【Needle Coke Market】 Can Prices Remain Firm Amid Weak Downstream Demand?

【Needle Coke Market】 Can Prices Remain Firm Amid Weak Downstream Demand?

1. Market Overview

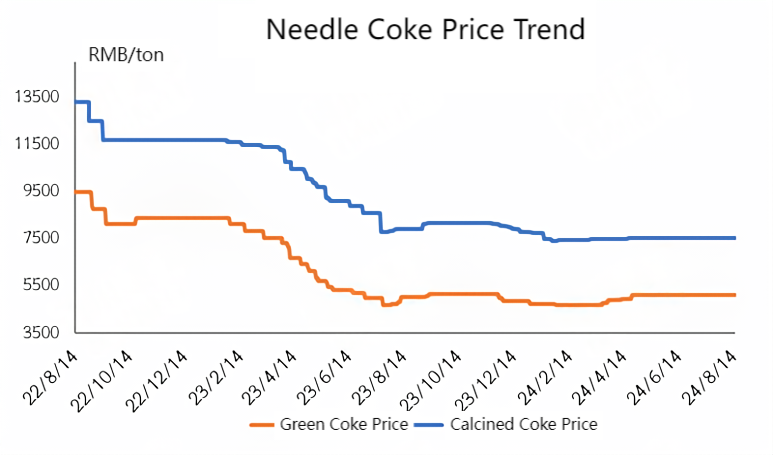

Since August, trading activity in China’s needle coke market has weakened, with demand from downstream anode materials and graphite electrodes softening. The price of green coke has declined slightly by 50-100 RMB/ton. As of August 14, the price range for domestic needle coke is 4,900-5,300 RMB/ton for green coke and 6,500-8,200 RMB/ton for calcined coke. The mainstream transaction price for imported oil-based needle coke is 500-1,200 USD/ton for green coke and 750-1,250 USD/ton for calcined coke, while imported coal-based needle coke trades at 800-1,000 USD/ton for calcined coke. According to company feedback, the demand for green coke has gradually decreased since August, with downstream inventory restocking coming to an end and overall purchasing enthusiasm slowing down, leading to a preference for on-demand procurement.

2. Analysis of Needle Coke Demand from the Graphite Electrode Market

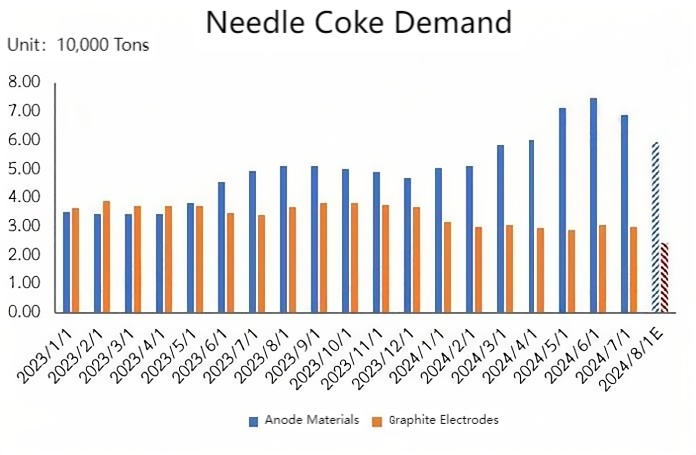

Losses among electric arc furnace (EAF) steel plants have worsened, leading to production cuts and shutdowns by several enterprises in August. As of now, the overall operating rate is below 50%, making it difficult to maintain actual transaction prices in the graphite electrode market. Only the mainstream large manufacturers are operating normally, while some small and medium-sized enterprises have reduced production, switched to other products, or engaged in partial process outsourcing. Against this backdrop, needle coke sales continue to exhibit a weak trend, with mainstream enterprises mainly fulfilling orders for existing customers. It is reported that export orders for needle coke have increased in August, while domestic supply is concentrated among mainstream manufacturers, with small and medium-sized enterprises either switching to producing petroleum coke or halting production.

3. Analysis of Needle Coke Demand from the Anode Materials Market

New orders in the anode materials market are insufficient, with some inventory still to be consumed by power battery manufacturers and automotive companies. Procurement demand remains limited, and anode material companies are adopting a more cautious approach, producing based on sales. The market continues to experience an oversupply situation, with downstream manufacturers holding the bargaining power, leading to a stable but weak market price. Since August, the enthusiasm for needle coke procurement in the anode materials sector has waned, with inventory restocking largely completed and purchases being made on an as-needed basis.

4. Raw Material Market Analysis

1) Oil Slurry Market:

Low-sulfur oil slurry prices have weakened slightly. As of August 14, mainstream prices for low-sulfur oil slurry range from 3,960 to 5,100 RMB/ton, with the lower end decreasing by 30 RMB since the beginning of the month. Low-sulfur resources are relatively scarce, with only a few manufacturers in Shandong available for external sales. Most oil-based needle coke is purchased from major refineries. Since August, fluctuations in low-sulfur oil slurry prices have been minimal, providing some support for oil-based needle coke.

2) Coal Tar Pitch Market:

The focus of coal tar prices has shifted downwards locally, weakening support for coal tar pitch, and leading to a slight decline in prices. However, since there is currently only one coal-based needle coke producer in operation, the overall impact on needle coke is minimal.

5. Market Outlook

1) Supply Side:

The operating rate of the needle coke market is expected to remain at a medium-to-low level in mid-to-late August. Although a coal-based needle coke plant in Ningxia has resumed production, it is mainly for self-use, with limited external sales. An oil-based needle coke plant is expected to start trial operation of its new project by the end of August. Overall, the average operating rate of the needle coke market is expected to be around 30% in August.

2) Demand Side:

EAF steel plants are entering the off-season, with weak operations expected, which will have a negative impact on the graphite electrode market. To avoid stockpiling large quantities of raw materials and causing financial difficulties, mainstream graphite electrode manufacturers are likely to focus on essential procurement of needle coke. Anode material demand is unlikely to see any significant improvement, with existing inventory being consumed and new orders possibly declining.

Conclusion

Given the above factors, the needle coke market price is expected to be predominantly bearish in mid-to-late August, with domestic needle coke prices ranging from 4,900 to 5,250 RMB/ton for green coke and 6,500 to 8,000 RMB/ton for calcined coke.

Feel free to contact us anytime for more information about the needle coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies