【Calcined Petroleum Coke】Market Overview (as of December 18)

【Calcined Petroleum Coke】Market Overview (as of December 18)

As of December 18, the average market price for calcined petroleum coke was 2,457 RMB/ton, an increase of 33 RMB/ton (1.36%) from the previous working day.

1. Low-Sulfur Calcined Coke: The market remains relatively quiet, with prices showing limited upward movement. Many enterprises are producing based on sales, facing ongoing pressure to move inventory.

2. Medium to High-Sulfur Calcined Coke: Overall market transactions are satisfactory, with enterprises maintaining a firm pricing stance. Instances of selling at a loss have significantly decreased.

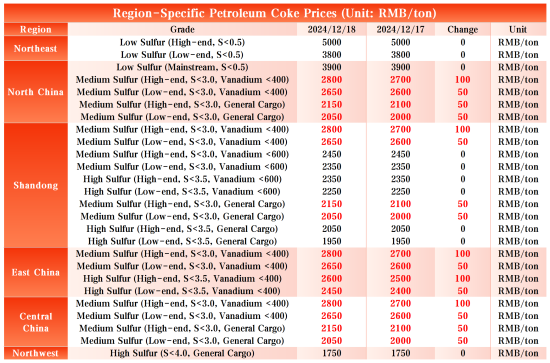

Region-Specific Petroleum Coke Prices (Unit: RMB/ton)

Market Prices

Low-Sulfur Calcined Coke:

Using Jinxi and Jinzhou petroleum coke as raw materials: mainstream transaction prices range from 3,800 to 4,200 RMB/ton.

Using Fushun petroleum coke: ex-factory mainstream transaction prices range from 4,600 to 5,000 RMB/ton.

Using Liaohe and Binzhou Zhonghai petroleum coke: mainstream transaction prices are around 3,800 to 4,100 RMB/ton.

Medium to High-Sulfur Calcined Coke:

lSulfur 3.0%, no specific requirements for trace elements: previous ex-factory mainstream contract prices were 2,050–2,150 RMB/ton (cash); current negotiation prices are in the same range.

Sulfur 3.5%, no specific requirements for trace elements: previous ex-factory mainstream contract prices were 1,950–2,050 RMB/ton (cash); current negotiation prices remain unchanged.

Sulfur 3.0%, vanadium 400: previous contract prices were 2,650–2,800 RMB/ton (cash); current negotiation prices are consistent with previous levels.

Supply

The current national daily supply of commercial calcined coke is 27,127 tons, with an operating rate of 60.99%, representing a 0.83% decrease from the previous working day.

Upstream Market

Petroleum Coke:

1. Sinopec refineries are maintaining stable prices and shipments. Major anode material manufacturers' procurement plans remain steady, with overall scheduling being satisfactory.

2. In the Yangtze River region, Anqing Petrochemical and Changling Petrochemical are experiencing smooth shipments for anode-use coke. Jingmen Petrochemical and Jiujiang Petrochemical are dispatching carbon-grade coke as needed. Wuhan Petrochemical's coking unit has not yet resumed operations.

3. In North China, Yanshan Petrochemical is operational. Shijiazhuang Refinery and Luoyang Petrochemical are primarily dispatching 4A-grade coke.

For China National Petroleum Corporation (CNPC) refineries:

ln Northeast China, Liaohe Petrochemical's auction prices have slightly decreased by 10 RMB/ton.

Jinxi Petrochemical has not yet announced final prices.

Dagang Petrochemical plans to hold an auction this Friday.

China National Offshore Oil Corporation (CNOOC) refineries are largely fulfilling existing orders. Huizhou Petrochemical has initiated a 10-day maintenance shutdown.

Downstream Markets

Graphite Electrodes:

Current market transaction prices are varied. Some enterprises are offering discounts to boost year-end cash flow, leading to slight price increases in certain low-priced resources due to rising low-sulfur petroleum coke prices. Mainstream enterprises are maintaining stable pricing, with the market price range holding steady.

Electrolytic Aluminum:

The cancellation of export tax rebates continues to impact the market. Combined with a downward trend in alumina prices, production costs are expected to decrease. Market expectations of increased aluminum ingot social inventory are contributing to a continued decline in spot aluminum prices.

Anode Materials:

Market feedback indicates that transactions have remained relatively stable throughout the week. While downstream demand is gradually recovering, order volumes are limited. The anode materials market is highly concentrated, and some small to medium-sized enterprises have not seen significant improvements in operating rates or shipments, leading them to produce primarily based on existing orders.

Market Outlook

In the short term, mainstream prices for low-sulfur calcined coke are expected to remain stable. Medium to high-sulfur calcined coke prices may increase in line with market trends, influenced by raw material costs.

Source: Baiinfo

Feel free to contact us anytime for more information about the cpc market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies