【Negative Electrode】Are Negative Electrode Material Prices on the Rise?

【Negative Electrode】Are Negative Electrode Material Prices on the Rise?

In the past couple of days, there's been a flurry of discussions in the market about the price hike of negative electrode materials, all sparked by the rise in petroleum coke prices. But what's the actual situation? Can the price of negative electrodes really rise, and if so, who are the main drivers?

Let's cut to the chase: yes, the price of negative electrodes is expected to increase, with some products likely to see a rise of around 10%, but this might not be sustained.

Let's first look at the costs. Currently, the major part of the production cost of negative electrode materials lies in raw materials and graphitization, and recently, both these prices have seen some changes.

1. Petroleum Coke:

Starting from January, some manufacturers have gradually started raising prices, with the cumulative increase ranging from 200 to 500 yuan/ton. This increase in cost is not sufficient to significantly impact the price of negative electrode materials. However, over the past two years, with the adjustment of the demand structure for raw materials in negative electrode materials, the penetration rate of medium and high sulfur coke has further increased. The recent continuous rise in aluminum electrolysis prices has also brought the possibility of a future rise in medium and high sulfur petroleum coke prices.

2. Needle Coke:

Since the beginning of this year, needle coke prices have been at a low level, with the mainstream price reported at 5000-6000 yuan/ton, already within the cost range of some manufacturers. In April, some manufacturers have slightly raised prices due to a sudden increase in orders; overseas needle coke companies have also seen a price increase of 100 USD/ton. However, there is still pressure on sustained price increases. Learn more about the price of graphite electrodes using needle coke as raw material.

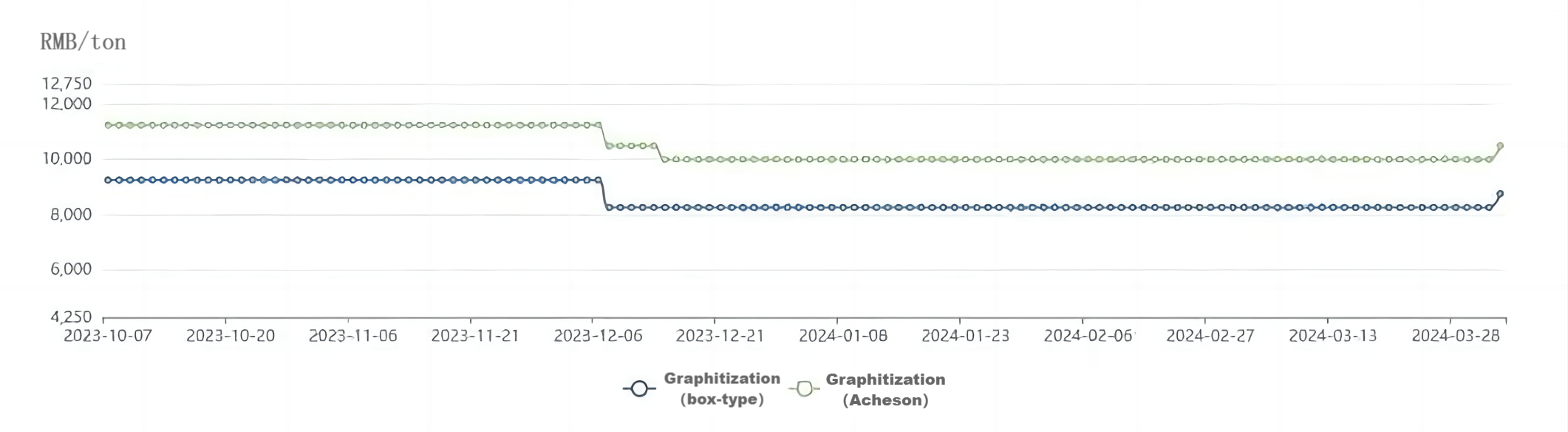

Graph 1: Petroleum Needle Coke Production Prices Trend

(Data source: ICC Xinlu Information)

(Data source: ICC Xinlu Information)

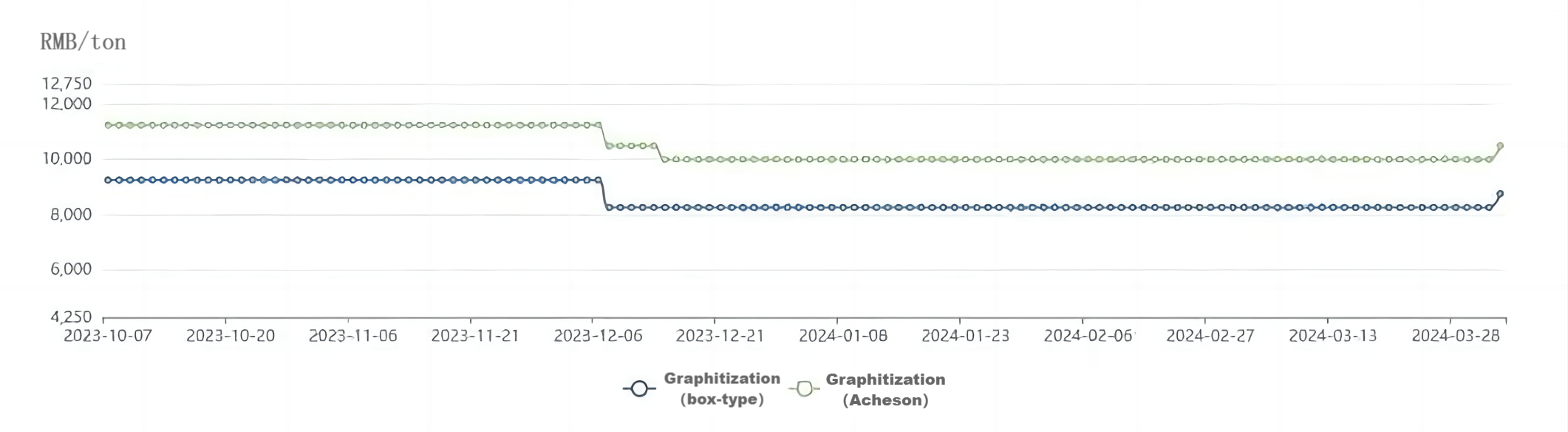

3. Graphitization:

According to monthly data on negative electrode production, the production volume of negative electrodes increased by nearly 50% month-on-month in March. The short-term surge in demand has also led to expectations of a price increase in some contract manufacturing. In April, the production volume of negative electrodes is expected to continue to rise, leading to an anticipated price increase of 500-1000 yuan/ton for contract manufacturing. Currently, there is still an expectation of a price increase of 500-1000 yuan/ton for contract manufacturing of graphitized materials.

Graph 2: Graphitization Contract Manufacturing Prices Trend

(Data source: ICC Xinlu Information)

Overall, the cost increase of negative electrode materials from raw materials and processing fees is roughly estimated to be between 1500-2000 yuan/ton.

Now, let's consider the basic supply-demand situation. Both graphitization and negative electrode materials themselves are in a buyer's market, so the sustainability of price increases will face pressure. It's expected that it will be difficult to fundamentally change this situation this year, but high-quality production capacity is still scarce, which is one of the short-term drivers for pushing up prices.

The price hike of negative electrodes this time is the result of multiple factors stacking up. Currently, some manufacturers are already operating at a loss while fulfilling orders, and a business that continues to operate at a loss naturally cannot last long. Thus, the cost increase urgently needs to be passed on downstream. Contact us for more information on the new energy negative electrode material market.

No related results found

0 Replies