【Steel Market】The First Half and Second Half of the Year: Sin and Love

Graphite electrodes are vital to EAF steelmaking—acting as the "core component" for arc heating. With excellent conductivity and heat resistance, they're key to improving steel quality and output. Master them, master EAF steelmaking!

【Steel Market】The First Half and Second Half of the Year: Sin and Love

"Breaking below 3,000 yuan, all long positions lost their psychological support!"

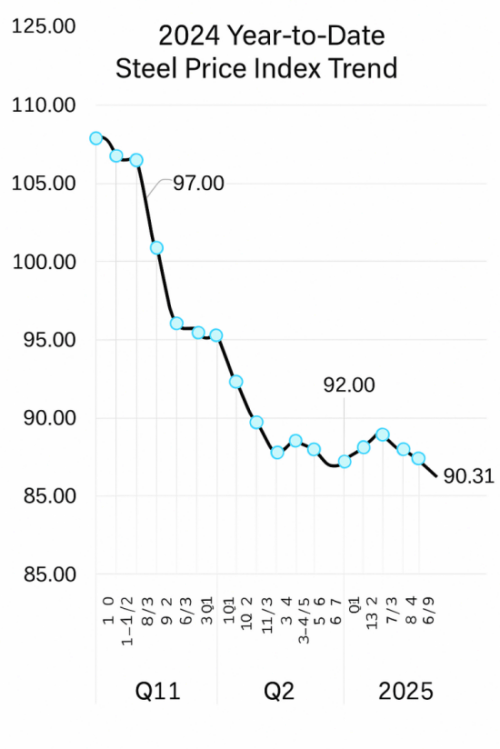

On May 28, the rebar futures price plunged to 2,950 yuan/ton, marking a new low for the first half of 2025. Since then, phrases such as "continuous decline," "broad-based slump," and "collapsed confidence" have defined the steel industry's market trend in H1 2025.

On June 11, Ansteel, along with its subsidiaries Bengang and Lingyuan Iron & Steel, announced their July steel product ex-factory pricing policies. All three companies kept their major steel product prices flat compared to June.

Meanwhile, China Baowu, regarded as the industry's bellwether, also maintained flat pricing for July.

According to industry insiders,

although mainstream steelmakers opted for flat pricing, there is still room for covert price cuts on some products, mainly due to pressure in orders for cold-rolled series, while the hot-rolled series sees relatively better demand. Given that steel mills are still earning marginal profits, supply is not expected to decline sharply. On the demand side, steel consumption from manufacturing is likely to weaken further in July. On one hand, the short-term "export rush" in domestic manufacturing may be nearing its end; on the other hand, falling global steel prices have dampened external demand, likely pressing down China's export steel prices.

However, the analyst also noted that although supply-demand imbalance may worsen in July, the overall fundamentals remain manageable. Feedback from downstream steel users indicates a reduction in orders, coupled with ongoing global tariff disputes, leading to expectations of weakening overseas demand. Nevertheless, domestic consumption still shows resilience. While downstream buyers are reluctant to stockpile, the pressure lies more in the order intake than in inventory accumulation, thus having limited impact on overall supply-demand dynamics.

Recently, domestic coking coal prices have rebounded strongly, and the broader ferrous market shows signs of price stabilization. With support from the cost side, discussions have resurfaced on whether China's steel prices are forming a bottom. The analyst believes that steel prices may not have fully bottomed out. While there has been a minor rebound recently, it is unlikely to reverse the overall downward trend. The key resistance lies in intensified supply-demand contradiction during the off-season, downward pressure on raw materials, and growing macro uncertainties.

Looking ahead to the second half of the year, China's steel market faces three major uncertainties: The trajectory of the China–U.S. "tariff war"; Global economic growth; Domestic steel production levels. These factors will remain major sources of downward pressure on steel prices.

Li Yueli, Senior Analyst at SteelCN.com,

believes that after futures prices fell below last year's lows, a rebound has begun — albeit a modest one. Steel prices have entered a bottoming-out phase. Based on data from inventories, raw materials, and capital flows, there's no need to be overly pessimistic. However, the downward trend has yet to be definitively reversed. Bottoming does not equal the lowest point, and the process may last 1–2 months. Caution is still advised in operations. This year, external negative factors have disrupted market trends, and domestic demand has weakened. The sharp decline in coking coal and coke has further clouded the steel market outlook.

She added that,

in H2, tariff shocks will ease. Given that crude steel output in the first five months increased overall, to meet the annual target of "production control and reduction," steel mills are expected to cut output. Combined with potential policy-driven rallies around key meetings in July and September, steel prices are likely to see a significant turnaround in Q3. The persistent downtrend of H1 may change, possibly presenting the best trading window of the year. However, caution is warranted again in the second half of Q4, where downside risks may re-emerge.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies