Analysis and forecast of graphite electrode Market in July

Analysis and forecast of graphite electrode Market in July

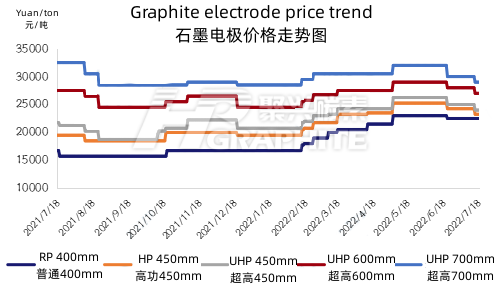

Graphite electrode price trend

1. Positive factors

Supported by the cost side, the prices of low sulfur petroleum coke, needle coke and coal tar pitch are relatively high, and graphite electrode production cost is high.

Supply reduction. It is understood that recently the shutdown and production reduction of some graphite electrode enterprises have increased, some enterprises are expected to reduce production capacity by more than half, and graphite electrode market supply side is expected to continue to shrink.

Low inventory. Since the first half of 2022, graphite electrode enterprises production has been continuously restricted. The enterprises reflect that they basically maintain the balance of production and sales, and there is basically no excess inventory accumulation.

2. Negative factors

In the off-season of the terminal steel market, steel plants inventory is not easy to consume, the steel price falls. Under the condition of many losses, steel plants shutdown and production reduction have increased.

The graphite electrode market has low-cost supply, which affects the market mentality.

3. Supply side

According to statistics, as of June 2022, China's graphite electrode total capacity was 1.817 million tons. According to statistics of 51 domestic graphite electrode enterprises, from January to June 2022 China's graphite electrode total output was about 461,300 tons, a decrease of 49,700 tons or 9.73% over the previous year. Among which, RP total output was 50,600 tons, HP total output was 105,800 tons, and UHP total output was 304,900 tons.

It is expected that the graphite electrode market supply side will continue to shrink. On the one hand, due to high cost and poor demand, graphite electrode enterprises are not enthusiastic about production. In order to avoid inventory accumulation, many enterprises have plans to reduce production or suspend the production of molding and other processes; On the other hand, the current anode material market is still performing well, and the profits of anode and its processing links are considerable. Some graphite electrode enterprises are attracted by profits and turn to anode production or anode processing.

4. Cost and profit

By mid July 2022 low sulfur petroleum coke average market price was about 8305 yuan/ton, up about 56% from the beginning of the year and 165% from the same period last year; needle coke average market price was about 13,841 yuan/ton, an increase of about 37% over the beginning of the year and about 52% over the same period last year.

Based on the current graphite electrode raw material price, UHP small and medium specification graphite electrode current cost is about 23,000 yuan/ton, and UHP large specification graphite electrode current cost was about 28,000 yuan/ton. Combined with graphite electrode market current transaction price, some graphite electrode enterprises have made losses.

5. Market forecast

In the off-season of the terminal steel market, steel plants inventory is not easy to consume, and the production operation of steel plants is difficult to improve in the short term, which continues to have a negative impact on the graphite electrode market. However, graphite electrode enterprises' supply is adjusted downward, and the enterprises' inventory pressure is not large, which has a certain stabilizing effect on the market.

In the short term, graphite electrode market cost is expected to be high and stable, and graphite electrode price is mainly weak and stable. Get the latest reports of GE market, please contact us.

No related results found

0 Replies