【CPC】Market Supply Adequate and Mainstream Prices Stable as of September 9

【CPC】Market Supply Adequate and Mainstream Prices Stable as of September 9

Market Overview

On September 9, the average price of calcined petroleum coke (CPC) was 2,148 RMB /ton, stable compared to the previous working day. The calcined petroleum coke market is currently operating smoothly. After a slight adjustment earlier, low-sulfur calcined petroleum coke prices have stabilized. Calcined petroleum coke made from Fushun petroleum coke remains difficult to sell despite price increases, with few new orders. The mid-to-high sulfur calcined petroleum coke market is performing reasonably well. The downstream electrolytic aluminum market has stable demand, and companies are mainly fulfilling orders as they come. The prices of mid-to-high sulfur calcined petroleum coke from major enterprises have remained relatively stable.

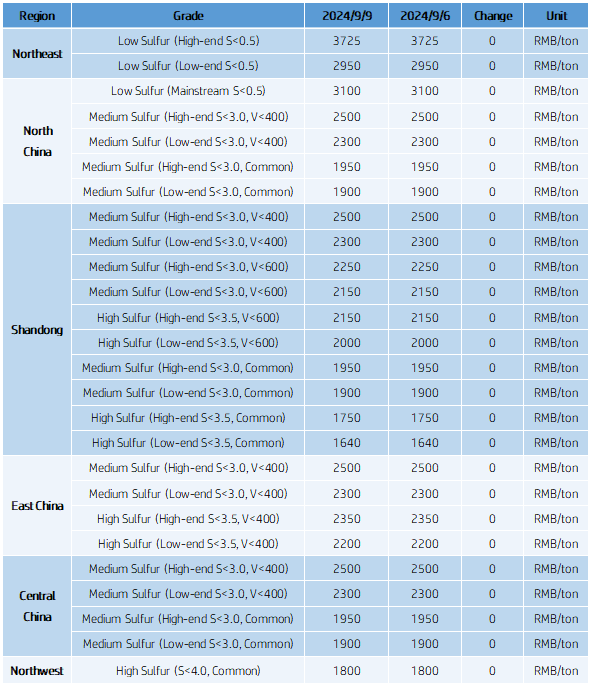

Regional Market Prices

Market Prices

Low-sulfur calcined petroleum coke (using Jinxi, Jinzhou petroleum coke) mainstream transaction prices are between 3,000 and 3,200 RMB /ton.

Low-sulfur calcined petroleum coke (using Fushun petroleum coke) ex-factory mainstream prices are between 3,400 and 3,725 RMB /ton.

Low-sulfur calcined petroleum coke (using Liaohe, Binzhou Zhonghai petroleum coke) mainstream transaction prices are around 2,850 to 2,950 RMB /ton.

Mid-to-high sulfur calcined petroleum coke (sulfur 3.0%, trace elements not specified) previously had a mainstream ex-factory contract price of 1,950 RMB /ton, and current negotiations are at 1,900 to 1,950 RMB /ton.

Mid-to-high sulfur calcined petroleum coke (sulfur 3.5%, trace elements not specified) previously had a mainstream ex-factory contract price of 1,640 to 1,750 RMB /ton, and current negotiations are at 1,640 to 1,750 RMB /ton.

Mid-to-high sulfur calcined petroleum coke (sulfur 3.0%, V<400) previously had a contract price of 2,400 RMB /ton, and current negotiations are at 2,400 RMB /ton.

Supply Aspect

Currently, the daily supply of commercial calcined petroleum coke nationwide is 26,574 tons, with an operating rate of 62.44%. The supply of calcined petroleum coke remains stable compared to the previous working day.

Upstream Market

· Petroleum Coke: Currently, Sinopec’s refineries have stable trading of petroleum coke. In East China, Jilin Petrochemical mainly produces 3A and 4B grades, while Yangzi Petrochemical and Jinshan Petrochemical focus on 4B shipments. In Northwest China, Tabei Petrochemical maintains stable prices for petroleum coke. In North China, Cangzhou refineries are still under maintenance and plan to resume operations around October 25. PetroChina refineries maintain stable prices. In Northeast China, low-sulfur coke orders are being fulfilled with good sales for aluminum use. In North China, Daqing Petrochemical has reduced its listed price by 30 RMB /ton. In Northwest China, Lanzhou Petrochemical and Karamay Petrochemical have some units under maintenance, with other refineries focusing on shipments. CNOOC refineries are currently shipping according to orders.

Downstream Market

· Graphite Electrodes: The market environment for graphite electrodes is generally poor, with downstream demand being average. The market trend is not clearly improving, and graphite electrode companies are facing difficulties in sales. The presence of low-priced resources disrupts the low-end market prices, creating a chaotic trading environment. Companies are mainly focusing on stable transactions.

· Electrolytic Aluminum: Ongoing external market influences, combined with a strong supply and weak demand domestically, and a decrease in China's PPI both month-on-month and year-on-year in August, reflect overall industry sluggishness, further affecting market sentiment. Spot aluminum prices continue to decline.

· Negative Electrode Materials: The negative electrode material market remains weak and stable. Due to poor demand from downstream battery manufacturers, September orders for negative electrode materials are below expectations. The buyer’s market has increased bargaining power, and with an overall surplus in the negative electrode material market, there is a large volume of low-to-mid-end products. Prices are often pressured down by buyers, approaching cost lines with minimal profit margins for producers.

Market Forecast

Prices for all grades of calcined petroleum coke are expected to remain stable tomorrow.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies