【CPC】Calcined Petroleum Coke Market Analysis for Late July

【CPC】Calcined Petroleum Coke Market Analysis for Late July

Market Overview

As of July 30, the average price of calcined petroleum coke is 2182 RMB/ton, holding steady from the previous business day. Recently, the calcined coke market has shown little fluctuation overall. Some companies producing low-sulfur calcined coke have adjusted prices slightly downward in line with previous market trends and the cost of green coke, resulting in weaker overall sales. The market for medium-high sulfur calcined coke remains stable, with some companies beginning to pre-sell August orders. Supply levels remain steady, and some companies have seen small price increases for specific contract terms.

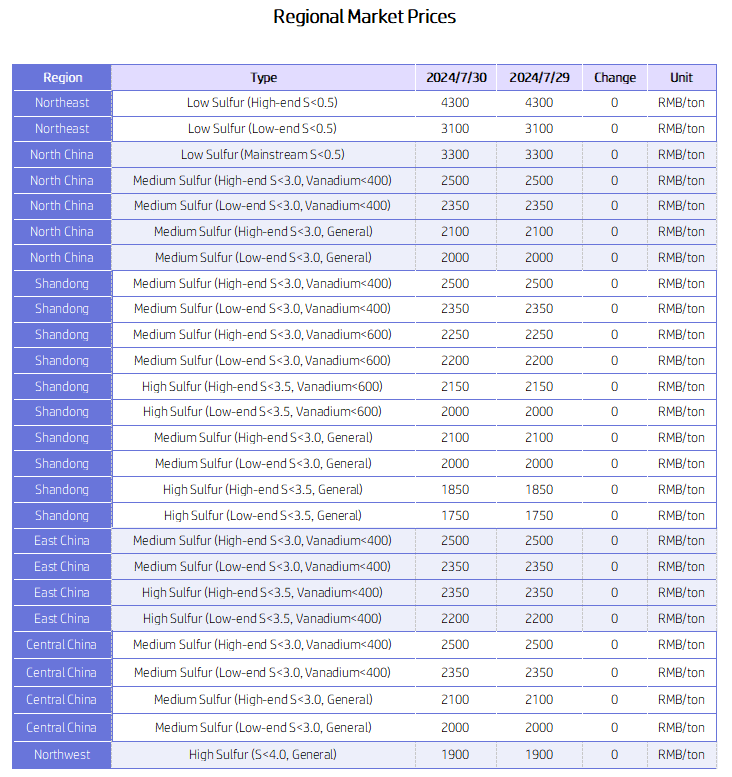

Market Prices

Low Sulfur Calcined Coke (Jinxi, Jinzhou petroleum coke as raw material): 3200-3350 RMB/ton.

Low Sulfur Calcined Coke (Fushun petroleum coke as raw material): 3950-4300 RMB/ton.

Low Sulfur Calcined Coke (Liaohe, Binzhou Zhonghai petroleum coke as raw material): 3000-3100 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.0%, no trace elements required): Previously 1950 RMB/ton, now 1900-2000 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.5%, no trace elements required): Previously 1750-1830 RMB/ton, now 1750-1830 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.0%, Vanadium 400): Previously 2400 RMB/ton, now 2400 RMB/ton.

Supply Situation

Recent daily supply of commercial calcined coke in China is 26,834 tons, with an operating rate of 63.05%. The supply of calcined coke has decreased by 1.39% compared to the previous business day.

Upstream Market

Petroleum Coke: Recently, Daqing Petrochemical's price was reduced by 170 RMB/ton, and the company will continue with this pricing structure next month. Northeast refineries have seen stable prices with generally average trading performance. Other refineries like Taizhou Petrochemical and Zhoushan Petrochemical have experienced price fluctuations. Please refer to Baichuan Yingfu for updated pricing. Sinopec's petroleum coke trading is stable, with fluctuating prices in South China regions such as Maoming Petrochemical and Guangzhou Petrochemical.

Downstream Market

Graphite Electrodes: The market is currently stabilized with mixed pricing due to various transaction complexities. The presence of low-priced resources continues to impact the graphite electrode market, causing price volatility.

Aluminum: The price of alumina futures continues to decline, weakening support for aluminum prices. The lack of demand in the spot market has further dragged down aluminum prices.

Negative Materials: There is a slight decrease in inquiries and order volumes from battery manufacturers. The negative materials market faces a "volume without profit" dilemma due to ongoing cost-cutting efforts, pushing prices close to cost lines for mid-to-low-end products.

Market Forecast

It is expected that the prices of various types of calcined coke will remain stable in the near term.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies