【Graphite】Can the West Undermine China's Dominance in the Global Market?

Graphite electrodes are primarily used in electric arc furnace (EAF) steelmaking, serving as a crucial high-temperature conductive material. They are also widely applied in the aluminum industry, electrolytic cells, and chemical equipment as conductive and heat-resistant components.

【Graphite】Can the West Undermine China's Dominance in the Global Market?

"Can the West undermine China's dominance in the global graphite market?" Recently, Mine, a publication under the Western data company GlobalData, published a feature report on the graphite market. Below is the full translation.

Can the West Undermine China's Dominance in the Global Graphite Market?

Graphite is a core material in electric vehicle (EV) batteries—but just how fragile is the supply chain? Should we be concerned? Ed Pearcey provides an in-depth analysis.

Graphite is not only a key raw material for many industrial processes but also an essential component of lithium-ion batteries—thus becoming central to the expansion of electric vehicles.

As the anode material in batteries, graphite will continue to play a central role in the energy transition.

However, like many other critical minerals, a significant portion of global graphite reserves is under China's control.

According to research from GlobalData, China holds 81 million tonnes of natural graphite reserves in 2025, accounting for nearly 28% of the global total; its production in 2024 reached 1.27 million tonnes, making up 82% of global output.

This presents a series of challenges for global supply chains. Once export controls, tariff threats, or geopolitical tensions rise, the risks can quickly escalate.

Concerns over China's dominance are increasing, prompting countries like the United States and Australia to develop domestic graphite resources.

For example, the U.S. Department of Commerce recently revised its preliminary ruling from May 2025 (regarding anti-subsidy tariffs on Chinese anode materials), stating that "significant administrative errors" were made in the original calculation, aiming to reduce reliance on imported Chinese graphite and strengthen domestic battery supply chain resilience.

[Translator's note: On July 17, based on recommendations from multiple Western graphite producers, the U.S. Department of Commerce imposed a 93.5% anti-dumping duty on Chinese graphite imports, bringing total tariffs to 160%.]

In 2019, the U.S. had only a few battery factories. Today, 34 are in planning, construction, or operation. According to data from the International Energy Agency (IEA) in early 2025, the U.S.'s battery manufacturing capacity has doubled since 2022. Benefiting from production tax credits, capacity exceeded 200 GWh in 2024, with nearly 700 GWh under construction.

The European Union has listed graphite as a critical raw material, ramping up efforts to secure supply and develop its own resources. Potential deposits in Sweden and Finland have drawn significant attention.

China's Supply Chain Threat

GlobalData analyst Martina Raveni stated:

"China's monopoly on graphite poses a threat to global supply chains and importing countries, as China not only dominates procurement—especially in Africa and South America—but also controls the processing stages."

"The concentration of this critical resource means global availability and pricing are heavily influenced by China's export policies."

In July 2023, in response to U.S. restrictions on semiconductor equipment exports to China, Beijing introduced export licenses for several minerals, including graphite.

By the end of 2024, China further tightened graphite export controls toward the U.S. Raveni expects:

"China will continue to leverage its status as the largest producer and refiner to restrict graphite exports."

China also dominates global EV battery production, with over 75% of global sales. GlobalData notes that Chinese automakers benefit from manufacturing experience, integrated supply chains, and fierce domestic competition, giving them a significant cost advantage.

In December 2024, China implemented export license management for high-purity (~99%) synthetic graphite and flake graphite to ensure domestic demand is met. Although China's global share has declined, it still accounts for over 60% of flake graphite and nearly 80% of synthetic graphite.

Western Graphite Initiatives

Belinda Labatte, Executive Chair of Canadian critical mineral mining company Lomiko, said:

"It is widely recognized that China has carefully constructed an economically hegemonic ‘chokehold' strategy. Therefore, it is indeed risky for a single country to control all aspects of the defense and new technology supply chains."

She noted that China is increasing annual spending on critical minerals to $13 billion (about RMB 93.28 billion), "while Western countries are actively responding with even larger-scale public-private investments."

"The new Canadian government has launched an industrial revitalization plan to fully support critical mineral projects," said Labatte.

She mentioned that countries like Argentina, Brazil, and Mexico "rely on special funds established by China," emphasizing that "supply chain dominance has become the new front of economic warfare."

"We don't need deregulation—we need to shift capital market financing models to public-private partnerships."

Corina Hebestreit, Secretary-General of the European Advanced Carbon and Graphite Materials Association, also believes the issue "is not about loosening legislation but about quickly and seamlessly implementing existing regulations."

In her view, whether China poses a threat depends on perspective: "From China's viewpoint, clearly not; from the perspective of the U.S., EU, or NATO, absolutely yes. That's why all parties are working to enhance their domestic supply or at least diversify sources."

"In reality, graphite itself is not rare—it's the limited capital investment that makes natural graphite seem out of reach."

China's Graphite Reserves and Output

GlobalData's Global Graphite Mining Outlook to 2030 (2025 Update) shows that, as of January 2025, global natural graphite reserves stand at 290 million tonnes, with China accounting for 28%.

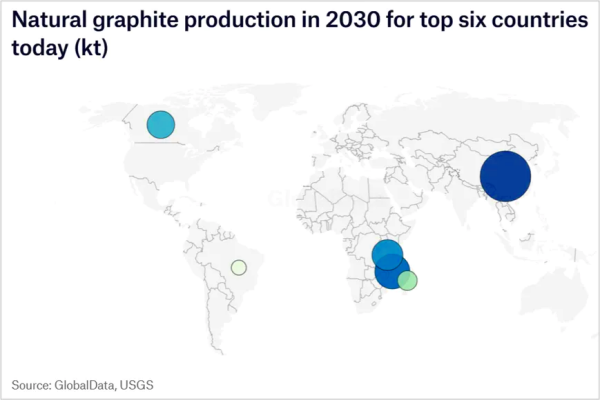

Between 2024 and 2030, global natural graphite production is expected to grow at a compound annual growth rate (CAGR) of 15.6%, reaching over 3.78 million tonnes by 2030, driven by new projects in Mozambique, Tanzania, China, Canada, and Australia. Production is estimated to grow 1.3% in 2024 and jump 18.1% in 2025 to 1.83 million tonnes.

Raveni pointed out that there are already international examples of expanding natural graphite capacity. Madagascar, the world's second-largest producer, is expected to continue growing with capacity expansions from the Molo project and Sahamamy and Vatomina projects.

According to data cited by the U.S. Geological Survey from GlobalData, about 15% of China's graphite production is amorphous graphite, while the remaining 85% is flake graphite, commonly used in EV batteries.

Graphite's Green Imperative

"Graphite is vital for many green technologies, including EV batteries and hydrogen fuel cells," said Raveni. "The pressure to reach net-zero will significantly drive up demand for graphite."

The EU, in particular, aims to be a global leader in green hydrogen, and scaling hydrogen technologies will increase pressure on graphite supply.

Strict carbon emissions regulations in the U.S. and EU also make it more difficult to establish a domestic synthetic graphite industry.

Raveni noted:

"Synthetic graphite has higher purity and longer lifespan but costs more than twice as much as natural graphite and has higher energy consumption and carbon emissions during production. Therefore, the value of the graphite market is closely tied to electricity prices and is vulnerable to price fluctuations."

"Under carbon constraints, despite being slightly inferior in quality, natural graphite may be more favored due to China's dominance and net-zero targets."

Aidan Knight, Associate Analyst at GlobalData's Strategic Intelligence Department, proposed several measures to reduce the environmental impact of the graphite industry:

·Use dry processing, dust suppression systems (mist, fog cannons, or chemical suppressants), and enclosed facilities to reduce dust and water usage;

·Establish closed-loop water recycling systems, line tailings dams to prevent seepage, and implement water treatment systems to remove heavy metals and particulates, minimizing environmental pollution.

Graphite Supply Outlook

Although China currently dominates graphite supply and processing, political efforts are underway to break Beijing's monopoly and establish non-Chinese supply channels.

Western countries now face a historic opportunity: to leverage rising graphite demand to build and secure independent supply chains. Whether similar breakthroughs can be achieved for other critical minerals under China's control remains to be seen.

Feel free to contact us anytime for more information about the Graphite Products market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies