【Graphite Electrode Market】Continued Cooling and Adjustment - How Far from Bottom Rebound?

【Graphite Electrode Market】Continued Cooling and Adjustment -

How Far from Bottom Rebound?

Market Overview

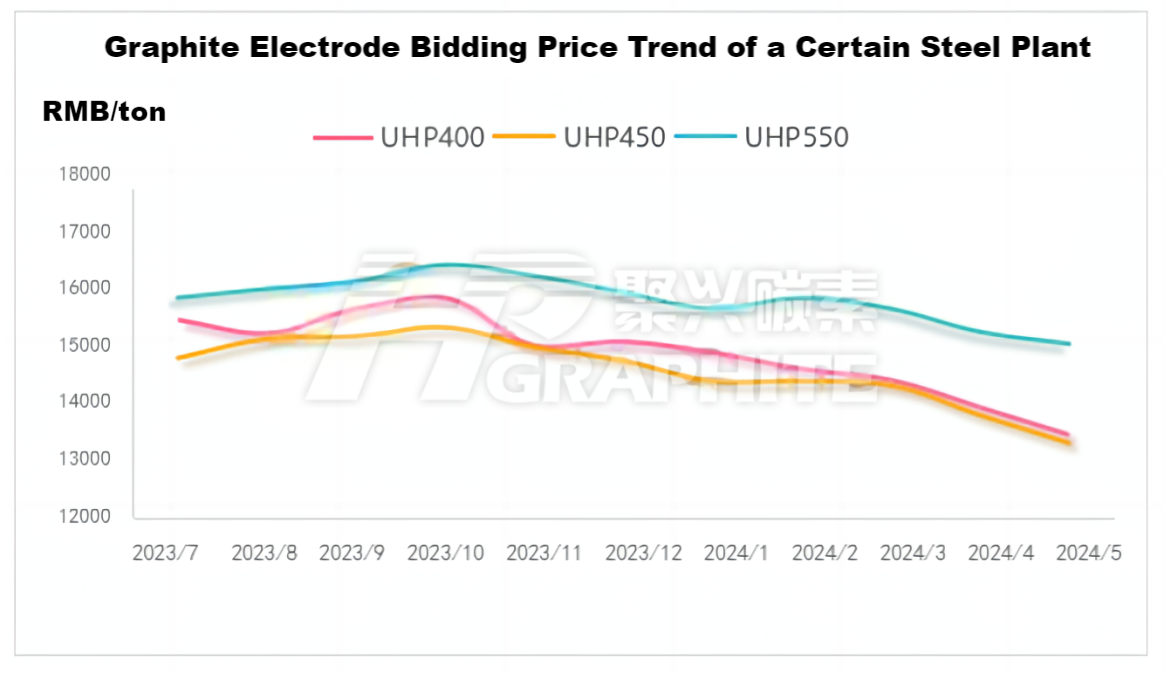

The graphite electrode market is currently experiencing weak supply and demand, with prices continuing to decline. After approaching the cost line in April, domestic graphite electrode prices continued to cool and adjust in May. As of May 31, the mainstream price for UHP 400mm electrodes was 15,000-16,000 RMB/ton, UHP 450mm (with 30% needle coke) was 14,500-15,000 RMB/ton, UHP 600mm was 17,000-18,000 RMB/ton, and UHP 700mm was 20,500-21,500 RMB/ton. Weak end-user demand, blocked exports, and low-price competition within the industry have driven the transaction focus lower, reducing graphite electrode companies' willingness to ship.

