【Negative Electrode】Mid to Low-End Product Competition Continues, Manufacturers Under Sales Pressure

【Negative Electrode】Mid to Low-End Product Competition Continues, Manufacturers Under Sales Pressure

1. Stable Prices for Synthetic Graphite, Little Expectation of Decline

Data Source: Longzhong Information

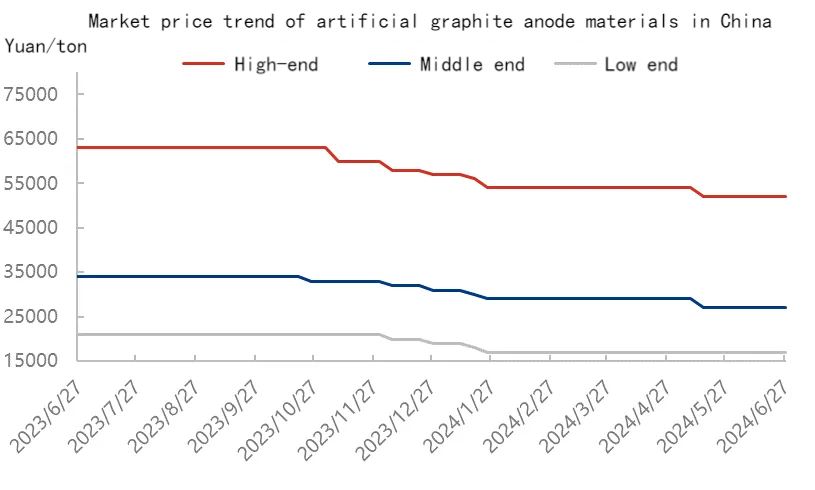

Currently, synthetic graphite prices remain stable. High-end power applications are priced at 33,000-50,000 RMB/ton, high-end digital applications at 48,000-68,000 RMB/ton, mid-end products at 23,000-35,000 RMB/ton, and low-end products at 15,000-22,000 RMB/ton.

According to BYD's bidding prices for the second half of the year, single-stage petroleum coke particles are priced at 11.5-12.5 RMB/kg, secondary petroleum coke particles at 14-15 RMB/kg, single-stage needle coke particles at 16-18 RMB/kg, and secondary needle coke particles at 20-22 RMB/kg. The bidding prices have increased by 10-15% compared to the previous round, with a unit price increase of approximately 1,500-2,000 RMB/ton. However, the actual profit for negative electrode material manufacturers has not significantly improved. Competition for mid to low-end products continues, and manufacturers remain under sales pressure. Current prices for mid to low-end negative electrode materials are already at low levels, with profit margins bottoming out, leaving little expectation for further decline.

2. Cost Decline, Slight Profit Increase

Data Source: Longzhong Information

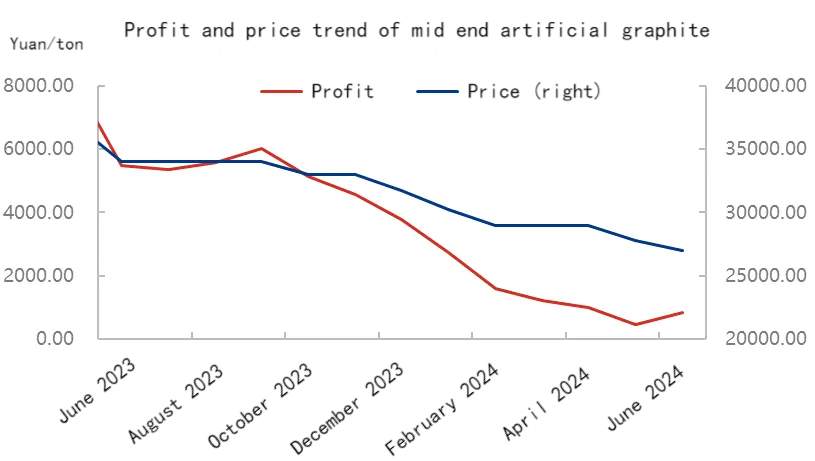

In June, the profit for mid-range synthetic graphite was 849.22 RMB/ton, an increase of 393.58 RMB/ton compared to May, with a gross profit margin of 3.15%, up 1.51 percentage points from May. This is mainly due to the slight decline in prices for low-sulfur coke and coal tar pitch, stable prices for coating asphalt and graphitization processing fees, and a slight reduction in negative electrode material costs, resulting in a small increase in overall theoretical profit margins. Graphitized carburant is widely used in the automotive, construction, machinery manufacturing, and petrochemical industries.

Looking ahead, in July, sales of low-sulfur petroleum coke performed poorly, and refineries may further lower prices to control inventory. Demand for petroleum-based needle coke has declined, with fewer orders and some maintenance companies resuming production, halting the price increase. Orders for outsourced graphitization have also decreased in line with the reduction in negative electrode production, but due to cost constraints, subcontractors' prices remain stable. After the mid-year rush, market activity has declined, reducing demand for negative electrodes. Negative electrode companies also face operational pressures such as funding, leading to tighter overall production. Considering the current substantial overcapacity and the market entering a new negotiation cycle, negative electrode prices are expected to see a slight decline in the future.

Feel free to contact us anytime for more information about the anode materials market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies