【Petroleum Coke】 Market Price Divergence, How to Break the Deadlock?

【Petroleum Coke】 Market Price Divergence, How to Break the Deadlock?

In September, petroleum coke sales diverged, with Chinese domestic low-sulfur petroleum coke prices showing a slight uptick, while the high-sulfur market faced abundant supply and declining prices. The main reasons are as follows:

Increased Proportion of High-Sulfur (Above 4%) Petroleum Coke due to Poor Refining Profits

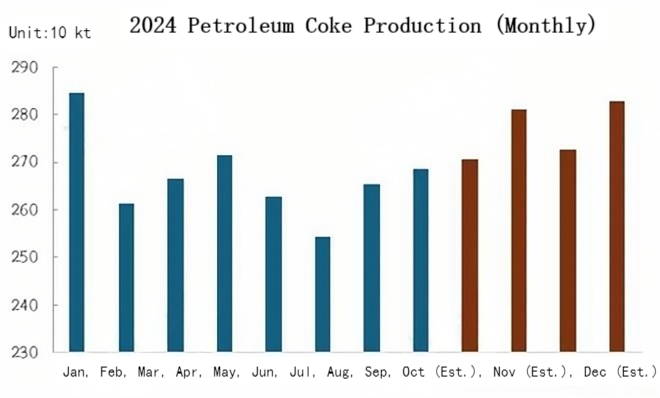

Recently, some local refineries resumed production after previously halting due to poor refining profits. Additionally, some delayed coking units that were previously shut down for maintenance have started to operate again, leading to a slight increase in petroleum coke supply. To learn more of calcined petroleum coke latest market info.

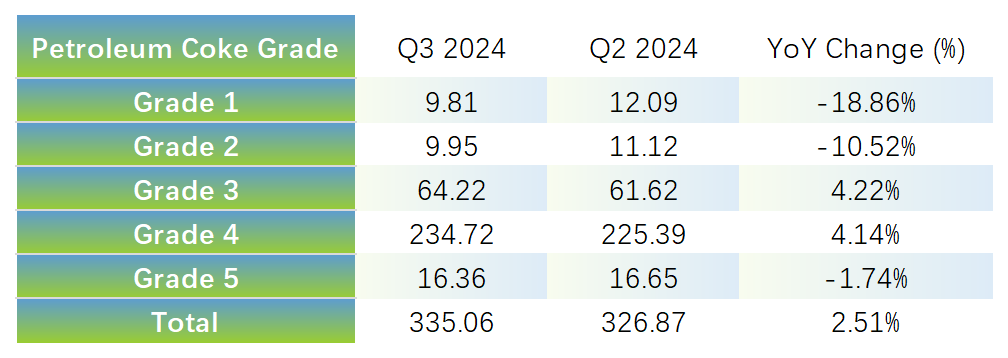

The petroleum coke quality from major refineries remains relatively stable, while the quality from local refineries fluctuates frequently. Overall, the Chinese domestic commodity market has been weak, with poor performance in refined oil markets. As refineries faced inverted refining margins, many started using lower-cost coking feedstock, which indirectly degraded the petroleum coke quality.

As a result, the supply of good quality low-sulfur petroleum coke (sulfur < 4%) has decreased, while the share of higher-sulfur (sulfur > 4%) petroleum coke has increased.

Reduced Imports and Declining Port Inventories

In September, imports of petroleum coke are expected to remain at low levels.

As of now, the total petroleum coke inventory at major Chinese domestic ports is 4.0722 million tons, with northern ports holding 2.7422 million tons.

Prices for Chinese domestically produced low-sulfur petroleum coke have gradually risen, driving improved sales of imported low-sulfur sponge coke, with some traders aiming to raise prices. However, inventories of imported sponge coke with sulfur above 3.5% remain high, and many Chinese domestic refineries produce similar low-cost products, reducing downstream purchasing interest. Additionally, with a pessimistic market outlook, some traders are offloading inventory at low prices.

Sales of imported shot coke are generally weak, as downstream industries like glass and silicon carbide are also underperforming. Some local refineries have started producing high-sulfur shot coke, which is priced lower, capturing a share of the imported shot coke market. The demand for high-sulfur fuel-grade coke in the southern region has decreased due to policy changes, making importers cautious.

The metal silicon market remains weak, with operating rates declining. This has pressured sales of Taiwanese shot coke, and prices are expected to continue falling in October's tenders.

Aluminum Carbon Market Demand Stable; Negative Electrode and Silicon Demand Weak

Aluminum producers maintain stable operations, leading to steady demand for aluminum-grade petroleum coke. However, demand in other petroleum coke-related industries remains weak. With ample petroleum coke supply, aluminum carbon producers are adopting a wait-and-see approach and procuring as needed.

Demand for negative electrode materials from battery and automotive manufacturers has underperformed expectations, leading to reduced operating rates at negative electrode producers. However, due to cautious procurement in the previous period, raw material inventories at these enterprises are low. With petroleum coke prices now at low levels, there is some short-term purchasing interest.

Steel mill production continues to decline, reducing graphite electrode consumption. Steel companies are primarily using existing inventories, and given the uncertain market, their intention to stockpile graphite electrodes is weak. Graphite electrode manufacturers are maintaining low production levels, providing limited support for raw material prices.

The metal silicon market remains sluggish, with prices falling and operational activity decreasing, leading to cautious petroleum coke procurement. In the northwest, many silicon carbide and glass production lines have halted or reduced output, further weakening demand for shot coke.

Market Outlook

In the near term, only one coking unit under Sinopec plans to shut down for maintenance, reducing daily output by 1,300 tons. Additionally, six other coking units are operational, and a new 2 million ton/year delayed coking unit is about to commence production. As a result, Chinese domestic petroleum coke supply is expected to increase further in October compared to September. While port inventories are decreasing, they remain at relatively high levels. The overall petroleum coke market remains well-supplied. With weak downstream demand unlikely to recover soon, petroleum coke prices are expected to continue diverging. Prices for good quality petroleum coke may rise slightly by 10-100 yuan/ton, while prices for lower-quality high-sulfur petroleum coke may face further declines, also within a range of 10-100 yuan/ton.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies