【Carburant】Chinese Carburant Market Costs and Demand Analysis

【Carburant】Chinese Carburant Market

Costs and Demand Analysis

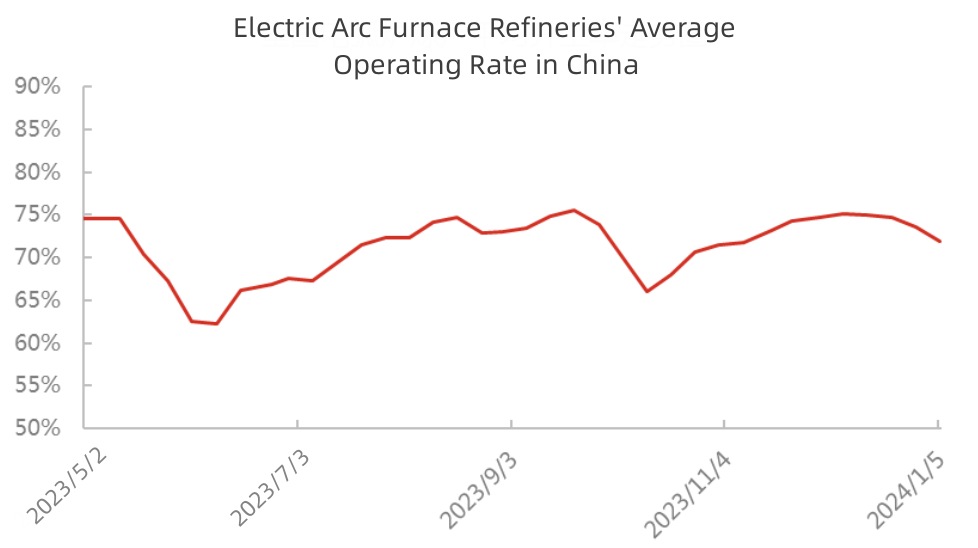

In recent times, Chinese carburant market prices have maintained a weak and stable trend, with an average operating rate of 71.85% for electric arc furnace steel mills. This represents a decrease of 1.78 percentage points compared to the previous period and an increase of 39.36 percentage points year-on-year. The decline is particularly evident in the northwest region, where steel mills have adopted staggered production measures due to environmental policies.

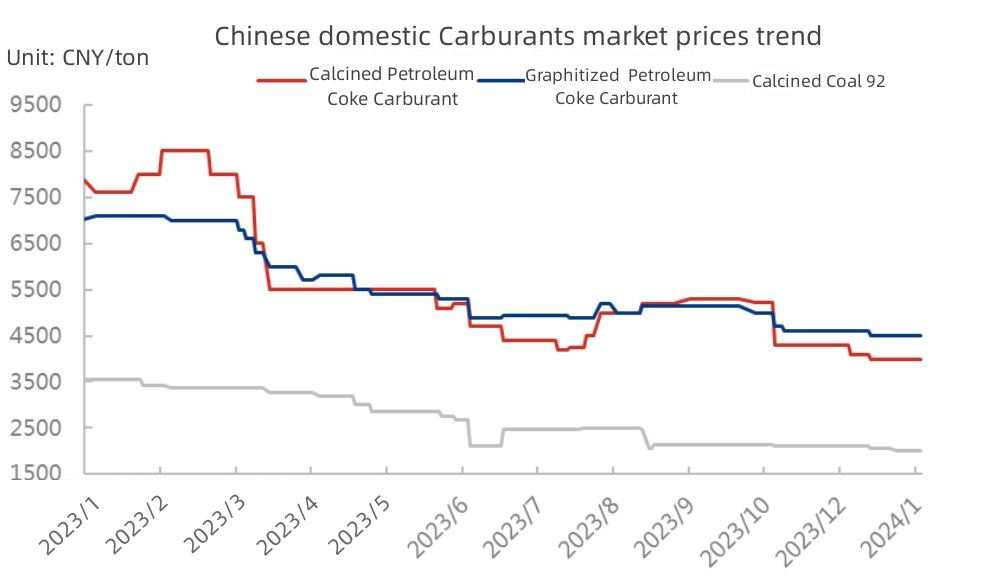

Price Aspect: Chinese carburant market has continued to trade with a weak momentum. In terms of calcined coal, coal prices have remained weak and stable, with a relatively balanced market supply and demand. The prices in the coal market have experienced slight fluctuations. The prices of raw materials for calcined coal carburants, such as smokeless coal, have been weak and stable, with most manufacturers maintaining normal production. Shipments of graphitized petroleum coke (GPC) carburants have been moderate, with a general attitude towards receiving goods and no significant positive support, leading to overall stability in GPC carburant prices. In the northeast region, the prices of calcined petroleum coke (CPC) carburants have experienced a slight decline, with some support from the rising prices of low-sulfur petroleum coke raw materials. The decline in the operating rate of downstream steel mills has resulted in moderate demand-side support. Considering the overall raw material costs and downstream demand, it is expected that the carburant market prices will mainly exhibit a weak and stable trend in the near term.

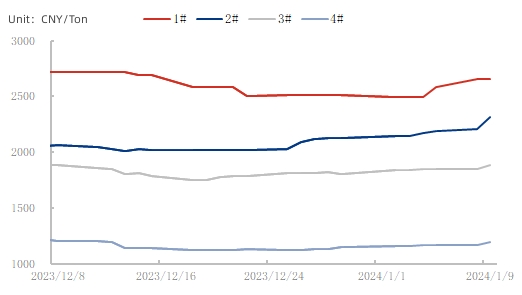

Cost Aspect: As of the time of writing, the price of 1# coke is 2820 yuan/ton, and 2# coke is priced at 2021 yuan/ton. Currently, domestic petroleum coke demand-side support is stable, and the petroleum coke market transactions are relatively active, with good contract signing conditions. It is expected that the short-term petroleum coke market will mainly operate in a consolidative manner, with low-sulfur coke prices maintaining high levels in the transition, and some narrow adjustments in prices for medium to high sulfur petroleum coke.

Demand-side: Recently, Chinese independent electric arc furnace operating rate and capacity utilization have significantly declined. A steel mill in the Hubei region of central China has undergone maintenance from January 1st to January 7th. In the Fujian region of eastern China, a steel mill resumed production on the 24th, and a steel mill in the Jiangsu region has been undergoing maintenance from December 25th to January 9th, lasting for about 16 days. Currently, most electric arc furnace steel mills remain profitable. However, due to the winter storage of scrap steel, the price of scrap steel has risen, and some steel mills have reported difficulties in acquiring scrap steel, leading to a slight reduction in production. Even manufacturers intending to increase production due to existing profits are forced to shorten the increase in production time.

In summary, with raw material prices adjusting narrowly and demand-side transactions being moderate, influenced by environmental policies, the operating rate and capacity utilization of independent electric arc furnaces may continue to decline in the short term. The support from the demand side for the carburant market is moderate, and it is expected that the domestic carburant market prices will continue to operate weakly and stably in the near term. Some manufacturers may be affected by environmental policies and heavy snowfall, potentially impacting shipments. For more information on the carburant market, please feel free to communicate with us at any time.

No related results found

0 Replies