【Tariffs】 Electric Vehicles, Lithium Batteries, and Graphite Anodes to Face Section 301 Tariffs!

【Tariffs】 Electric Vehicles, Lithium Batteries, and Graphite Anodes to

Face Section 301 Tariffs Starting June 15!

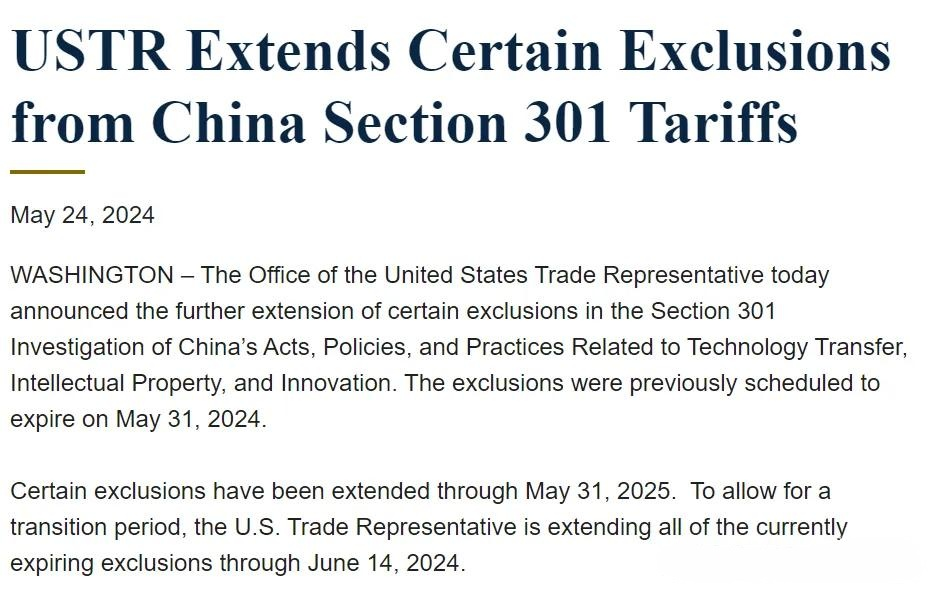

The United States Trade Representative (USTR) recently announced an extension of certain exclusion clauses under Section 301's investigation into "China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation." The exclusions, originally set to expire on May 31, 2024, have been extended to May 31, 2025. To allow for a transition period, the USTR has extended all current exclusions set to expire until June 14, 2024.

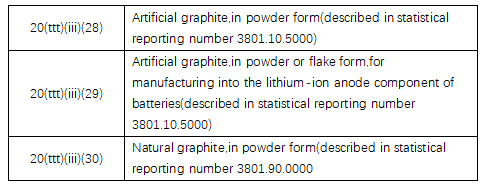

However, graphite anodes are not included in these exclusions! This means that starting June 15, a 25% tariff will be imposed on graphite anodes exported from China to the United States.

Tariff Increase on Lithium Batteries

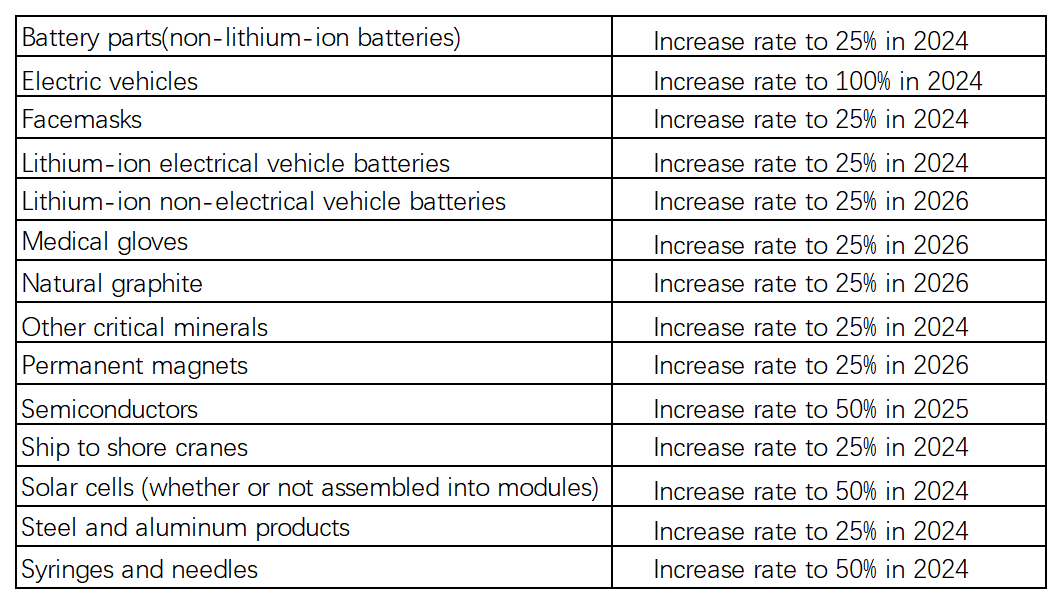

For lithium batteries, the new U.S. tariffs differentiate between power and non-power batteries:

Lithium batteries and battery components: From the original 7.5% tariff to 25%, effective 2024.

Non-power lithium batteries: From the original 7.5% tariff to 25%, effective 2026.

In 2023, China exported over 5 million vehicles, becoming the world's largest car exporter. The global production of anode materials reached 1.7621 million tons in 2023, with a year-on-year growth rate of 20%. China's share of global anode material production increased to 97.3%. In terms of shipments, global anode material shipments reached 1.6795 million tons, with China accounting for 95%. To view the production & sales of lithium battery anode graphitized petroleum coke. By 2025, the planned overseas battery production capacity will demand 2.166 million tons of anode materials, while the current planned overseas anode material production capacity stands at 527,700 tons, indicating a significant shortfall. As China's new energy industry continues to grow globally and evolves into multinational corporations, our influence and voice will become increasingly stronger. Follow us on domestic and international anode material policies.

No related results found

0 Replies