【Anode Materials】Demand Cools After Mid-Year Surge, Price Decline Warning?

【Anode Materials】 Demand Cools After Mid-Year Surge, Price Decline Warning?

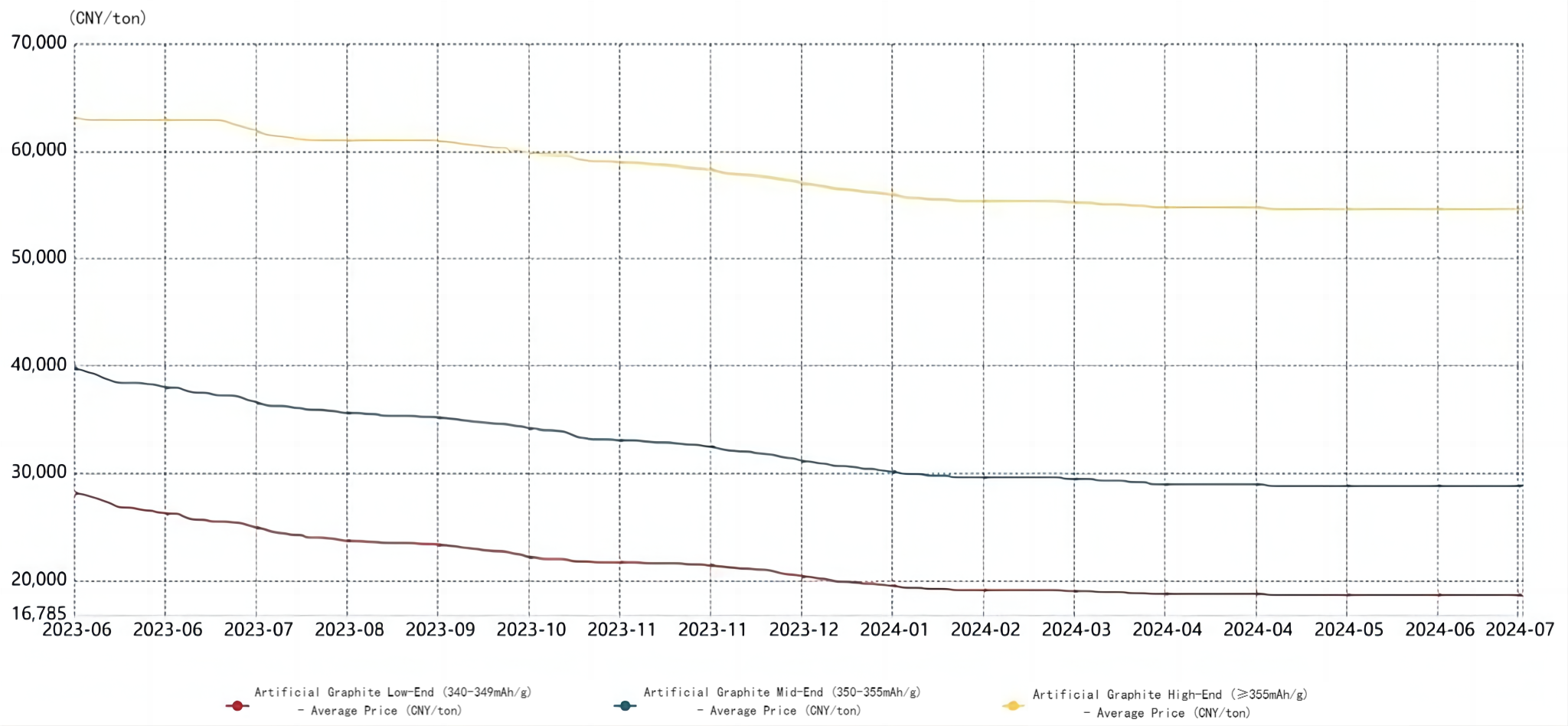

In June, the prices of anode materials remained weakly stable.

Cost Side:

Low-Sulfur Petroleum Coke: Due to a sluggish market, prices have the potential for further decline.

Coal-Based Needle Coke Raw Coke: The growth rate of prices has slowed compared to earlier periods, with a slight increase.

Graphitization Outsourcing: With the southwestern region entering the rainy season, outsourcing companies have resumed operations, accepting low-priced orders, leading to a slight decrease in overall prices. Graphitized carburant is widely used in steelmaking, casting, and metallurgy industries, with a full range of specifications.

Demand Side:

In June, the end market reached a mid-year surge point, with many customers completing their inventory buildup in advance, thereby controlling the current inventory levels. This led to a decrease in demand for raw anode materials. The issue of excess anode production capacity continues to put pressure on anode prices. However, since there is very limited room for further cost reductions in anode materials and anode companies are facing significant financial pressures, there is strong sentiment to maintain prices, resulting in weakly stable anode prices.

Future Outlook:

Entering July, the performance of low-sulfur petroleum coke shipments has been poor. To control inventory, refineries may continue to lower prices. Customer demand for coal-based needle coke is declining, with a reduction in orders, and some companies are resuming production after maintenance, ending the price increase trend. Orders for graphitization outsourcing are also decreasing along with the decline in anode production, but due to cost constraints, outsourcing companies' quotations remain mainly stable. After the mid-year surge, the end market's activity is cooling down, reducing the demand for anodes. Anode companies are also facing operational pressures such as financial constraints, leading to a tightening of overall production. Considering the current significant excess capacity and the market entering a new negotiation cycle, it is expected that anode prices may see a slight decline in the future.

Feel free to reach out to us at any time for more information regarding the anode materials market. Our team is dedicated to providing you with in-depth insights and tailored assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to assist you with the utmost dedication.

No related results found

0 Replies