Raw Material Market

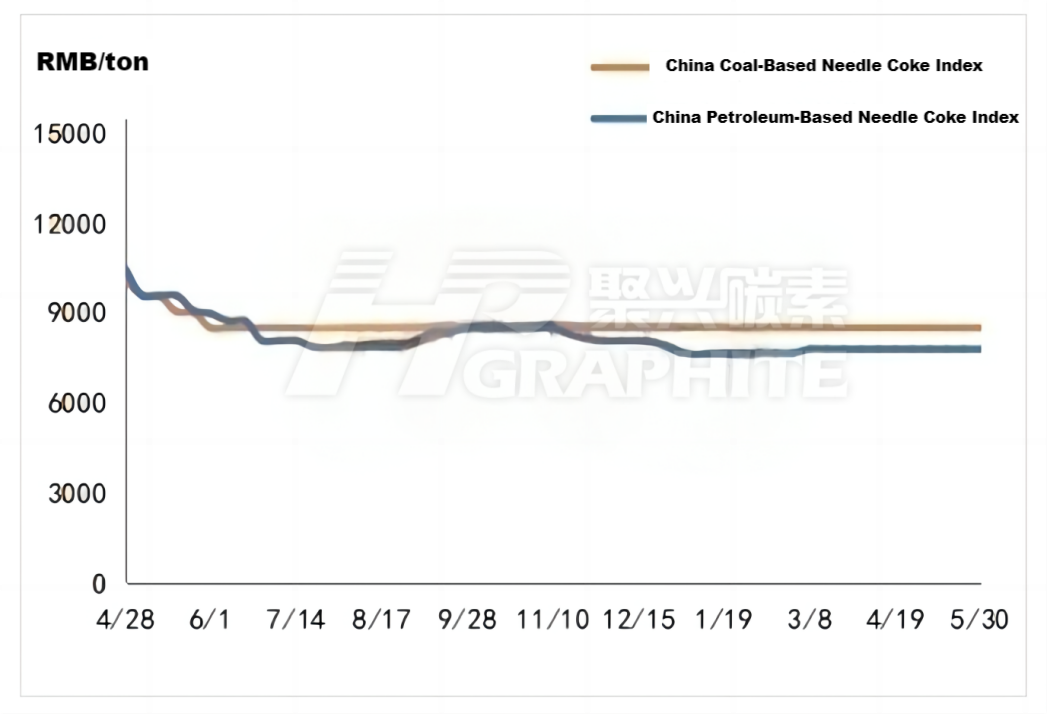

Prices of upstream raw materials like needle coke remain stable, while the petroleum coke market sees average trading and declining prices for low-sulfur coke. Amid overall losses in the graphite electrode industry, many companies have adjusted their needle coke ratios to lower production costs. However, varying adjustment methods and extents among companies have resulted in a fragmented market, with prices for the same specifications of graphite electrodes varying widely.

Supply Situation

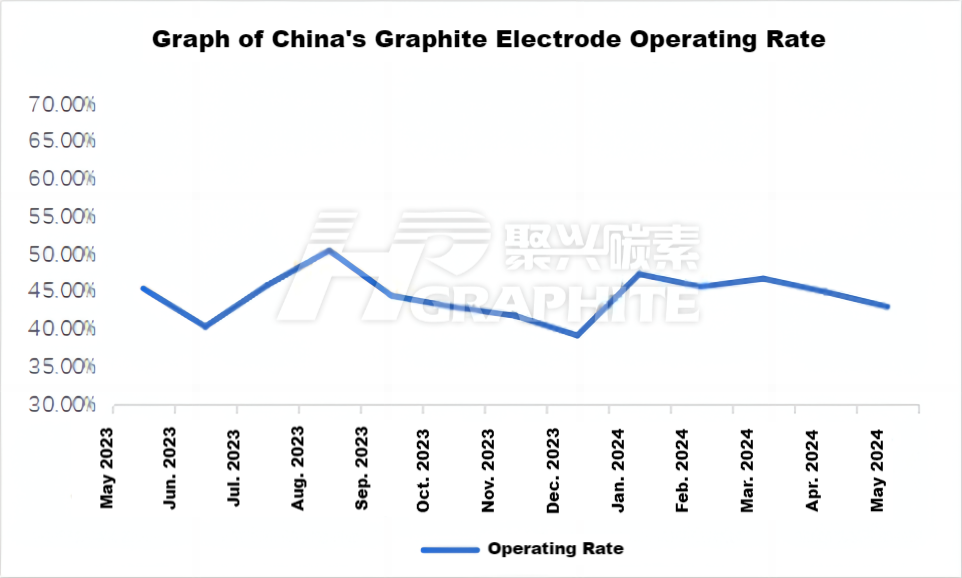

Facing market downturn and price drops, companies' production enthusiasm has notably decreased. With losses per ton sold, many companies are reluctant to ship, opting instead to control production to avoid inventory accumulation. Measures include combining equipment rectification with maintenance schedules, such as a two-week equipment overhaul by a top-5 graphite electrode company in May. Some companies have chosen to halt production entirely, planning to resume once the market recovers.

