100% tariff. Although the direct impact on graphite electrodes was limited, indirect impacts from transportation and costs were significant.

Price Analysis

By the end of 2025, mainstream prices were:

Graphite electrodes 300–600mm

Regular Power (RP): 14,500–15,800 CNY/ton

High Power (HP): 15,800–17,500 CNY/ton

Ultra-High Power (UHP): 16,300–18,400 CNY/ton

UHP 700mm: 21,000–21,900 CNY/ton

The average market price was 16,347 CNY/ton, up 4.31% from the beginning of the year.

The 2025 graphite electrode price trend was "rise – fall – rise." Prices increased slightly year-on-year. In the first half, sharp fluctuations in low-sulfur petroleum coke prices caused graphite electrode prices to surge and then fall rapidly. With weak post-holiday steel demand, prices kept declining and many transactions were at a loss. Falling raw-material prices further pressured costs.

In the second half, low-sulfur petroleum coke rebounded, supporting electrode prices. Seasonal demand in September helped restore some profits, and prices continued to rise. By late December, falling raw-material prices led to a bearish outlook and nominally stable but actually lower transaction prices.

Supply Situation

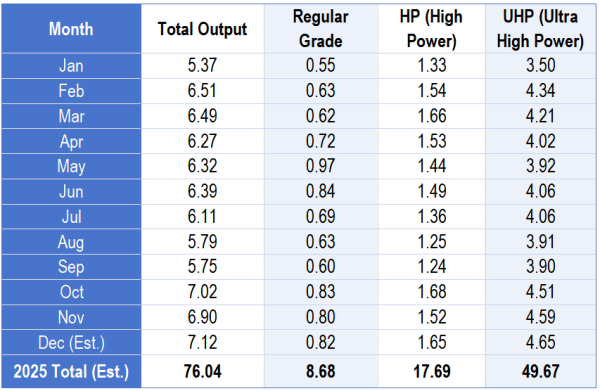

From January to November 2025, China's graphite electrode output was about 689,200 tons, down 100,500 tons (-12.72%) year-on-year.

RP: 78,600 tons, down 3.93%

HP: 160,400 tons, down 8.83%

UHP: 450,200 tons, down 15.36%

Full-year output is estimated at 760,400 tons (RP 86,800; HP 176,900; UHP 496,700), slightly lower than last year.

Overall production remained low due to weak demand and squeezed margins. Some companies stayed shut down. In early Q1, cold weather in northern China halted forming operations, and production recovered slowly. In the second half, rising costs and weak margins led some companies to halt production, while major producers maintained stable output.

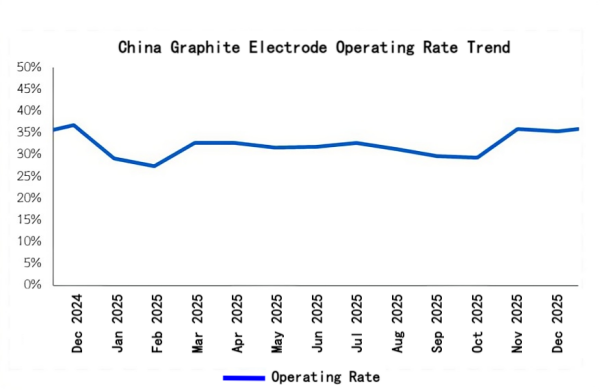

The average operating rate in 2025 was 32.3%, down 4.76% year-on-year. High capacity but many shutdowns and weak profits kept operating rates low.

Cost & Profit Analysis

By December, low-sulfur petroleum coke averaged 4,345 CNY/ton, up 29.03% from the start of the year and 30.19% year-on-year.

Low-sulfur calcined petroleum coke prices:

Jinxi & Jinzhou feedstock: 5,750–5,900 CNY/ton

Fushun feedstock: 6,300–6,400 CNY/ton

Liaohe & Binzhou CNOOC feedstock: 5,350–5,900 CNY/ton

Needle coke prices rose:

Green coke: 5,763 CNY/ton (+17.73%)

Calcined petroleum coke: 7,812 CNY/ton (+2.99%)

Coal tar pitch prices fell, lowering costs but overall raw-material costs remained high, squeezing profits.

Demand Analysis

Steel Sector

Steel prices fell overall in 2025. Demand for graphite electrodes was weak early in the year, improved briefly in September–October, and then stabilized.

Non-steel Sector

Silicon metal prices dropped sharply, weakening demand. Yellow phosphorus demand remained stable.

Import & Export

From January to November 2025, China exported 321,300 tons of graphite electrodes, up 5.44%. Full-year exports are estimated at 354,300 tons, up 4.35%. Main destinations: UAE, Russia, Iran.

Tariffs, anti-dumping measures, and geopolitical risks limited export growth. The Eurasian Economic Union imposed anti-dumping duties of 19.92%–22.51%, later switching to a quota system.

2026 China Graphite Electrode Market Outlook

Upstream raw-material prices are expected to remain strong. In 2026, prices may fluctuate slightly but will trend upward. Costs will support graphite electrode prices, keeping the market floor stable and reducing low-priced supply.

Demand will remain weak, mainly rigid demand from steel mills. Production will remain cautious.

Market sentiment will be mixed, but supported by costs, mainstream prices are expected to rise 300–500 CNY/ton.

Expected price ranges:

RP (300–600mm): 15,500–16,500 CNY/ton

HP: 16,500–18,000 CNY/ton

UHP: 17,000–18,500 CNY/ton

UHP 700mm: 21,000–21,900 CNY/ton

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies