【Graphite】China's Dominance Remains Unchallenged

【Graphite】China's Dominance Remains Unchallenged

According to foreign media reports, automakers like Tesla and Mercedes-Benz are striving to diversify their graphite supply for electric vehicle (EV) batteries beyond China. With the rising popularity of EVs, the demand for graphite, along with other materials like lithium and nickel, is increasing. The main product graphitized petcoke is widely used in anode materials production. Historically, the steel industry was the main consumer of graphite, but recently, the EV battery sector has overtaken steel in graphite consumption.

Among the materials used in EV batteries, graphite constitutes the largest portion by weight. So far, automakers have focused more on other materials like lithium or cobalt, responding slowly to the potential shortage of graphite.

Consulting firm Project Blue predicts that this year, the EV battery sector will, for the first time, account for over 50% of the natural graphite market. Automakers are working to secure graphite supplies from new production countries such as Madagascar and Mozambique.

The United States and Europe are implementing and proposing laws to reduce dependence on critical minerals from China, which could exacerbate the shortage of graphite produced outside China. Australian materials company Talga Group points out that automakers' insufficient investment in graphite development might lead to difficulties in securing graphite in the future.

An EV battery typically requires 50-100 kg of graphite, approximately double the amount of lithium needed. Previously, graphite was primarily used in the steel industry, but according to BMO Capital Markets, by 2030, EV sales are expected to rise to 35 million units, tripling the steel industry's demand for graphite.

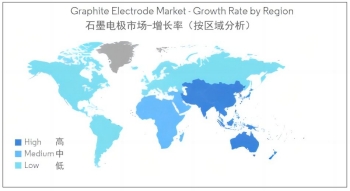

It forecasts that the graphite shortage will intensify over the next few years, projecting a global shortfall of 777,000 tons by 2030. Benchmark Mineral Intelligence (BMI) reports that around $12 billion in investment will be needed by 2030 to meet graphite demand, requiring the development of 97 new mines by 2035. BMI also notes that China accounts for 61% of the world's natural graphite production and 98% of the refined graphite used for anodes.

Despite several automakers signing new contracts to expand the graphite supply chain, the pace of change might be slow due to the overwhelming reliance on China, the largest graphite producer. Last year, China's share of refined graphite—a type of high-purity spherical graphite without coating—was 100%, and BMI forecasts that it will still account for 79% by 2032.

For automakers seeking EV subsidies under the U.S. Inflation Reduction Act, China's market dominance in graphite could pose a challenge. The Act only provides subsidies for battery materials produced in the U.S. or in countries with free trade agreements with the U.S. The EU has proposed legislation aiming to reduce dependence on critical mineral resources to below 65% by 2030.

While synthetic graphite made from petroleum products is also available, natural graphite has about 55% lower CO2 emissions. Automakers investing in graphite mining are aware of this. Additionally, natural graphite is cheaper and has advantages in battery performance compared to synthetic graphite.

For more information about the graphite market, feel free to contact us. For more info. on China's graphite market, feel free to contact us.

No related results found

0 Replies