【Ultra-High Power Graphite Electrodes】 Bottomed Out and Rebounded: What Lies Ahead?

【Ultra-High Power Graphite Electrodes】 Bottomed Out and Rebounded: What Lies Ahead?

In July, China's domestic ultra-high power (UHP) graphite electrodes saw a slight rebound, with prices increasing by 100 yuan/ton compared to the previous month. Prolonged losses led to large-scale production cuts and reduced supply, prompting graphite electrode manufacturers to reverse the downward trend by raising prices. What can we expect in August?

1. Review: Price Rebound in July

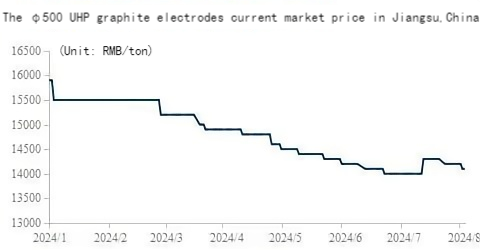

In July, UHP graphite electrode prices in China showed a strong upward trend, with major manufacturers raising prices by 500-1,000 yuan/ton. However, due to weak downstream demand, these prices were difficult to maintain. Early in the month, downstream transactions saw an increase of 200-300 yuan/ton, but as the month progressed, worsening losses in the steel market made it difficult for buyers to accept higher prices. For example, in Jiangsu, the current market price for φ500 UHP graphite electrodes is 14,100 yuan/ton, up 100 yuan/ton month-on-month, but downstream transactions remained sluggish.

2. Costs: Raw Material Price Decline Eases Cost Pressure

Petroleum Coke: Low-sulfur coke prices dropped by 250 yuan/ton compared to the previous month. Overall, the average price of petroleum coke in July continued to decline due to increased supply and limited demand growth, with the market showing a downward trend.

Coal Tar Pitch: The price of medium-temperature coal tar pitch fell by 350 yuan/ton month-on-month. The market is under pressure due to high inventory levels, weak raw material coal tar prices, and limited support from the cost side. Downstream buyers remain cautious, making it difficult to raise prices.

Needle Coke: Prices remained stable in July, with moderate trading activity. Some companies, facing high inventory levels, offered slight discounts to reduce stock, while downstream purchases were mostly on a need basis.

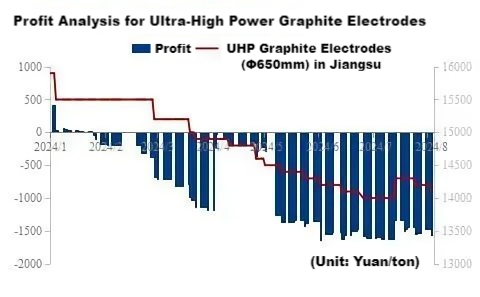

In terms of costs, based on the current market price of 14,100 yuan/ton for φ500 UHP graphite electrodes, the loss per ton is estimated at 1,552 yuan.

3. Demand: Downward Trend in Downstream Demand

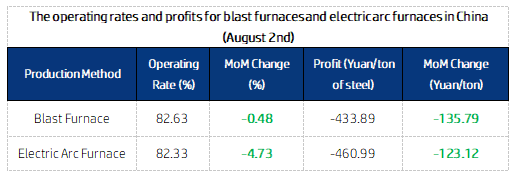

As of August 2nd, the operational and profitability rates for blast furnaces and electric arc furnaces in China are as follows:

In July, both blast and electric arc furnace operations declined, leading to a sluggish market.The new national standard for rebar accelerated the price decline, pushing steel profitability to a new low for the year and increasing anxiety in the steel market.

4. August Market Outlook: Cautious Attitude

1. Demand: Steel prices are expected to continue falling, with more steel mills entering loss-making territory and being forced to cut production. By early August, 38 steel mills had already started reducing output, leading to decreased demand for graphite electrodes.

2. Supply: Graphite electrode manufacturers are maintaining reduced production and inventory levels, with most operating at low production levels. Significant changes in output are unlikely.

3. Costs: Raw material inventories remain high, with expectations of continued weakness. This may ease some of the cost pressure on graphite electrodes and reduce losses.

Overall, despite the slight price increase in July, market sentiment remains cautious. Participants are generally conservative about the future price trend of graphite electrodes, given the weak downstream demand and rising inventory levels, which may exert downward pressure on prices. A strong inclination towards price reductions is expected in the near future.

Feel free to contact us anytime for more information about the graphite electrode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies