Graphite electrode demand & industry concentration is improving

Under the background of carbon neutrality, graphite electrode demand & industry concentration is improving

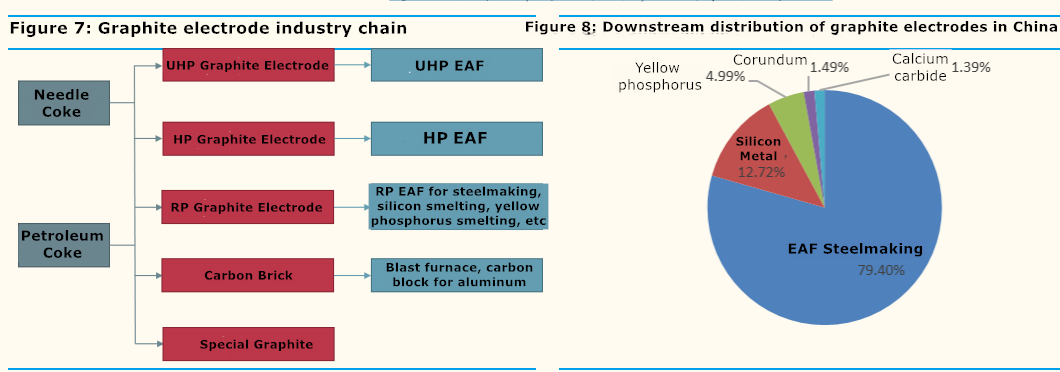

Graphite electrode is a conductive material mainly used in steel industry

Graphite electrode is a kind of high-temperature resistant graphite conductive material produced by a series of processes, such as mixing and kneading, molding, roasting, impregnation, graphitization and mechanical processing, using petroleum coke and needle coke as aggregate and coal pitch as binder. The production process has high requirements for equipment, the production cycle usually lasts three to five months, and the power consumption is large. It is used in EAF as a conductor for heating and melting furnace charge in the form of arc discharge. According to the quality index, it can be divided into RP graphite electrode, HP graphite electrode and UHP graphite electrode.

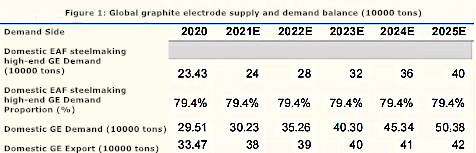

EAF steelmaking is the largest downstream demand for graphite electrode, accounting for 80% at home and 90% abroad. The first characteristic of graphite electrode is that it can conduct current and generate electricity, so as to produce high temperature molten waste iron or other raw materials in blast furnace to produce steel and other metal products; The second characteristic is low resistivity and resistance to the thermal gradient in the EAF, so it is widely used in the steel industry.

At present, UHP graphite electrode is mainly used in electric furnace steelmaking. In recent years, great progress and development have been made in the design and manufacture of UHP AC electric furnace. For example, the development of variable impedance and high impedance AC technology has significantly improved the operating conditions of electric furnace and plays an important role in electric furnace steelmaking. UHP graphite electrode can be used in large capacity EAF and special steel EAF .

Supply side: Blind expansion of industry capacity, capacity utilization rate less than 50%

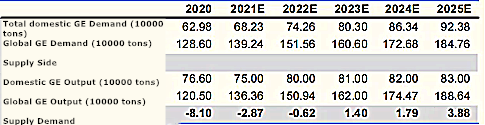

Before 2016, graphite electrode prices were low due to low downstream demand. In 2016Due to the low downstream demand, the price of graphite electrode is low. In 2016, the graphite electrode manufacturers cleared their production capacity due to falling below the manufacturing cost line, and the social inventory reached a low point. In 2017, the ground strip medium frequency furnace was cancelled at the policy end, and a large amount of scrap iron flowed into the electric furnace of the steel plant, resulting in a sudden increase in the demand for graphite electrode in the second half of 2017, a significant change in the relationship between supply and demand, the price reached the highest point, and quickly changed from the buyer's market to the seller's market, The huge profit margin makes many enterprises eager to build or expand production capacity.

In the second half of 2017, the capacity of graphite electrode was 1.2 million tons, and the capacity utilization rate was only 49%. If we add the capacity under construction and planned construction that have not been put into operation, as well as the capacity of enterprises that have stopped production for many years to resume and expand production, the total capacity will reach 2 million tons. At the same time, the capacity utilization rates of prebaked anode for aluminum and carbon (graphite) electrode for submerged arc furnace are about 65% and 45% respectively.

From 2018 to 2019, due to excessive investment, production and purchase, resulting in excessive stock in the market, the average price of graphite electrode plunged in 2019. In the first half of 2020, the epidemic led to a further decline in the average selling price of graphite electrodes. With the economic recovery, graphite electrode production and sales improved from August, steel mills increased purchasing intention, export market also gradually improved.

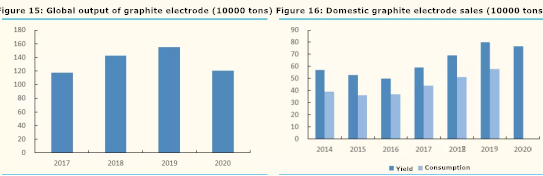

In 2020, the global output of graphite electrode decreased by 22%, and the domestic output of graphite electrode decreased by 4.4%. According to data, due to long-term losses in the industry and the impact of the epidemic on overseas graphite electrode production, the global output of graphite electrode in 2020 was 1.205 million tons, down 22% year-on-year. China's output of graphite electrodes decreased from 570,000 tons in 2014 to 500,000 tons in 2016, after which the output increased rapidly with a compound annual growth rate of 20.4%. In 2020, the average operating rate of graphite electrode in China was 49.20%, down 18.06% compared with the same period last year, and the output was 766,000 tons, down 4.4% compared with last year.

Short term electricity factor and raw material price rise raise the average cost of the industry, small and medium-sized enterprises face a large loss

There are some common problems in the graphite electrode industry. Low-level facilities are repeatedly built, low-end products account for a large proportion, the structure is unreasonable, and there is a gap between product quality and the international advanced level, which is difficult to form long-term competitiveness. Regional development is unbalanced, the distribution of products is not rational, the sense of innovation is not strong enough, and investment in high-tech research and development is insufficient. Blind expansion has brought serious oversupply, the market appears disorderly competition, even vicious competition.

In addition to overcapacity, most of the raw materials for graphite electrode production rely on imports. Since the beginning of the year, the price of petroleum coke, the raw material for producing high power and UHP electrodes, has risen by about 60%, and the price of needle coke has risen by about 65%. There are still strong upward expectations, and the price of coal asphalt has risen by about 70%, and the cost pressure of graphite electrode is obvious.

Since the middle of September, provinces have gradually implemented the power restriction policy, graphite electrode production is limited. Overlay autumn and winter environmental protection production limit and the Winter Olympics environmental protection requirements, is expected to graphite electrode production limited state or continue to 22 March, high-end graphite electrode market supply or continue to shrink. Under the influence of steel production limit pressure, the demand for graphite electrode is mainly rigid demand, and the export market is stable.

The industry as a whole has excess capacity, but power limits lead to tight supply and demand within the year, driving up prices. At the same time, the recent small and medium-sized enterprises are facing environmental protection and energy consumption problems, increasing losses, may lead to further production cuts. The current graphite electrode price is in the historical bottom range, affected by this, the price is expected to have a steady rise in space.

It is expected that in 21 years, the supply of graphite electrode will shrink, the release of production capacity lags behind, and the overall profit of the industry will be insufficient under the combined cost pressure, and the willingness of enterprises to sell will appear. Downstream steel mills to stock demand, the overall supply and demand of graphite electrode tightening, the price is expected to increase.

Up to now, the UHP graphite electrode has reached 21,500 yuan/ton, an increase of nearly 50% since the beginning of the year. On the one hand, the downstream steel production limit pressure is large, the start of the steel mill is restricted, but the power limit in some areas is relaxed, the graphite electrode procurement demand increased a little, the export is stable and good. On the other hand, due to the rising cost of raw materials and the impact of national environmental protection policies, the industry supply contraction, the production cycle of graphite electrode products should be at least more than 4 months, stacking the stock cycle, it is difficult to increase the volume in the short term. Under the cost pressure, the price of graphite electrode is expected to rise steadily.

Due to tight supply this year, the gap between supply and demand is estimated to be 28,700 tons, but the industry as a whole is still surplus capacity, capacity utilization rate is less than 50%. If excluding external constraints, the industry is still in a state of oversupply, is expected to 23 years of excess supply of 14,000 tons, contact us to know more graphite market news.

No related results found

0 Replies