【Anode Materials】Limited Downside Potential with Stable Prices

【Anode Materials】Limited Downside Potential with Stable Prices

1. Key Points

1)Jixi: One of the world's largest deposits of high-quality flake graphite, with over 40% large-flake crystalline graphite. Leveraging Jixi's rich mineral resources, the expandable graphite produced here has high expansion ratios and stable quality, making it highly sought after in flame retardant markets in countries like Japan and South Korea, where demand exceeds supply.

2)Industrial Parks: The establishment of a national-level emergency equipment industrial park and the Xiantao graphite cluster industrial park. These projects include a 300,000-ton graphite purification process and a 100,000-ton graphite deep processing project, with a planned investment of 3.8 billion yuan over an area of 700 acres. Graphitized carburant (gpc) for anode industry, specification reference available.

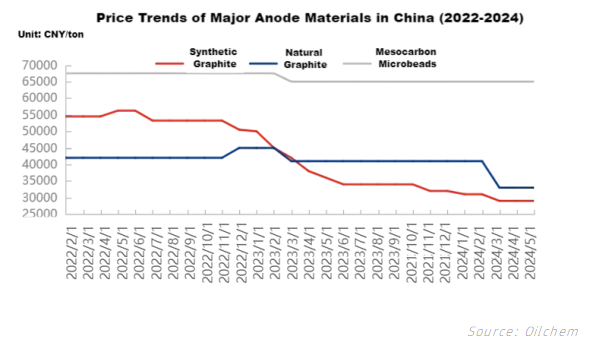

2. Market Trends

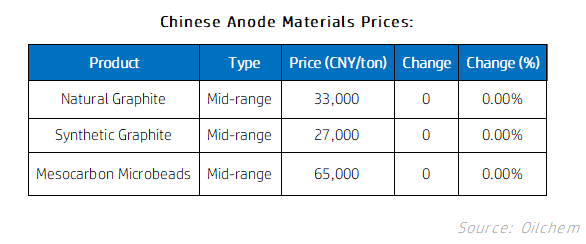

Mainstream Anode Materials Prices:

Natural Graphite: 33,000 - 37,000 CNY/ton

Synthetic Graphite: 24,000 - 39,000 CNY/ton

Mesocarbon Microbeads: 65,000 - 70,000 CNY/ton

3. Production and Sales Dynamics

Supply Side: Production of anode materials is stable with high capacity utilization. There is no significant inventory pressure, with production typically aligned with orders.

Demand Side: Downstream orders are strong, with most fulfilling previous orders, indicating a positive demand outlook for anode materials.

4. Related Product Market Trends

Petroleum Coke: The domestic market is experiencing weak consolidation, with some price declines. Leading companies like Sinopec and CNOOC maintain stable production and sales, adhering to order contracts, and prices remain steady.

Needle Coke: Market transactions are satisfactory, with downstream purchasing as needed. Manufacturers are executing order contracts, keeping needle coke prices stable. Raw coke prices range from 5,200 to 5,500 CNY/ton, while calcined coke prices range from 6,500 to 7,800 CNY/ton.

5. Market Forecast

In the short term, leading companies indicate that anode material prices have reached a bottom, with limited room for further declines. Prices are expected to remain stable moving forward. For further analysis and forecast of the anode material market, feel free to contact us.

No related results found

0 Replies