Demand Trends

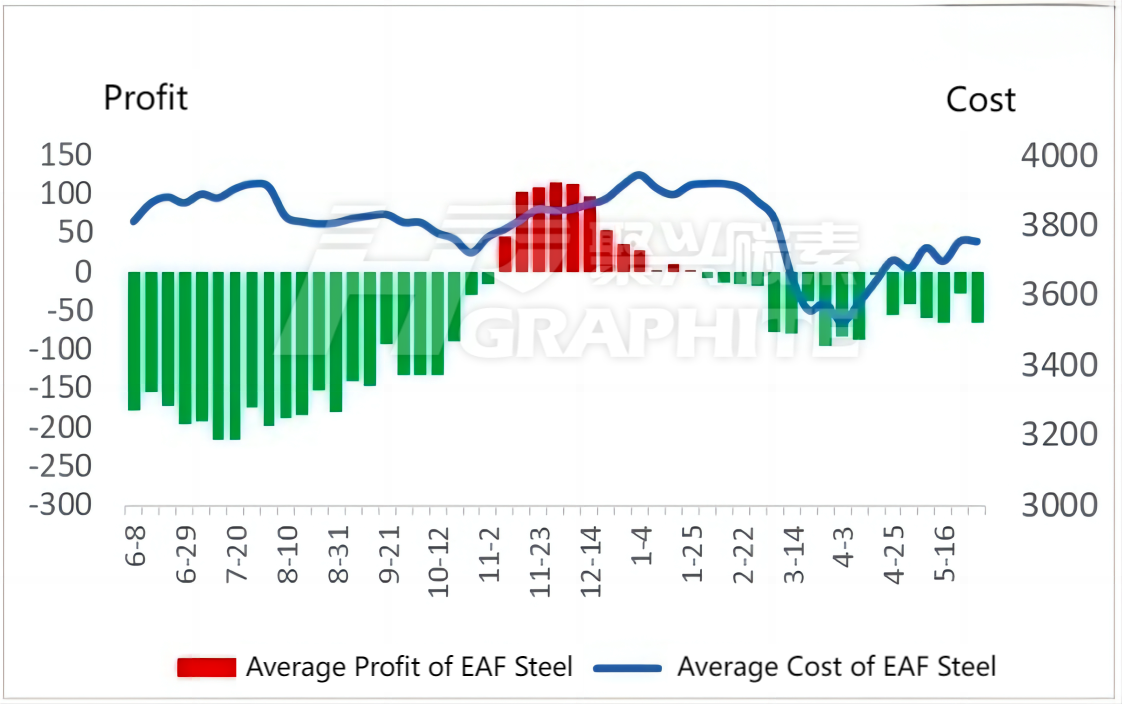

End-user steel mills are operating at low capacity, with blast furnaces running below full capacity and purchasing graphite electrodes only as needed, lacking significant growth momentum. Recently, the cost for electric arc furnace (EAF) steel mills has not changed much, but weak steel prices have led to reduced overall profitability for EAF mills. With the rainy season approaching in June, downstream demand may weaken further, prompting some EAF mills in southern regions (e.g., Guangxi) to proactively halt production for maintenance.

Market Outlook

Given the stable price trends of upstream materials like needle coke and petroleum coke, weak downstream industry demand, and complex international trade dynamics, graphite electrode prices are still bottoming out. During this period, companies will be tested on cost management, process control, technology, and product quality. By the third quarter, as production adjustment measures are gradually implemented and supply tightens, the graphite electrode market is expected to recover from its slump to some extent. Feel free to contact us for more information about the upstream and downstream markets of graphite electrodes.

No related results found

0 Replies