【Anode Materials】Market Outlook for August

【Anode Materials】Market Outlook for August

In the first half of the year, the supply dynamics of anode materials underwent significant changes, with top companies further increasing industry concentration. The proportion of artificial graphite in anode products also rose by one percentage point. In July, the anode materials market largely executed previous orders, with increased production and stable prices. Currently, most anode companies have inventory, and the production demand from downstream battery manufacturers continues to grow. In August, the market for anode materials will see a mix of positive and negative factors.

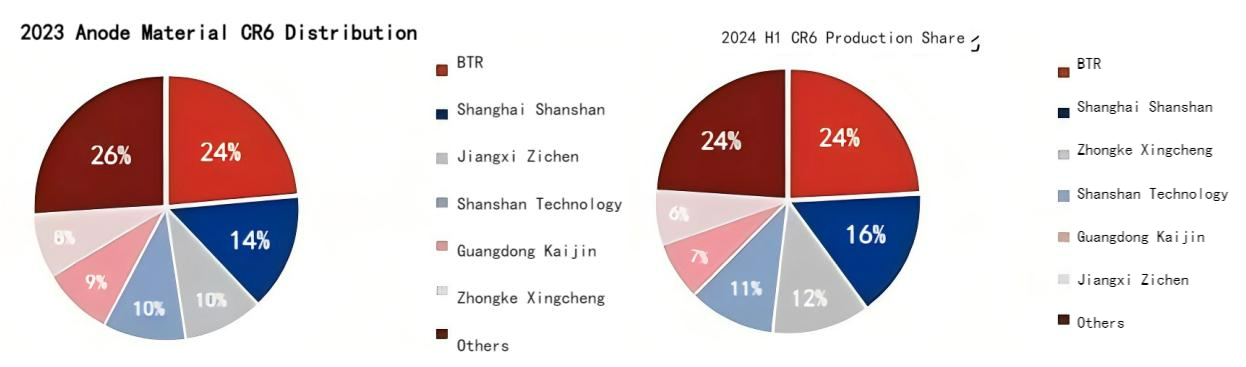

Supply Dynamics of Anode Materials: Increased Industry Concentration and Changes in Rankings

By mid-2024, anode materials production reached 869,000 tons in the first six months, up 44.8% year-on-year. The market supply chain has been reshaped, with the top six companies now holding 76% of the market share, up 2 percentage points from last year, indicating a continued increase in industry concentration. BTR and Shanghai Shanshan remain in the top two positions, with market shares of 24% and 16% respectively. Shanghai Shanshan's market share increased by 2 percentage points. Zhongke Xingcheng moved up to third place due to increased downstream demand and cost reduction efforts. In contrast, Jiangxi Zichen fell to eighth place, focusing on mid-to-high-end products but facing challenges due to high inventory costs and declining consumer demand for high-end anode materials.

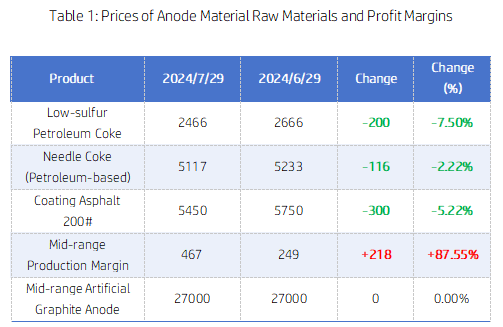

Falling Raw Material Prices and Slight Recovery in Production Margins

In July, prices for the main raw and auxiliary materials for artificial graphite anode products fell. By the end of the month, the average price of low-sulfur petroleum coke was 2466 yuan/ton, down 200 yuan/ton or 7.5% month-on-month. The average price of petroleum-based needle coke was 5117 yuan/ton, down 116 yuan/ton or 2.22%. The average price of coating asphalt 200# was 5450 yuan/ton, down 300 yuan/ton or 5.22%. The price of mid-range anode materials remained at 27000 yuan/ton. More information on the prices of graphitized petroleum coke products...

With sufficient inventory of anode materials, the overall pace of raw material procurement slowed, leading to continued price declines and a partial recovery in production margins, with mid-range artificial graphite anode margins increasing to about 467 yuan/ton, up 218 yuan/ton or 87.55% from the previous month.

August Production Increase, Anode Demand Remains Strong

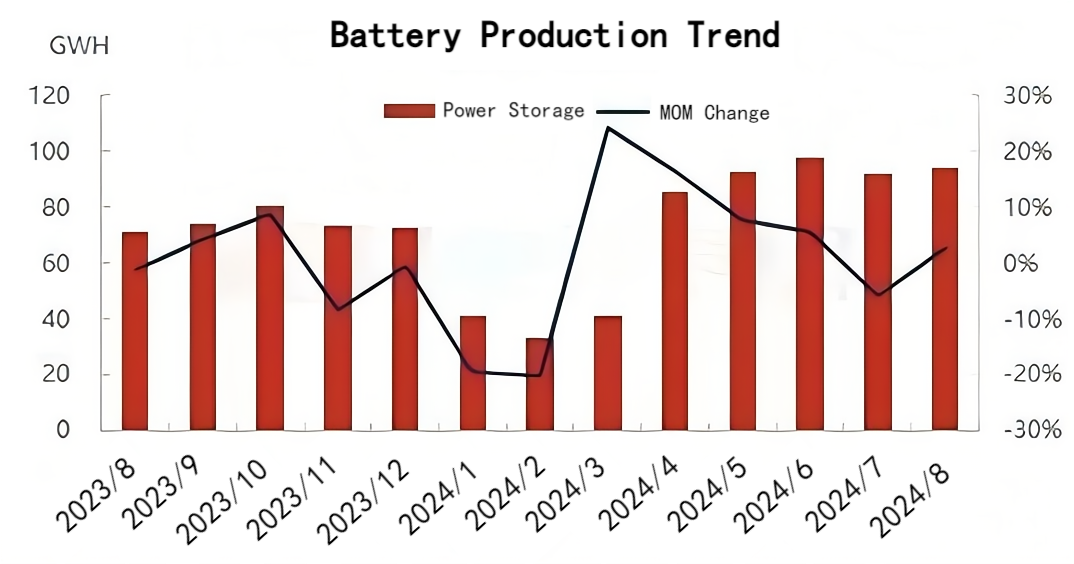

In August, according to industry data forecasts, mainstream enterprises' production of power and energy storage batteries is expected to reach 94 GWh, a slight increase of 2.7% month-on-month. Top battery companies are slightly increasing production, while second and third-tier battery companies maintain stable production levels.

Facing the upcoming August, many new energy vehicle manufacturers are launching new models to meet the traditional peak sales season of "Golden September and Silver October." Competition in China's new energy vehicle market remains intense. Consumer electronics are still in the traditional sales season, and energy storage projects are steadily advancing. Downstream demand for anode materials remains robust, with orders continuing to rise.

Currently, the anode materials market largely produces based on sales, with steady demand growth keeping production at high levels. Particularly during the flood season from June to October, the processing costs of anode materials are more competitive. However, it should be noted that anode manufacturers are slowing down their raw material procurement pace, typically preparing inventory about a month in advance. Given sufficient anode material inventory, it is estimated that production in some regions may slightly decrease in August, but overall there will be no significant fluctuations. Companies will flexibly adjust production strategies to control inventory levels.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies