【Mysteel Data】 Survey of China's Independent Electric Arc Furnace Production (June 7, 2024)

【Mysteel Data】 Survey of China's Independent

Electric Arc Furnace Production (June 7, 2024)

This week, a survey of 87 independent electric arc furnace (EAF) steel plants in China, including 76 plants producing construction steel, reveals the following:

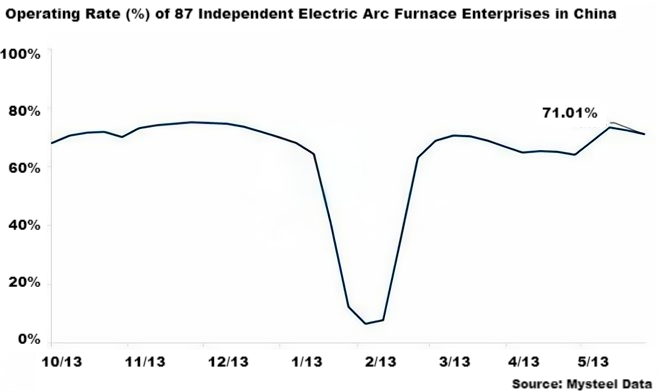

1. Average Operating Rate:

The average operating rate for 87 independent EAF steel plants is 71.01%, down 1.35 percentage points from the previous week, but up 8.80 percentage points year-on-year. The operating rate slightly declined in East and South China, while remaining stable in other regions. Specifications and Performance Reference for Graphite Electrodes Used in Electric Arc Furnace Steelmaking.

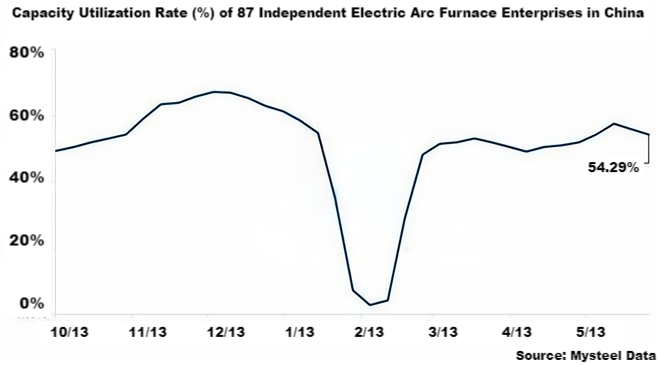

2. Average Capacity Utilization Rate:

The average capacity utilization rate for these 87 EAF steel plants is 54.29%, down 1.64 percentage points from the previous week, but up 8.50 percentage points year-on-year. Capacity utilization slightly decreased in East, South, Central, and Northwest China, slightly increased in North and Southwest China, and remained stable in Northeast China.

3. Daily Crude Steel Production:

The daily crude steel production of these 87 EAF steel plants decreased by 2.95% from the previous week.

4. Rebar and Wire Rod Production:

Weekly rebar production from 76 construction steel-focused EAF steel plants decreased by 4.78%. Weekly wire rod production decreased by 1.40%.

5. Profitability:

Among the 76 construction steel-focused EAF steel plants:

1. 32.89% are slightly profitable.

2. 44.74% are breaking even (some due to production halts).

3. 22.37% are incurring losses.

6. Weekly Insights:

The operating rate and capacity utilization rate of China’s independent EAF steel plants saw a slight decline this week.

Several plants in South China halted production for maintenance:

A plant in Guangdong stopped on May 29, involving a 70T EAF.

A plant in Guangxi halted on May 26, involving a 120T EAF.

A plant in Fujian began maintenance on May 27, expected to last half a month, involving a 100T EAF.

Looking ahead to next week, a plant in East China's Fujian is expected to resume production in mid-June, involving a 100T EAF.

7. Profitability Trends:

The proportion of slightly profitable steel plants decreased by 5.27 percentage points this week. The market sentiment is weak due to fluctuating rebar prices and a noticeable drop in spot prices in East and South China, narrowing the scrap-rebar and scrap-board spreads, and increasing cost pressures on steel plants. Steel plants in East and South China are still experiencing losses, leading to a general lack of enthusiasm for production, with some plants postponing their resumption plans. In contrast, steel plants in North and Southwest China are still reasonably profitable, with some increasing their operating hours to boost production.

8. Outlook for Next Week:

With macro-level production controls potentially in place and a traditionally slow season with limited demand growth, the production enthusiasm among steel plants is expected to remain moderate. It is anticipated that the operating rate and capacity utilization rate of independent EAF plants will continue to decline slightly.

Feel free to contact us anytime to obtain further information about the market for steelmaking in short process electric arc furnaces. Our team is committed to providing you with in-depth insights and tailored assistance according to your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help you with our expertise.

No related results found

0 Replies