【Petroleum Coke Market】Supply and Demand Imbalance Continues, Slight Price Adjustments

【Petroleum Coke Market】Supply and Demand Imbalance Continues, Slight Price Adjustments

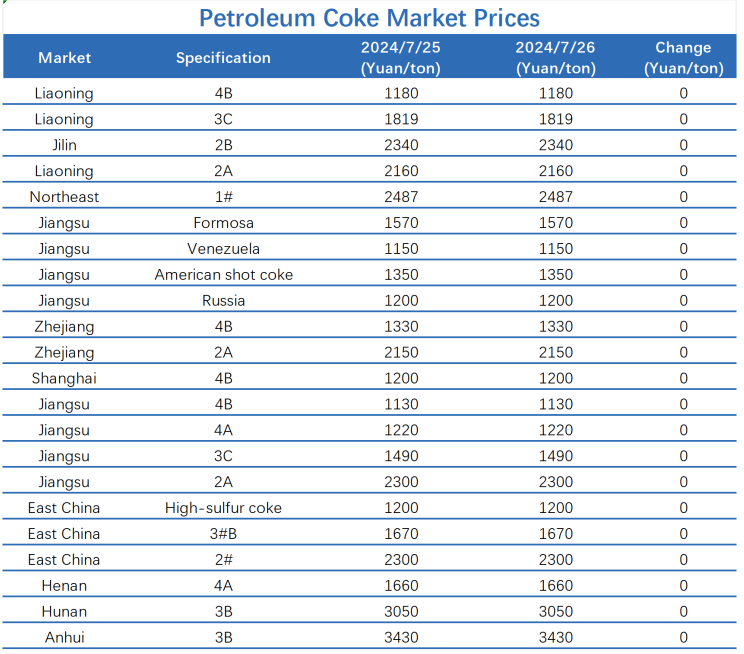

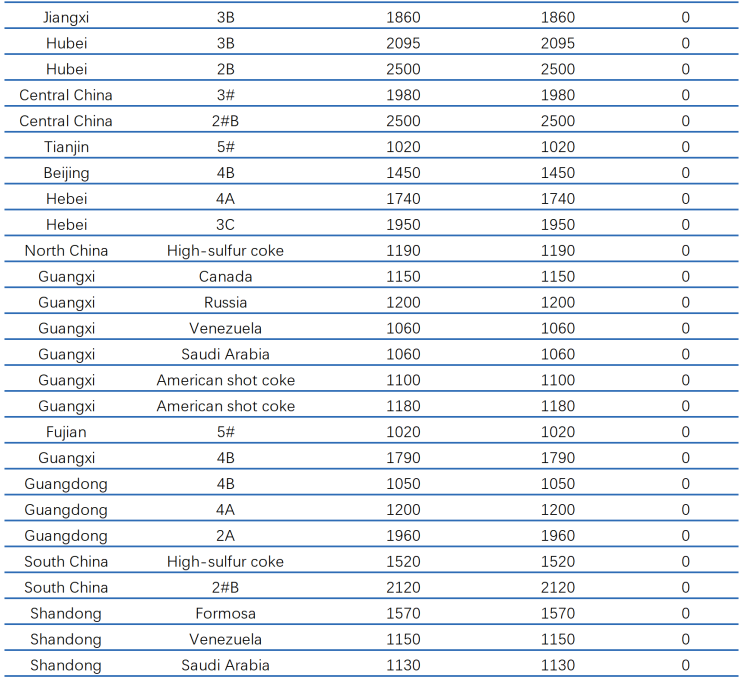

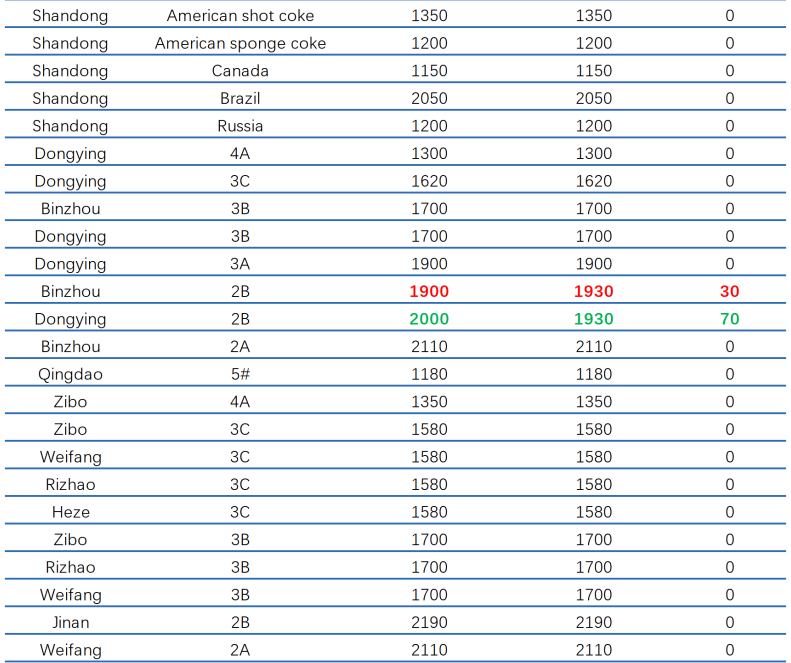

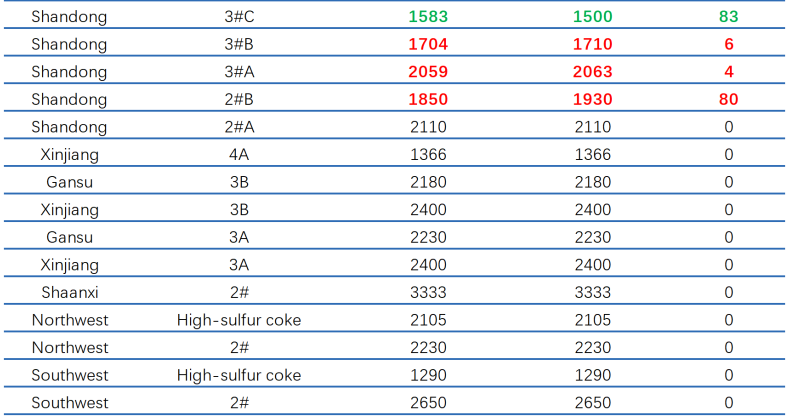

From July 21 to 26, the overall transaction performance in the Chinese petroleum coke market was fair, with refinery production and sales generally balanced, and sporadic price fluctuations.

In the Central China region, the petroleum coke market saw stable refinery prices with balanced production and sales, maintaining price stability. In Shandong, Sinopec refinery petroleum coke prices saw slight adjustments, with fluctuations between 20-30 yuan/ton, and market transactions were fair. In North China, the trading atmosphere was fair, with mid- to high-sulfur coke prices largely stable, refinery sales were decent, and there was no inventory pressure. Calcined petroleum coke (CPC) has a wide range of applications due to its high carbon content, low sulfur levels, and other desirable physical and chemical properties.

This week, the low-sulfur coke market had a sluggish trading atmosphere, with prices mainly declining. However, some refineries saw price increases, with fluctuations ranging from 20 to 150 yuan/ton.Mid- to high-sulfur petroleum coke production and sales were balanced, but as the month-end approached, downstream procurement became increasingly cautious. The new round of pre-baked anode pricing remains uncertain, and profit margins for intermediate carbon production enterprises continue to shrink, with limited market support.

It is expected that the supply-demand imbalance in the petroleum coke market will persist next week, with prices remaining primarily stable. Some refineries may see slight price adjustments.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies