【Anode Materials】 2024 Anode Coke Market Development and Trends

【Anode Materials】 2024 Anode Coke Market Development and Trends

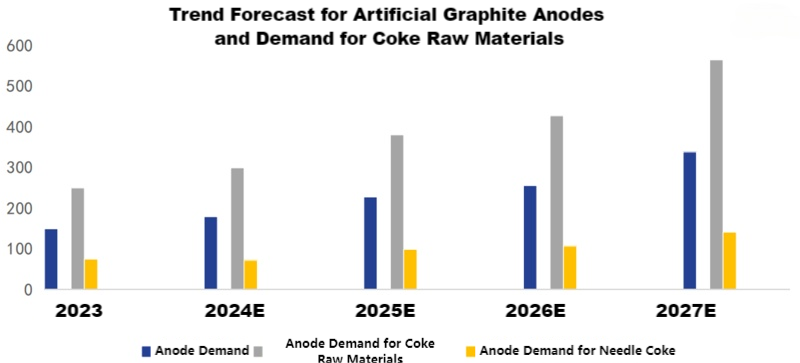

1. Forecast of Anode Coke Raw Material Demand

As the demand for artificial graphite anodes continues to rise, the need for coke raw materials will also grow. From 2023 to 2027, the annual growth rate of anode demand is expected to reach 23%, with the demand for needle coke increasing at an annual rate of 17%. Graphitized carburant plays a crucial role in the anode material industry, driving the continuous advancement of lithium-ion battery technology and the development of the market.

Diverse Demand for Carbon Materials Driven by Battery Technology Development

Battery and anode technologies are flourishing with a clear trend towards diversification.

Upstream carbon material companies face increasing demands for precise research and development capabilities and technological proficiency.

2. Application Proportions and Development Trends of Different Coke Raw Materials

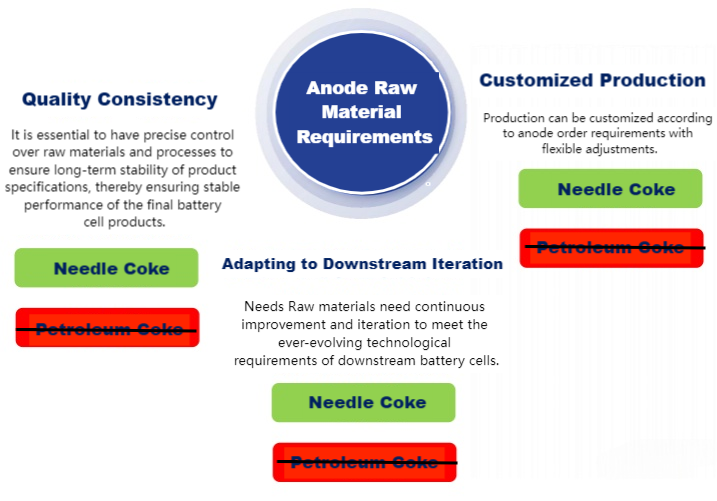

In the future, the demand for coke raw materials for anodes will not be limited to ordinary needle coke and petroleum coke. The differentiated demand for specialized anode coke (needle-like coke), isotropic coke, and fast-charging coke will become more significant.

The production logic of traditional petroleum coke cannot meet the evolving demands of anode materials, being merely a reluctant choice during periods of intense competition. Consequently, the application proportion of traditional petroleum coke is expected to continue declining.

3. Review of the Anode Coke Market Trends

Due to the continuous cost reduction in downstream industries and the imbalance between supply and demand in the needle coke industry, upstream coke companies were forced to cut prices, leading to a continuous decline in market prices. In 2023, the prices of needle coke and low-sulfur petroleum coke dropped by more than 35%.

In the second half of 2023, as coke prices approached the cost line, cost support became evident, and prices of needle coke and low-sulfur coke stabilized at a low level.

4. Supply and Demand Forecast for the Needle Coke Market

Needle coke will continue to face overcapacity:

By 2026, the production capacity of needle coke is expected to reach 4.57 million tons (2.66 million tons from oil-based coke and 1.91 million tons from coal-based coke).

Needle coke demand is expected to continue growing:

By 2026, the demand for needle coke from graphite electrodes and anodes will be 790,000 tons and 1.34 million tons, respectively, totaling 2.13 million tons.

Needle Coke ≠ Petroleum Coke

Needle coke, as a main product of oil slurry refining, focuses on performance and stability throughout the production process. Conversely, petroleum coke, a byproduct of oil refining, cannot meet the core requirements of anode coke raw materials. Thus, fundamentally, needle coke is not equivalent to petroleum coke and cannot be replaced by it in the future.

High-End Dilemma

Since the beginning of 2023, due to the cost reduction pressure from downstream industries, the needle coke industry has generally been in a loss-making stage. As of early this year, the operating rate of coal-based needle coke enterprises was less than 5%, and the operating rate of oil-based needle coke was below 40%, with some enterprises approaching their operational limits. The prolonged industry losses have severely impacted the enhancement of product technology and quality, making it difficult to meet the continued cost reduction demands of downstream industries. Needle coke, as a high-end carbon material, must reflect its value; otherwise, the operating rate will remain low, and production capacity will be underutilized, resulting in significant losses for the nation and the new energy sector.

5. Future Development Strategies for Anode Coke Products

With the continuous expansion of needle coke and specialized anode coke production capacities, the competition in the anode coke industry will intensify. Controlling costs, ensuring quality consistency, and targeted joint R&D will be crucial for the survival and development of enterprises.

Ensuring High-Quality Consistency:

High-quality consistency is a core requirement from downstream battery and anode enterprises, crucial for maintaining stable product processes and performance, and is a key competitive factor for coke enterprises.

Targeted Joint R&D:

Given the diverse and complex application scenarios of current terminal batteries, needle coke enterprises need to actively integrate downstream through joint R&D to meet the requirements of niche market customers.

Continuously Reducing Production Costs While Ensuring Quality

As the penetration rate of new energy vehicles exceeds 30%, the main market for new energy vehicles is shifting from high-end to mass market. Downstream cost reduction demands are increasing, requiring needle coke enterprises to continue promoting cost reduction and efficiency enhancement without compromising needle coke quality.

Feel free to contact us anytime for further information about the anode materials market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to assist you.

No related results found

0 Replies